With Turkish PPI Hitting A Shocking 132%, Erdogan Goes After Short-Sellers As Hyperinflation Craters The Lira

It's just another day in the life of that lovable, laughable economic farce known as Erdoganomics (yes, it's even more laughable and idiotic than MMT, if one can believe that), where cutting interest rates in the middle of hyperinflation is supposed to fix everything. Unfortunately, it doesn't work like that, and the latest CPI and PPI data out of Turkey today confirmed as much.

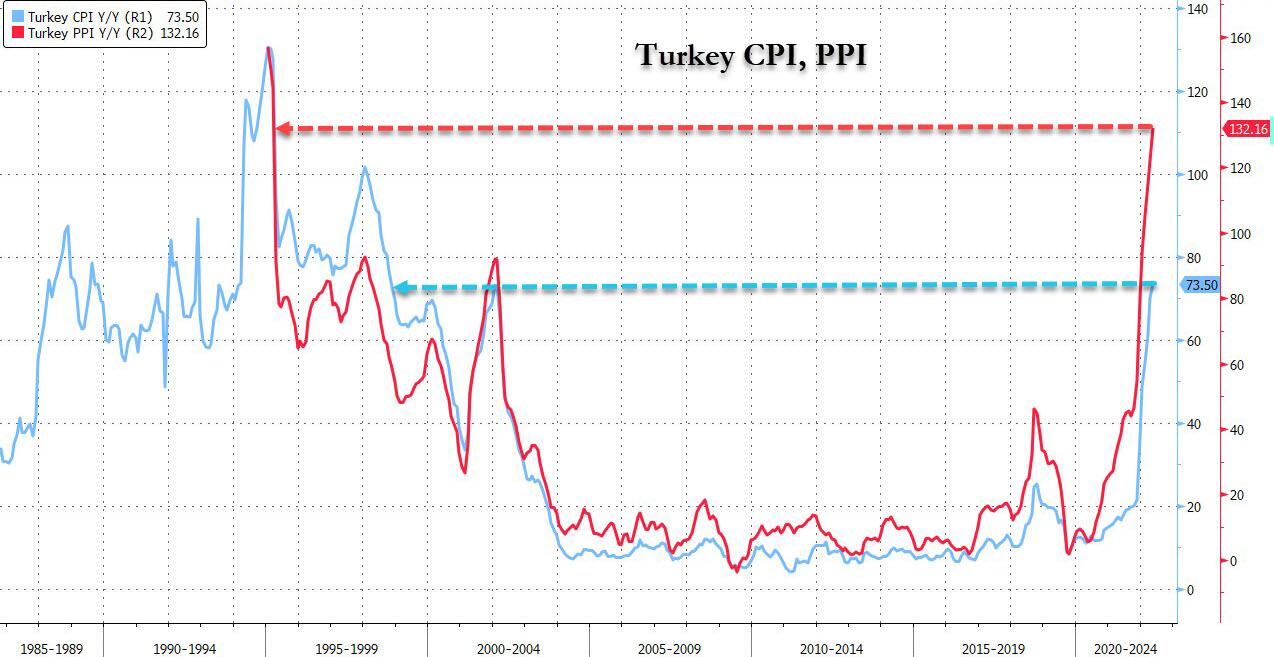

Turkey’s inflation soared in May to the fastest since 1998 as the continued surge in food and energy was not helped by the country's ultra-loose monetary policy. Consumer prices rose an annual 73.5%, up from 70% in April, according to data released by the state statistics agency Friday whose head will either quit or be fired soon. The median forecast in a Bloomberg survey of 20 economists was 74.7%. There was a silver lining in the core index which strips out the impact of items such as food and energy (which nobody needs right) and which rose "only" 56%. Meanwhile producer prices rose by a mindblowing 132% - yes PPI exploded more than double from a year ago.

The chart showing Turkey's descent into hyperinflation is shown below.

(Click on image to enlarge)

The biggest drivers of the latest surge in inflation were food and energy, exacerbated by the global rally in commodities and the Russian invasion of Ukraine. Turkey is a major importer of oil.

Turkish inflation has been in double digits for much of the past half-decade as authorities prioritized economic growth and exports while ignoring inflation and in fact, cutting rates to encourage it. President Erdogan has long advocated the theory that high interest rates cause inflation rather than curb it, much to the terror of any foreign investors left in the banana republic, pressuring the central bank to keep borrowing costs low in the face of risks to the lira and prices.

With the central bank terrified to raise rates and anger the country's authoritarian ruler after ending last year with 500 basis points of cumulative easing, it has instead promoted policies aimed at widening the use of the local currency and making available long-term investment loans. The approach has left Turkey with the world’s deepest negative rates when adjusted for inflation.

