WTI Holds Gains After Biggest Crude Draw In Over 2 Months, US Production Rises

Image Source: Unsplash

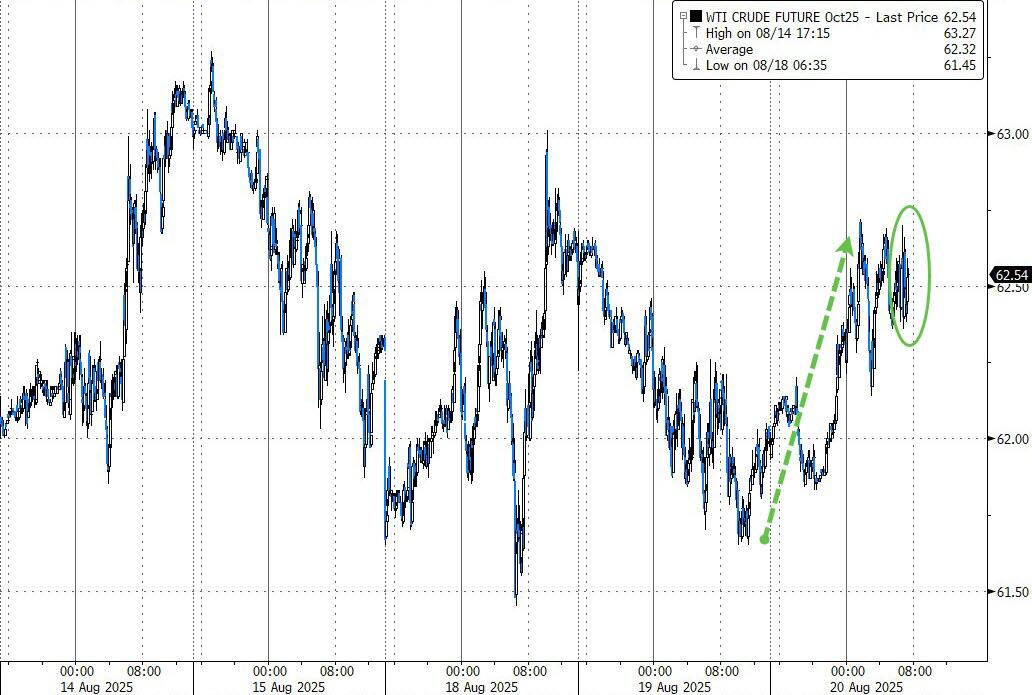

Oil prices are higher this morning, bucking a broadly risk-off sentiment across markets, following API's report overnight showing US crude stockpiles declined last week, while traders assessed negotiations to end Russia’s war against Ukraine.

“Focus is gradually shifting back towards fundamentals,” said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management.

Declining US inventories in EIA data later “could lend support, as many fear a significant inventory build in the coming quarters.”

The drop shows summer demand remains solid even as supply is on the rise.

Investors are watching on progress toward a ceasefire between Russia and Ukraine following a series of high-level talks brokered by President Donald Trump.

"The latest series of meetings aimed at brokering peace in Ukraine was also weighed by financial markets, but had a more pronounced impact on oil. Intense talks about ending hostilities, however elusive, raised the spectre of Russia re-entering the international market. That was until overnight, as Russia, based on comments from its foreign minister, appears less than enthusiastic about a meeting with the Ukrainian leader, a prerequisite for any potential peace," PVM Oil Associates noted.

Any eventual peace deal could lead to fewer restrictions on Russia’s crude exports, although Moscow has largely kept its oil flowing despite an array of sanctions.

API

-

Crude -2.4mm (-1.2mm exp)

