Gold Stocks - Get In Ahead Of Taylor Swift?

Image Source: Pixabay

[Ed. Note: Microcap and early-stage stocks, particularly gold mining stocks, are high risk investments. Do your own careful due diligence before considering any investment.]

Would superstar Taylor Swift really buy a gold stock?

Well, technically her team of financial advisors would make the call — but let’s be honest… can they really afford to ignore what’s happening in gold right now?

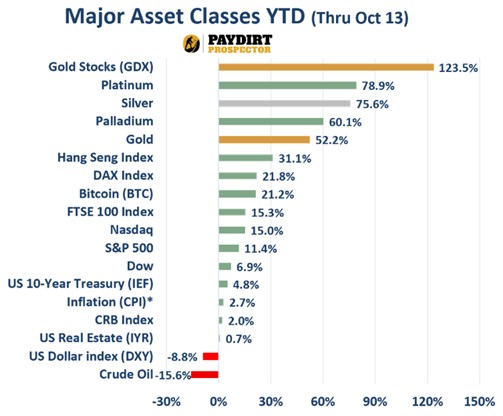

Gold stocks are the top performing major asset class of the year! It’s not even close — they’re outpacing global stock indexes, Bitcoin, real estate, and commodities.

And take a look at the top five performers: every single one is in the precious metals sector!

Maybe her financial team should knock on "Wood” before trusting that tired 60/40 portfolio they know “All Too Well.” A little gold could bring some “Daylight” to their strategy — and maybe turn a few “Wildest Dreams” into reality. It’s not “Bad Blood,” just simple math: “Karma” tends to shine on those who diversify. After all, living the “Life of a Showgirl” means knowing when to change costumes — and when to add a little gold to the lineup.

Which Gold Stocks Would They Pick?

Most mainstream advisors would stick with ETFs like GDX — but that approach gives you the good and the bad.

ETFs are mostly passive, meaning they buy based on company size, not quality. That’s not exactly how you maximize gains in a bull market.

To really win, you’ve got to screen for the best. That’s what we do in Paydirt Prospector — we look for early-stage, overlooked mining stocks with strong upside potential. Many of these names are unknown to mainstream advisors—heck, even investors in the sector haven’t heard of some of them!

The portfolio is already performing exceptionally well… others are still flying under the radar — which means they’re still great buys.

Why Fund Managers Can’t Buy These Stocks (and Why You Can)

Here’s the kicker: big funds can’t touch many of these companies. They’re too small, or too early stage, or too fast-moving for institutional investors.

That’s where we — individual investors — have the edge:

- We can buy before the crowd.

Before the headlines. Before the Taylor Swifts of the world (and their managers) finally catch on.

I love finding those unknown companies — the ones just starting to drill, or about to announce results, still trading cheap.

I’ve shared several promising names in recent talks, the same kinds of stocks I think fund managers wish they could own. I’ve been in the business for almost 20 years now. My Dad was a gold prospector and I’ve worked for other newsletters and bullion dealers. I’ve learned so much I even wrote a book about how to buy mining stocks.

And now, these early-stage stocks are the most exciting I’ve seen in a decade.

Oh, and Taylor? See you at the gold party.

More By This Author:

A Very Healthy Bull

Sell Gold- No Wait, Don’t

Did You Miss Gold’s Major Milestone?

Disclosure: You can get the full portfolio here — before the crowd catches on.