ZIRP At 20; The ZLB Is A Trap, But Not The One Central Bankers Think It Is

Were they rushed, or were they late? Middle 2000’s consensus put an academic opinion on the latter. The Bank of Japan had been Japan’s central bank since 1882, but it hadn’t been allowed to become a modern one until years into the 1990’s crisis. When speaking on the topic, Economists mostly mean independence and mandate rather than monetary competence. This speaks to the now global problems we all face.

Reforming the BoJ was part of the government’s committed effort to clean up its banking system. Throughout much of the decade, it was asserted how the economy’s big problems all related in some way to its zombie banks. As an agent of the government, BoJ wouldn’t be in a position to respond effectively.

The central bank law was passed in June 1997 becoming effective on April 1, 1998. Before that even happened, Japan’s zombies were already embroiled in another crisis. On November 3, 1997, Sanyo Securities went bust and that kicked off the usual chain reaction of doubt and contagion. Already facing a “Japan premium” for borrowing dollars offshore, it would grow worse as did Japan’s economy which, already weak, easily tracked the downward trend.

What to do?

In March 1998, Governor Yasuo Matsushita was forced to resign after a corruption scandal implicated top officials. Japan’s big banks may have been zombies, but, apparently, they were still busy buying inside information about the central bank’s inner workings. A form of liquidity preferences, I suppose. Though the well-respected Masaru Hayami would take over shepherding BoJ into this new era, it was a thorough mess.

As the Asian flu embroiled Japan, the BoJ became independently unclear. The central bank had before brought the overnight benchmark money rate down to an unthinkably low 50 bps. By September 1998, the bank voted again this time for another 25 bps “rate cut.” Unlike the prior one, there was one dissenting ballot (Eiko Shinotsuka voted against, preferring instead a rate hike on the grounds ultra-low rates were harmful to savers).

By November, the situation was even more confused. Though BoJ would bias interest rates to “under 25 bps”, there would be two dissents; Ms. Shinotsuka still preferring higher rates, joined by Shin Nakahara who wanted them to go even lower.

On February 12, 1999, exactly twenty years ago today, ZIRP was born. But, as usual, it was more of a mess than a clean introduction. Like Bernanke who never actually said the word “taper” in 2013, the Bank of Japan at least at first never actually published the word “zero.”

“The Bank of Japan will provide more ample funds and encourage the uncollateralised overnight call rate to move as low as possible.”

Japanese monetary officials were obviously uncomfortable with all this. It was new and experimental but more than that officials realized their big problem, as they saw it, was how they were running out of room. After all, BoJ had pushed the benchmark rate to 1% all the way back in 1992. What troubled them, and would vex a new generation of central bankers elsewhere around the world following up behind, was that zero lower bound (ZLB).

Once you get there, the general public can sense you are there. But not in the way Economists and central bankers conceive. Officials never seem capable of grasping how getting to the ZLB in the first place is a measure of complete failure; the very real possibility that you don’t know how to fix what’s wrong. Or, what’s exponentially worse, what is actually wrong.

In June 2003, the US central bank’s policymaking body briefly contemplated this startling possibility. They had to because for many of the same reasons the ZLB was staring at Greenspan’s FOMC at that very moment. The committee would vote to bring the federal funds rate down to 1%, at the time equally as uncomfortable for them as it had been for Hayami’s gang four years earlier.

But rather than see ZIRP for the trap that it was, Economists instead focused in on Japan’s perceived mistakes surrounding it. The theory was sound, US officials would declare, BoJ’s execution flawed. Thus, the global economy’s own lost decade starting in 2007, just four years afterward, was set in motion.

MR. KOHN. Another problem in Japan was that the authorities were overly optimistic about the economy. They kept saying things were getting better, but they didn’t. To me that underlines the importance of our public discussion of where we think the economy is going and what our policy intentions are.

What do you do when confronted by this very situation? FOMC policymakers in 2003 focused in on the expectations part of the economic and financial components. The BoJ was too unsure in their assessments, expressing way too much public doubt about where they were going or why.

MS. JOHNSON. Relative to the kinds of options that these gentlemen have put on the table today, I think there would be a lot of agreement that there was one thing the Bank of Japan did that was very wrong. Namely, at each step along the way they portrayed the situation as abnormal and an emergency, and they indicated that the actions they were taking made them uncomfortable and that it was their intent to return to more-normal operations absolutely as soon as possible.

But I think the Japanese limited the effectiveness of their actions by this overtone they used to characterize the steps they were taking as they announced them. [emphasis added]

This right here is the ZIRP trap (or QE trap). If the economy doesn’t perform, you can never say that. As a central banker, you can never admit that you are uncomfortable with ZIRP or QE. Worse, as the evidence piles up that it hasn’t worked, again, the very fact you are at the ZLB or endorsing “extraordinary” policies like QE that are attempting to overcome it, the more forcefully you have to commit to what doesn’t.

How else do you square Ms. Johnson’s circle? The chief criticism was in forward guidance, that the market saw the BoJ’s ZIRP as noncommittal. Thus, the market didn’t really buy what BoJ was trying to sell (as Draghi would say in 2012, to do whatever it takes).

What would distinguish the Fed or ECB in futures years was this commitment (US QE3, for example, was initially sold as open-ended for this very reason). Again, they thought the theory was sound, the Japanese execution of it lacking.

