Yellow Metal Will Shine Like A Sun

Investors are getting jittery on investing money in equity. Tension is mounting between US & North Korea. Fund Managers (Mutual Funds) are also finding it difficult to find value at the Top of the Markets where penny stocks with no fundamentals have moved up by 50%. Markets have moved up but are the earnings catching up? If only Price is moving and Earnings are not catching, then it means Price will adjust soon. “Currently it looks like a rubber band. For Till how long will you be able to pull it?”

So investors across the Globe are in stagnation phase where they don’t know where to invest money.

I believe that the time has come to realign portfolios from an aggressive stance to a moderate one, and similarly, a moderate stance to a conservative position. The asset class which first comes to mind is yellow metal (gold!). Investors should look to increase their allocation in gold.

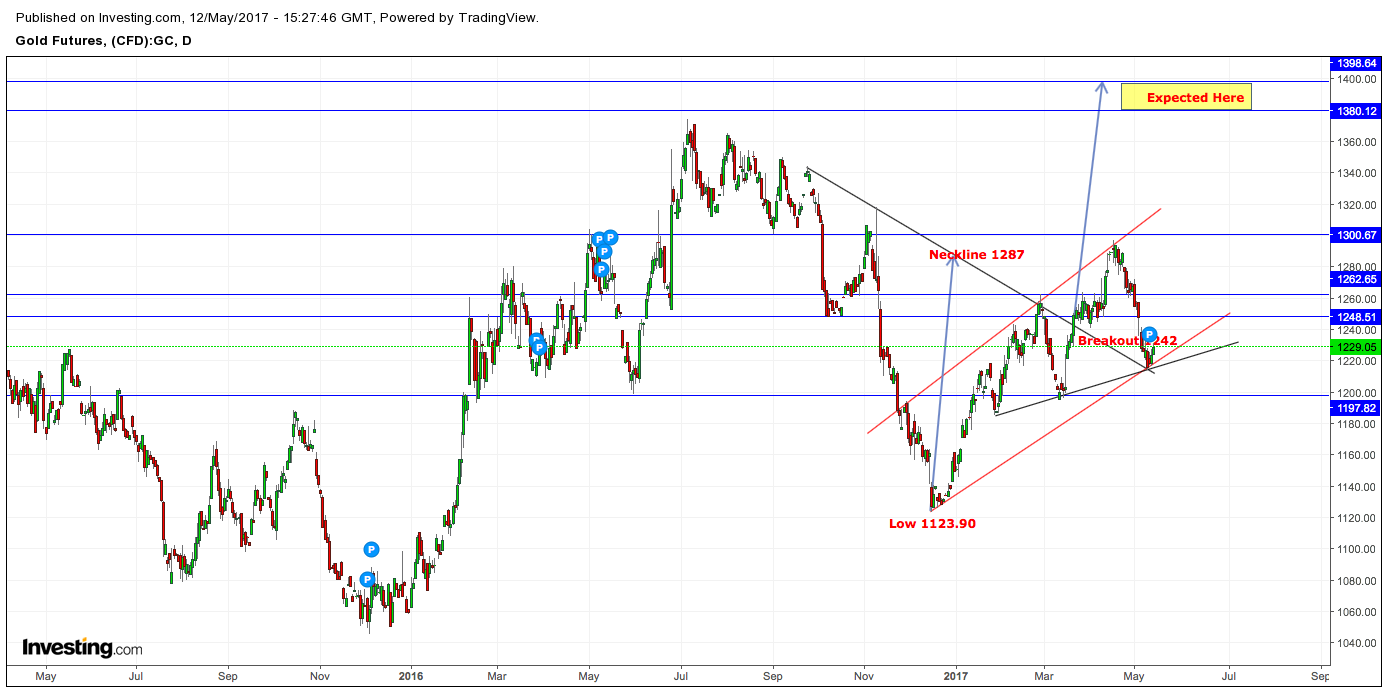

As per my reading of Gold Futures chart -

Short Term View - “Daily Charts” - Gold after a decent breakout (As expected, it came back to test the upper trend line) of descending H&S Pattern. One can go long for a positional target of 1260-1280-1300 Levels.

Long Term View - “Monthly Charts” - Gold has started its 3rd wave upwards. We can expect it to go up to 1380-1450-1550 Levels.

Happy Investing !!

Disclaimer: The above views are only for educational purposes. Equity & commodity trading has large potential rewards, but also large potential risks. You must be aware of these risks and be ...

more

Gold hit ATH of $2000!! Cheers

Wow! Go #Gold!

Long term targets achieved.. Gold is still looking bullish... Buy on dips will be recommended :)