Gold: Building A Bull Trap

Summary

- The VC PMI cycles indicate that we could see potentially a seasonal top in the near future.

- We are looking at the market completing the first annual target of $1650.

- It is a high probability that if the short trigger is activated up here by a close below $1650, it probably would identify a bull trap in the making.

We use the Variable Changing Price Momentum Indicator (VC PMI) to analyze markets, including how the coronavirus is affecting the market. Over the past few days the markets have been facing the reality that we really don’t know the economic consequences of the immediate and longer-term effects of the virus. The market is reflecting a deeper concern about the virus. Even though China claims to have contained the virus, it appears to be continuing to spread. It is a black swan that has caught everyone by surprise.

In relation to the price of gold, traders have an old saying, buy the rumor and sell the fact. Gold running up over the past couple of months has been in response to these rumors. Gold back at $1550 occurred at the beginning of the rumors about the virus coming out of China. Once we got above $1550, that level became a strong level of support.

Courtesy: TDAmeritrade

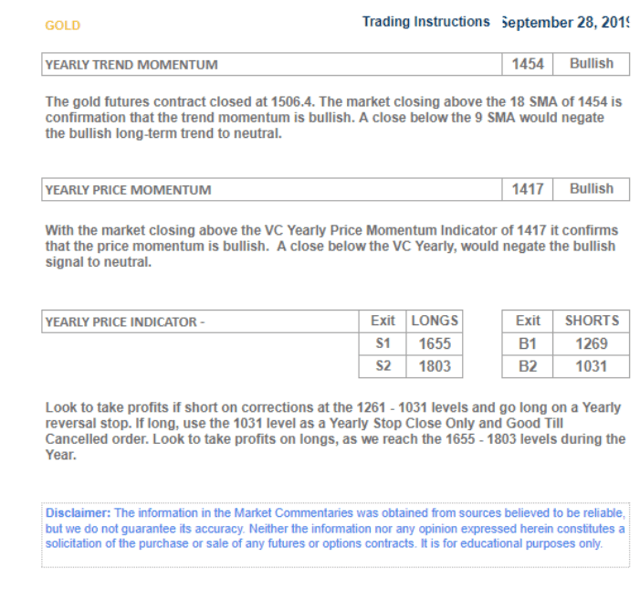

On the right side of the chart are the monthly numbers and on the left side the daily numbers.

In September 2019, we published annual targets for gold, which were $1650 to the $1800 level for the remainder of this year. We are looking at the market completing the first annual target of $1650. As we recommend to our subscribers, when the price target is met, it activates a neutral signal, so take profits and go neutral. The market has met the annual target, but also the daily, weekly and monthly targets. We are at an extreme level above the annual mean, and the VC PMI is alerting us that this area is an area of distribution or supply. The probability is high that people will start to sell the market, bringing in supply. Now we wait to see if there are solid buyers who will take the price higher or if there are just speculators who are coming in in response to the coronavirus.

We have been long this market for a long time, from the $1150 - $1160 area. We are at $1650. We have made a lot of money recently by trading this in derivatives, primarily in triple X derivatives such as NUGT. It is time for me to pause, let the market show us where it wants to go, and wait for a confirmation of the next trigger point: is it going to continue up to $1800 or are we looking at seasonal top that is in the process of being completed.

The VC PMI cycles indicate that we could see potentially a seasonal top in the near future. That is the expectation from these price levels, so we are stepping out of the long side. If you are long, hedge. Watch and wait to see where the market is going next. Sometimes you want to say thank you, step away and don’t chase the market. It is a high probability that if the short trigger is activated up here by a close below $1650, it probably would identify a bull trap in the making. At the extreme levels above the mean, particularly if a highly bullish speculative sentiment in relation to the coronavirus, could occur. Let the emotion out of the market and wait for the market to give us a high probability signal. The trigger point is a close below $1650 on a monthly basis. If we close below $1650 at the end of this month, we’ll activate an annual short trigger. By activating that trigger, it also activates the annual extreme level below of $1417. The 9-month average for the year is about $1454. $1475 is the next layer of support below. If the trigger happens, then we are looking at a possible $100 to $150 correction from these levels. I know I am going to make a lot of bulls upset, but I want to share what the VC PMI AI is telling us.

Disclosure: I am long DUST.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check us out on more