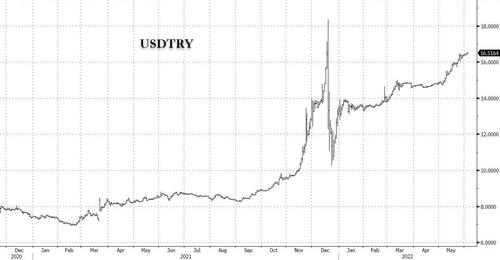

It’s also why the lira is again the worst performer in emerging markets this year against the dollar: after plunging in 2021, Turkey’s lira is on track for its longest weekly losing streak since December as worries over soaring inflation amid ultra-loose monetary policy and risk-off global sentiment piles pressure on the currency.

The currency was down 0.3%, extending this week’s drop to 1.7%. It’s on track for its seventh week of declines, the longest losing run since the week ending Dec. 17. According to Bloomberg, the lira has now erased more than 85% of the gains it made during the rally stoked after the government’s introduction in late December of FX-indexed deposit accounts aimed at offering local investors an alternative to investing in foreign currency amid the surge in inflation.

The good news, inasmuch as hyperinflation can be spun as 'good' is that the country’s benchmark Borsa Istanbul 100 stock index is headed for its best weekly performance since Jan. 7 as it surged to new record levels with local investors seeking assets to hedge against hyperinflation.

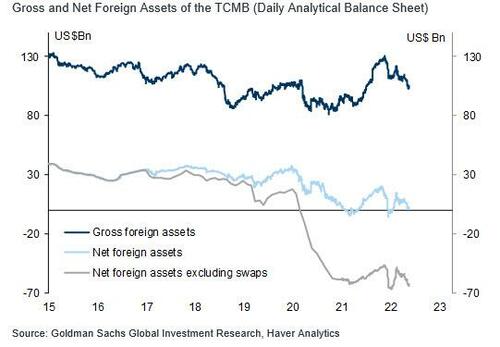

Meanwhile, instead of doing the right thing and pushing the economy into a recession while hiking rates sharply higher, Erdogan continues to drain Turkey's FX reserves which are rapidly approaching zero (and in some cases are below it)...

...while directly targeting lira short sellers again, as happens every time the currency craters lower. According to Bloomberg, Turkey is planning to restrict purchases by domestic investors of new lira bonds sold by multinational lenders, the latest effort to curb short selling of the local currency by limiting the supply of liquidity in the offshore market.

The central bank has made verbal warnings to local lenders to refrain from marketing such securities, known as supranational bonds, to their customers, Bloomberg sources note, who add that authorities are planning further to tighten control of the purchases. The goal is to increase the cost of speculating against the lira by making less local currency available outside Turkey.

As a result, the overnight forward-implied yield on the lira is already around 100% and the cost of borrowing in the offshore market may rise further if the latest measure proceeds. Such unsustainable spikes in the funding rates usually precede dramatic plunges in the lira, which many expect to trade below 20 vs the USD in the coming months.

The new policy is a variation of an approach used repeatedly by authorities to get in the way of the lira’s depreciation since a currency crisis in August 2018. In March, Turkey’s banking regulator warned local lenders not to provide lira liquidity to firms looking to speculate against it in the offshore market.

Such restrictions cause dislocations in the market and may provide temporary relief for the lira but without addressing the reasons for its chronic weakness. Under pressure from ultra-loose monetary policy and the fastest inflation in two decades, the Turkish currency has lost nearly 20% against the dollar this year, the biggest decline among its peers in emerging markets.

The latest step would take aim at lira-denominated debt issued by the likes of the International Finance Corp., the World Bank Group’s arm for the private sector, and the European Bank for Reconstruction and Development. Just this year, the London-based bank known as EBRD alone sold more than two dozen issues of lira debt, raising the equivalent of more than $500 million.

The supranational securities have been popular among local investors because they offer better returns with higher credit ratings than comparable domestic notes.

The urgency for more measures to defend the lira is rising after its depreciation accelerated in recent weeks. Fringe measures including a new deposit program that protects savers from the currency’s volatility bought some time by ensuring a period of stability following a crash in December. But the efforts, alongside unannounced interventions in the foreign-exchange markets by the Turkish central bank and state-owned lenders, have failed to stem the lira’s recent volatility, as investors focused on hyperinflation.

“It’s a continuation of what we’ve seen before of trying to provide the lira with support using measures which are unlikely to prove sufficient -- instead of raising interest rates in response to rapidly rising inflation,” said Piotr Matys, an analyst at InTouch Capital Markets Ltd.

With neither Erdogan nor anyone else inTurkey, willing to make sacrifices and stabilize prices, the currency, or the economy, the lira will be the first modern FX major currency to crater and lose all its value under the unbearable weight of hyperinflation.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more