-

Cushing

-

Gasoline +1mm

-

Distillates +500k

DOE

-

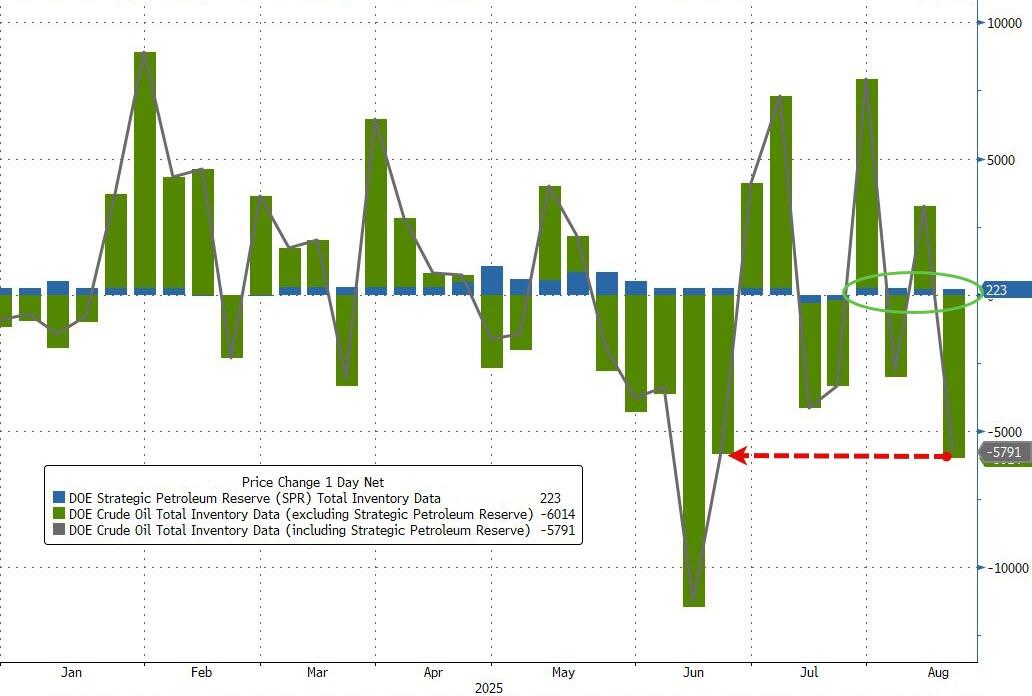

Crude -6.01mm (biggest draw since June)

-

Cushing +419k

-

Gasoline -2.72mm

-

Distillates +2.34mm

Official data confirmed API's reported drawdown in crude stocks (but far larger at over 6mm barrels - the biggest draw since the start of June). Stocks at the Cushing Hub rose for the 7th straight week while Gasoline inventories fell for the 5th straight week...

Source: Bloomberg

Despite another 223k barrel addition to the SPR, total US crude commercial stocks fell significantly...

Source: Bloomberg

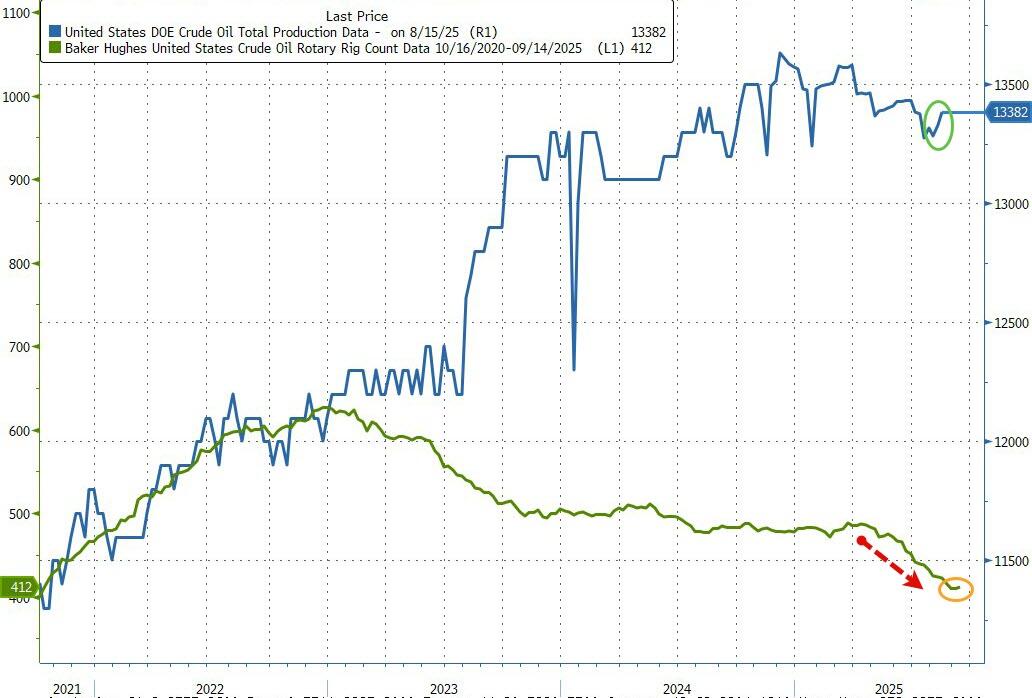

US Crude production edged higher as the rig count stabilized its declining trend...

Source: Bloomberg

WTI is holding gains after the big crude draw...

Source: Bloomberg

The longer-term outlook for the oil market looks bearish, with expectations for a glut later in 2025 as OPEC+ returns barrels and as Trump’s trade policies spark concerns about demand. Futures are down more than 10% this year.

More By This Author:

China, India Agree To Coordinate On Trade Even As US Blasts 'Global Clearinghouse For Russian Oil'Home Depot Misses Across The Board But Stock Jumps On Sticky Guidance

Nvidia Is Developing New AI Chip For China That Outperforms H20

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more