Gold Price Forecast: Will XAU/USD Recapture $1,950 On Powell's Testimony?

Image Source: Unsplash

- Gold price rebound pauses ahead of Russia-Ukraine peace talks 2.0, Powell.

- US Pres. Biden bans Russian flights from using the American airspace.

- Gold appears a ‘buy the dips’ trade amid escalating Ukraine crisis.

Russia’s aggression on Ukraine remains relentless, refueling a fresh wave of risk-aversion across the financial markets on Wednesday, disturbing a sense of calm seen earlier on. Jittery markets once again came to the rescue of gold, helping the bright metal stage a solid rebound from near the $1,900 threshold. In the first half of Wednesday, gold price licked its wounds amid the two-day downtrend, as investors digested the news about a lack of progress on the first round of peace talks between Russia and Ukraine. Meanwhile, growing worries over the damaging impact of the Russia-Ukraine war on the global economy helped cushion the downside in gold price.

In the second half of the day, gold bulls found the much-needed impetus in the comments from Russia’s Defense Minister Sergei Shoigu said Russia “will continue operation in Ukraine until it achieves its goals,” adding that they will strike Ukraine security service sites in Kyiv. Tensions mounted as the world united to impose stringent sanctions on Russia while soaring oil prices aggravated concerns over raging inflation, boosting the safe-haven gold at the expense of higher-yielding assets such as stocks and Treasury yields.

However, risk sentiment improved in Asia this Wednesday, as the S&P 500 futures sprung back into the green, in anticipation of the second round of peace talks between the two warring nations. US President Joe Biden’s State of the Union (SOTU) address also failed to temper the market mod, especially after he announced a ban of Russian flights from using the American airspace. Amid a better market mood, gold is easing from $1,950 so far this Wednesday. The focus now shifts towards the US ADP Employment data and Fed Chair Jerome Powell’s testimony. Powell may refrain to deliver any signals on aggressive tightening plans, in the face of the ongoing Ukraine crisis.

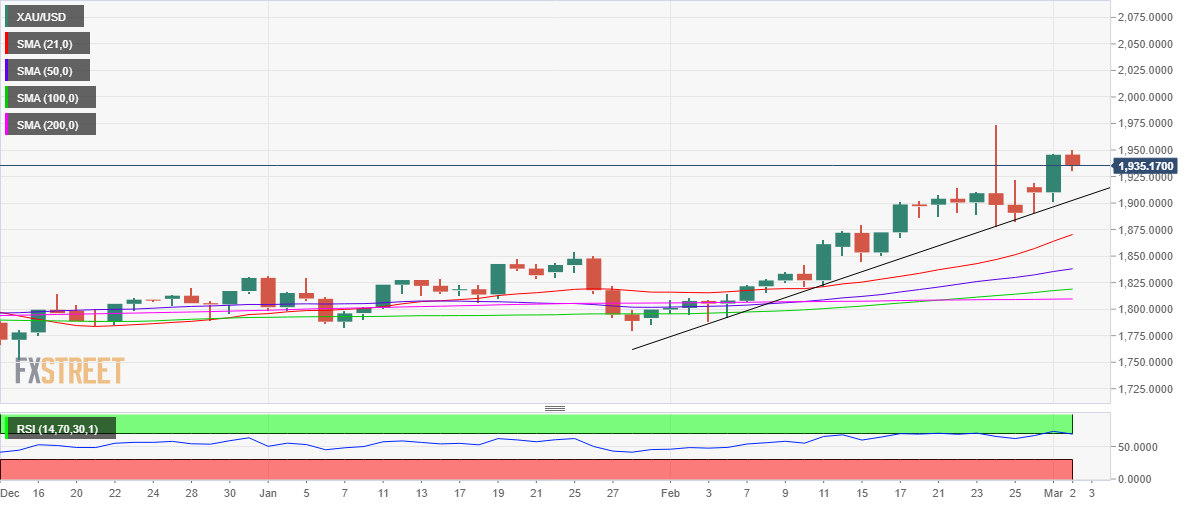

Gold Price Chart - Technical outlook

Gold: Daily chart

Gold’s daily chart shows that price jumped off the month-long rising trendline support, then near the $1,896.

Bulls tested the $1,950 barrier on the renewed upside, with eyes back on that level amid the latest pullback.

The 14-day Relative Strength Index (RSI) has slipped back below the overbought region, although remains in the positive territory, suggesting that there is room for another uptrend in gold price.

If buyers regain footing above $1,950, then a test of the multi-month highs of $1,975 will be once again on the table.

On the flip side, the further retracement could put the rising trendline support, now at $1,903, at risk.

The next support is seen at $1,900, below which a fresh downswing will be triggered towards the upward-pointing 21-Daily Moving Average (DMA) at $1,870.

Ahead of that cushion, the February 24 low of $1,878 will come to the rescue of gold bulls.

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more