But if you commit to an open-ended program at the same time you are overly optimistic about the success of that program, as Fed officials like their Japanese and European contemporaries surely have been, how do you actually get out of it? Realizing, of course, that you actually have to get out at some point – which was BoJ’s stated goal!

I promise to do X until Y happens, but Y never really happens. The only way for you to exit is for you to lie about both X and Y. You can’t just keep doing X because even in Japan people realized that forever X equals failed X (the “deflationary mindset”).

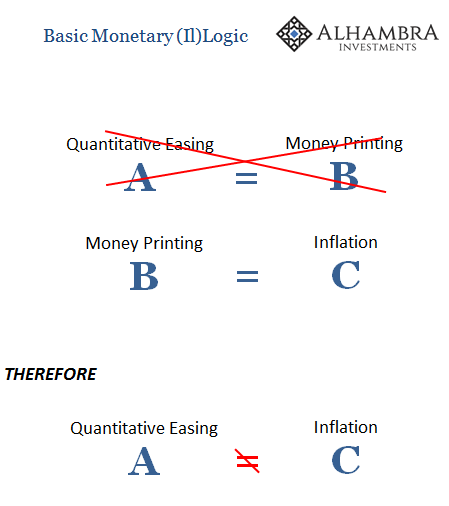

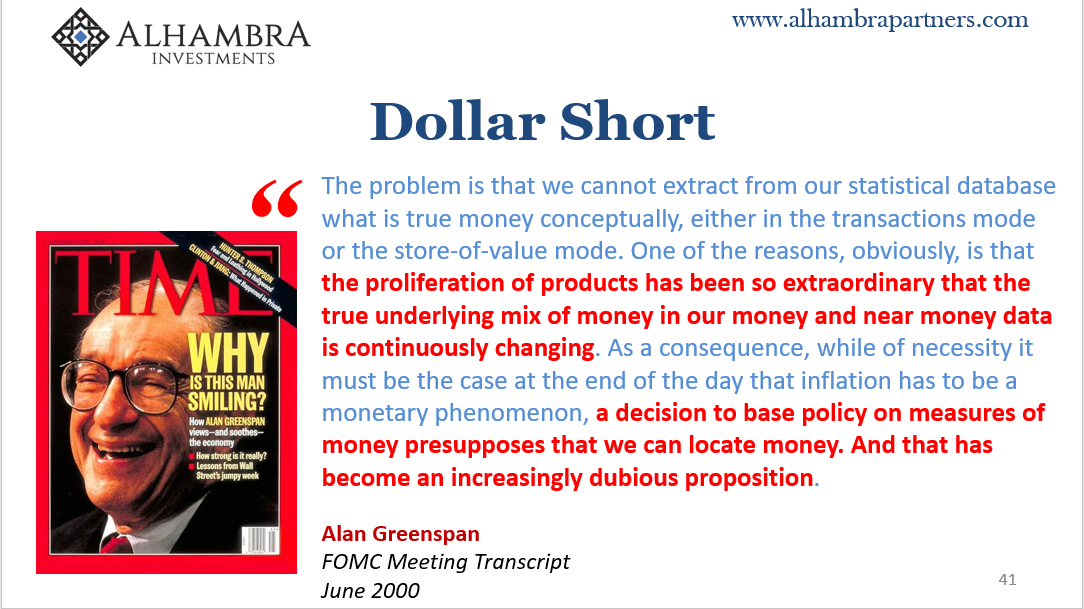

Ironically, it was Chairman Greenspan who would best elucidate what was at root here. Each central bank had long ago been taken over by Economists, each of whom readily traded monetary competence for this expectations policy nonsense.

CHAIRMAN GREENSPAN. Indeed, I’ve always been concerned about the fact that the Japanese are pumping in, pumping in, and pumping in money. They’re going to increase their monetary base inordinately. The price level is going to stop moving down, then it’s going to start up, and then it’s going to explode, and the discontinuity there is a very dangerous phenomenon…There is no credible long-term possibility that a central bank can keep creating money, in many cases high-powered money, and the price level will continue to fall. That just is not credible.

Yet, the Bank of Japan indeed every central bank has been doing just this. They have created “high powered money” at levels that in 2003 would’ve seemed distressingly insane. Still no inflationary recovery anywhere. What isn’t credible is what central bankers think is money.

It, therefore, becomes clear why just contemplating the ZLB is a trap – you don’t know a thing about the one subject you’re supposed to know better than anyone else. That’s not a Japanese failure any more than American or European; it is Economics.

The more these policies don’t work, the more you have to say they did. The ridiculous global “boom” of 2017 was a fiction created from 2003’s review of 1999.

What Japan first established and then everyone else a decade later proved was that if you get to the ZLB you’ve already lost. You really don’t know what you are doing. Central bankers that truly want to fix the economy have to start by fixing themselves. It’s been two decades already. Is that cause for optimism, enough is enough? Or for concern? They haven’t yet, so it’s pretty unlikely they ever will willingly.

February 12, 1999. Is ZIRP powerful easing, or is it powerfully delusional? The evidence has been piling up for twenty years. Japan’s lost decade was never about zombie banks, it was easily deluded, central bankers.

(Click on image to enlarge)

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more

Since it is considered dirty to just pump money in without offsetting sterilization in Japan, nothing happened, no inflation at all.