Worldwide Natural Gas Prices Soar On Supply Crunch

Natural gas prices are soaring in the US and Europe. Some of those prices are at new record highs. The impact in Europe is far more significant, where there's a supply crunch and a lack of alternative power generation that has sent power prices to the moon.

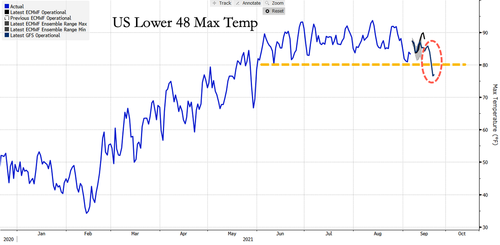

Let's begin in the US, where natural gas futures tagged seven-year highs on new climate models that forecast hot weather will linger through the end of the month, along with continuing concerns of tight supplies from the Gulf of Mexico after Hurricane Ida disrupted offshore production. Gas prices for October delivery surged an astonishing 8% to $4.92 British thermal units (MMBtu), the highest since Feb. 26, 2014.

Year-to-date, natural gas prices are up 85% on "relatively low production that still hasn't fully recovered from a pandemic downturn in activity. Production fell further after Hurricane Ida forced offshore production to be halted, while storm-damaged facilities are making the resumption of production a tall task," said WSJ's Dan Molinski.

And on Jan. 13, Goldman Sachs' Samantha Dart flipped her bearish natural gas stance to a bullish one on the premise of "supply disruptions," with a summer price target of "$3.25/mmBtu." It appears Dart made a great call at the time.

Here's why natural gas prices rocketed to the moon today: Maxar Technologies (MAXR) reported above-normal temperatures across the Lower 48 through Sept. 22. Readers may recall that we published a commodity note titled "End Of Summer? Above Average Temperatures This Week But Cooler Weather Ahead," which outlined above-average temperatures through this month before they are expected to fade.

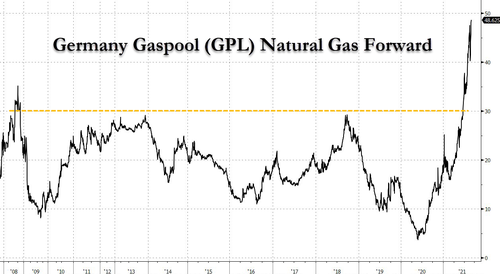

Across the Atlantic, a perfect storm is unfolding in Europe of a Russian supply shock of natural gas, and not enough alternative energy via wind power generation to satisfy demand.

On the supply crunch, we published two notes titled "European Nat Gas Prices Spike To Unprecedented Levels As Russian Supply Collapses" and "From Russia With 50% Less Supply: European Nat Gas Prices Explode To Record Highs As Putin Turns The Screws," both of which outlines Russia is flexing its muscles by tightening natural gas supplies to the continent.

The explosion in European natural gas prices is staggering.

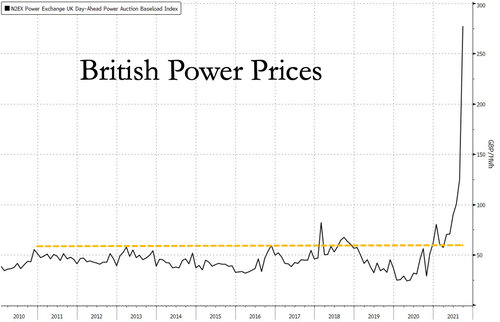

Compound that with a slump in alternative energy power generation, such as wind power, and electricity prices are shooting up.

Bloomberg's commodity analyst Javier Blas explains more about the situation in Europe:

🔌🔌🔌EUROPEAN ENERGY CRUNCH⚡⚡⚡ Day ahead UK electricity prices climb to a [[insert here hyperbolic adjective]] record high of £277 per MWh (that's more than €300 per MWh). Again, wind is generating very, very little. Gas is super pricey. CO2 too. Coal is fired-up pic.twitter.com/SMT3l6GJ9s

— Javier Blas (@JavierBlas) September 8, 2021

Surging energy prices in the US and Europe is still apparently "transitory" in central banks' eyes.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more