Why Markets Aren’t Ready For The Bank Of England To Start Selling Bonds

There seems little doubt now that the Bank of England will hike rates again when it meets on 5 May. That means Bank rate will probably hit 1%, the level at which policymakers have signalled they’d “consider” actively selling government bonds back into the market to speed up the process of shrinking its balance sheet. The BoE was among the first central banks to kick-start quantitative tightening (QT) earlier this year, by ending its policy of reinvesting proceeds from maturing bonds.

The incentive to speed up the process is clear: without active sales of bolds, the balance sheet reduction is going to be pretty slow. The weighted average maturity of the Bank of England’s bond holdings is longer than that of the Fed.

But the current financial backdrop suggests now is not the best time for the BoE to sell gilts. We suspect the Bank will therefore hold-off, and simply lay out a few extra details of how the policy could work in practice when the committee meets next week.

The BoE's balance sheet will be slow to shrink without active sales

Source: Bank of England, ING

Are markets ready for gilt sales? Not really…

Officials have recently emphasised that the 1% level is not an automatic trigger for selling bonds. After all, this is uncharted territory and requires the Bank to switch from being a player smoothing phases of market volatility, to one potentially exacerbating them.

This is, of course, not a position a central bank ever wants to find itself in, so there’s never going to be an ideal time to sell gilts. This being said, we subscribe to the BoE’s argument that the market impact of asset purchases varies depending on market conditions. Assuming a similar logic applies to sales, we can identify periods where the market impact would be more limited than others.

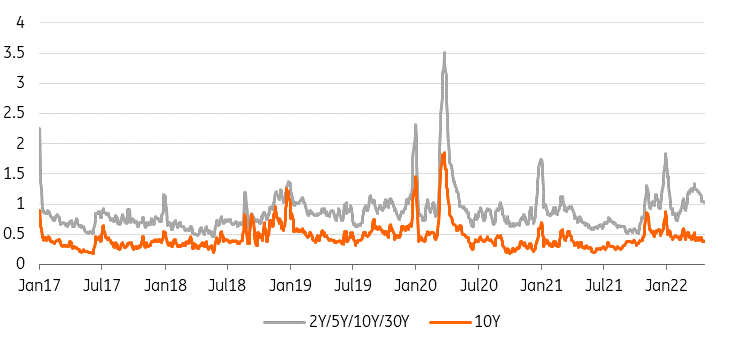

We’re focusing on two metrics here. First, the bid-offer spread is a good way to measure dealers’ willingness to provide liquidity at a certain price (the bid-offer spread). Some trading platforms include an obligation to quote for dealers which means that outside of periods of high volatility, bid-offer spreads have a mean-reverting quality to them. On the other hand, this is also one of their weaknesses. A tight bid-offer spread, particularly if mandated by trading platform rules, does not indicate how much liquidity is available at this tight price.

Wide bid-offer spreads suggest gilt liquidity has been impaired since last year

Source: Refinitiv, ING

This is why we find it useful to look at it in the context of market volatility. The idea is that bid-offer spreads are meant as compensation for dealers facing market volatility until they can hedge their risks. The greater the volatility, the greater compensation dealers would require for taking on new positions, and thus the lower the liquidity. This can help identify periods of structurally lower market liquidity which mean-reverting bid-offer spreads would miss.

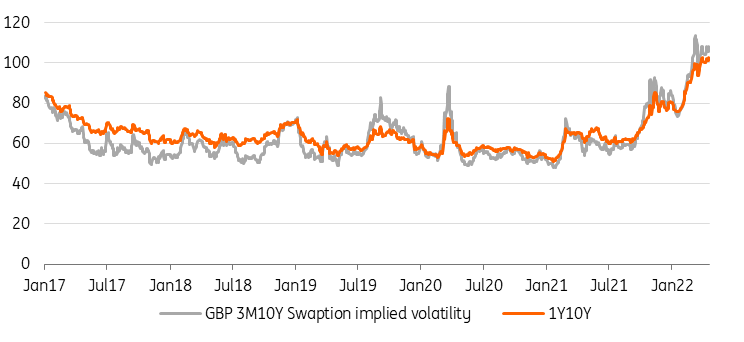

Our conclusion is simple: now is not the best time for the BoE to sell gilts. Granted, bid-offer spreads for 10Y gilts have reverted to some sort of baseline but that of other maturities have remained above their long-term average for around six months, even if the magnitude of the jump in spreads is well below that of March 2020. Looking at implied (ie forward-looking) volatility supports the view that the current period is characterised by impaired trading conditions, which outright BoE selling risks worsening.

GBP swaptions show markets expect durably higher volatility

Source: Refinitiv, ING

The Bank will need a mechanism to pause sales if markets become stressed

In short, we expect the Bank to keep its QT policy under review next week without laying out a firm timeline for starting sales. Assuming market conditions improve, there's still a fair chance the Bank will start selling at some point within the next 9-12 months.

However, we are still likely to get some further detail on how the policy could look in practice - and there are two points worth watching:

Firstly, our analysis above poses the interesting question of what will happen once the Bank has started selling, when markets enter another turbulent patch. Governor Andrew Bailey said earlier this year that the Bank wouldn’t do QT in a period of financial instability.

But the Bank will also be very keen to keep the policy predictable. Policymakers will want to ensure this remains a passive, background process, as much as possible. Deputy Governor Ben Broadbent even hinted earlier in the year that QT could continue even if Bank Rate were cut again in the future.

Reconciling both of those policy aims will, in practice, be delicate. The Bank may find it needs a kind of threshold - be it explicit or implicit - for pausing gilt sales in a period of market stress, perhaps based on those bid-ask spreads and implied volatility metrics discussed earlier.

Expect further details at the May meeting on how the policy could work

Secondly, there's the question of how - and how many - gilts will be sold back into the market when active sales begin. We've written previously that £25bn of bond sales in any given year would have a similar effect to 0.125-0.25% worth of rate hikes, which could suggest an initial sales volume of £2-3bn per month.

In terms of logistics, so far the Bank hasn’t said much officially, other than it is liaising with the Debt Management Office (DMO).

There are broadly two main options. Firstly, the Bank could keep the policy in-house and use regular auctions to unload gilts from different maturity buckets. That's essentially what it did with quantitative easing, but in reverse. Alternatively, it could ask the DMO to manage the process for it. This could see the DMO buy back old off-the-run gilts held by the BoE and finance them by selling more on-the-run gilts via the usual auction/syndication process.

This latter approach has the benefit of retaining only one seller, avoiding BoE auctions competing with the DMO. However, it could draw questions about the Bank’s independence. Read more on those, and other options, in our previous article.

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more