Yum China Falls 36% In The Past Year: What's Hurting It?

Image: Bigstock

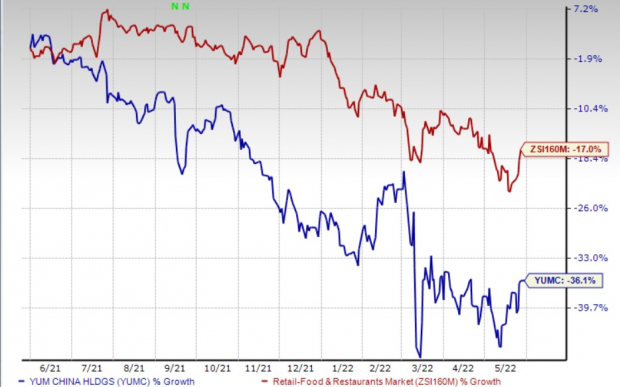

Are you still holding shares of Yum China Holdings, Inc. (YUMC - Free Report) and waiting for a miracle to take the stock higher in the near term? If yes, then you might lose more money as chances are very slim that the stock, which has lost its value by 36.1% in the past year, will take a U-turn in the near term. In the same time frame, the Zacks Restaurant industry declined 17%. Let’s delve deeper and analyze the factors that are hurting this Zacks Rank #5 (Strong Sell) company.

Primary Concerns

Restaurant industry traffic has been impacted by the coronavirus pandemic. During the quarter under discussion, the company's operations were affected by the Omicron variant. The company noted that the Omicron variant continues to have a severe impact in the second quarter. Economically important regions like Shanghai, Tianjin, Jilin, Suzhou, Shenzhen, and Guangzhou have been severely impacted by the Omicron variant. Reduced traveling, fewer social activities, and softened consumption demand continues to hurt the company’s foot traffic.

The company said that hundreds of millions of people in China are under restrictions due to the pandemic. The situation in China is very complex compared to 2020, and the company is finding it difficult to open stores and get employees to work. Not only store operations but delivery and supply chain have been hurt by the ever-changing restrictions.

The pandemic has been weighing on the company’s same-store sales. Same-stores sales declined sharply in first-quarter of 2022. Same-store sales dropped 8% year over year, primarily due to decreases of 9% at KFC and 5% at Pizza Hut. In March, same-store sales fell by more than 20% year over year. The dismal performance persisted in April (preliminary) as same-store sales slumped more than 20% year over year.

High costs have been hurting the company’s margin. Restaurant margin in first-quarter 2022 under review was 13.8%, down 490 basis points from the year-ago quarter's levels. The downside was primarily due to sales deleveraging, higher inflation in commodity, wage and utility costs, and an increase in rider cost related to rising delivery volume.

Image Source: Zacks Investment Research

Growth Projections

The company’s earnings in 2022 is likely to witness a decline of 36.4%. In the past 30 days, the Zacks Consensus Estimate for 2022 earnings has witnessed a downward revision of 45% to 77 cents. However, in 2022, revenues are likely to witness growth of 4.3% year over year.

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more