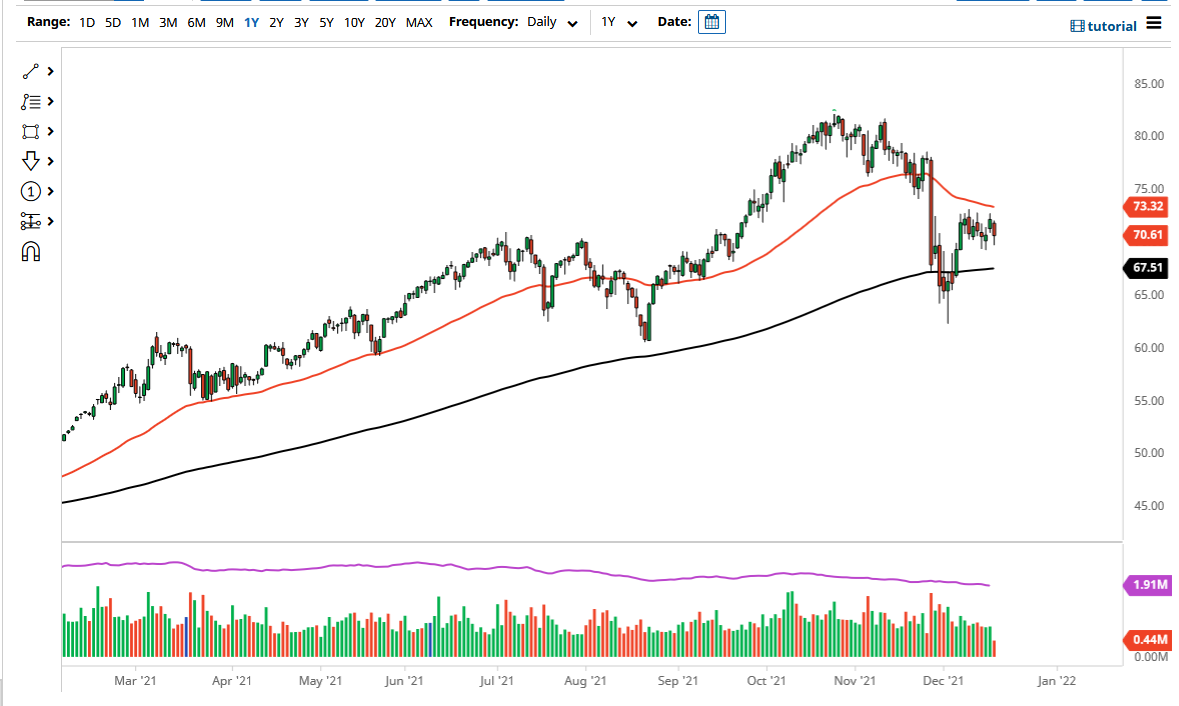

WTI Crude Oil Forecast: Consolidating Above $70

The West Texas Intermediate Crude Oil market fell during a large portion of the day, but it is also worth noting that we continue to find buyers near the $70 level (OIL, BNO).

That being said, I do not necessarily know that it is support that we will hold for the longer term, but in the short term it does make sense that we have somewhat limited losses. After all, it is the end of the year and that typically means more sideways grind than anything else.

To the upside, the $73 level looks to be rather resistive, and I think that is only going to be exacerbated by the fact that the 50-day EMA is sitting just above there and sloping lower. If we can somehow break above the 50-day EMA, then it is likely that we could go looking towards the $77 level above, but obviously we need to pick up momentum in order for that to happen. That will be the biggest problem over the next two weeks: the momentum, or perhaps better yet, the lack of momentum in the markets.

As we head into the holiday season, most traders are worried about putting on big positions and are more content to protect their gains for the year so that they can show clients better returns. The crude oil markets also have a lot of noise attached to them due to the fact that the OPEC members said that Omicron should have very little in the way of influence on demand, while at the same time the International Energy Agency suggested that the market was starting to move towards an oversupply situation.

Further irritating the situation is the fact that the US dollar has been a bit strong, which this contract is priced in. This is more likely than not going to be a scenario in which you are either a short-term range-bound trader, or you're waiting for some type of breakout which you can start following. The recent plunge in the oil market has been rather impressive, but whether or not it sticks may be determined over the next couple of weeks. At this point, I suspect that range-bound and short-term trading will probably be the best way forward, with smaller positions.

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more