Why EUR/USD Is Rallying… And What Could Cause It To Stop

Stop me if you’ve heard this one before, but the euro is the strongest major currency on the day despite the accelerating spread of coronavirus on the continent. Assuming we close anywhere near where we’re currently trading, this would mark the seventh consecutive rally in EUR/USD, which has tacked on more than 300 pips in that time.

So what’s driving the euro higher against its major rivals? It’s certainly not the economy, which remains mired in slow growth, high unemployment state, despite negative interest rates and aggressive asset purchases.

Instead, the euro is rising on the exact same dynamic that makes the Japanese yen a “safe haven” currency: the reversal of carrying trades. In a carry trade, investors buy higher-yielding currencies and sell lower-yielding currencies (like the euro), seeking to benefit from the positive “carry” between the two currencies in addition to any price moves in their favor. Traders typically put these trades on when they’re confident in the prospects for the global economy, which tends to benefit higher-yielding emerging market and commodity-correlated currencies.

Of course, markets are two-way animals, and these dynamics occasionally reverse as we’ve seen in the last couple of weeks. As traders become fearful about the prospects for the global economy, they emphasize the return of their capital over the return on their capital and accordingly “unwind” their carry trades. This means that they must sell the higher-yielding currency and buy back the lower-yielding currency used to fund the trade (commonly the euro of late). It’s this dynamic that has led to the massive rally in the euro, which has counterintuitively become a “safe haven” currency of sorts (see my colleague Joe Perry’s Week Ahead report for more on this phenomenon).

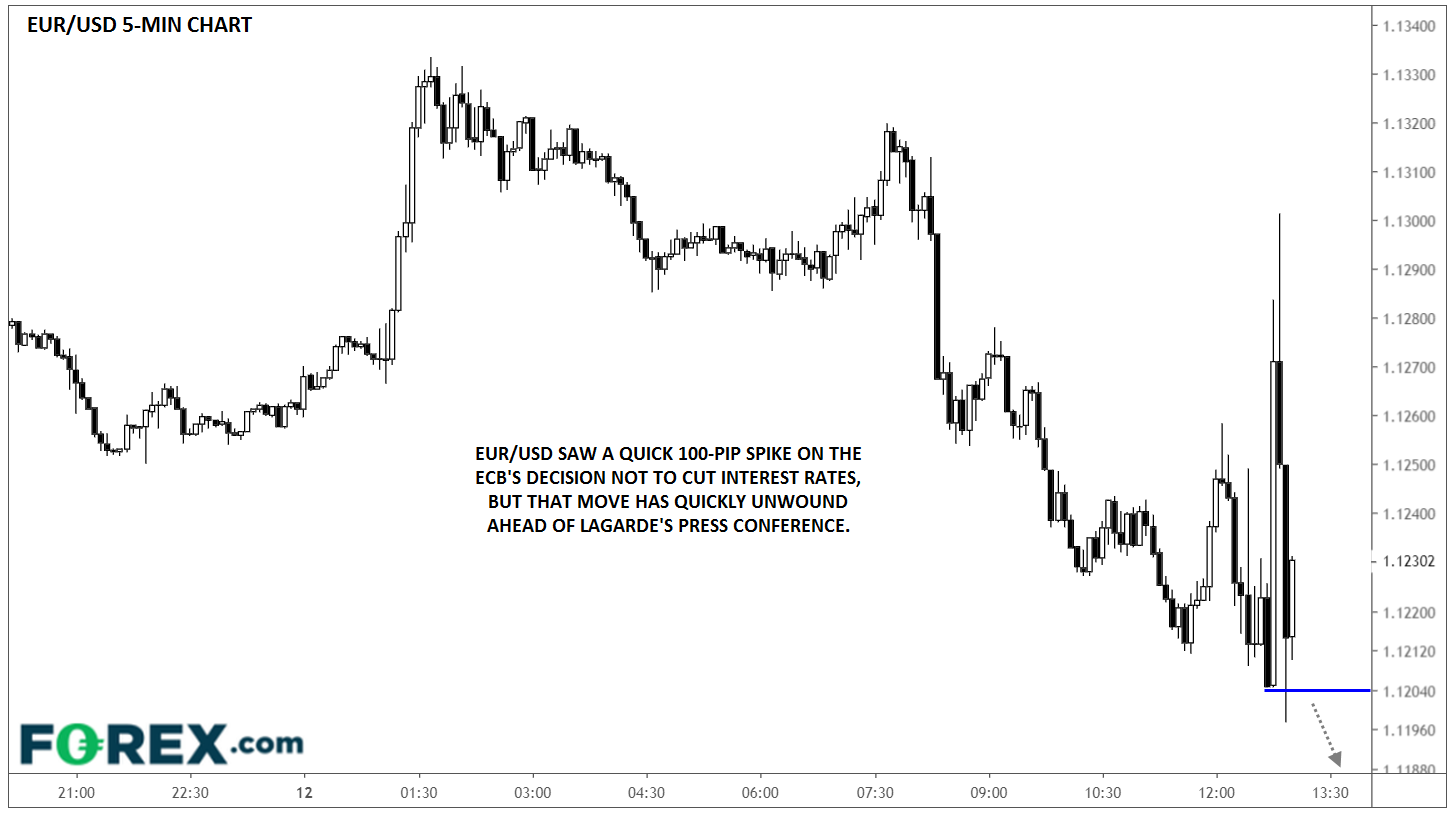

Turning our attention to the chart, there is a technical case for the EUR/USD rally to end soon assuming sentiment around coronavirus can stabilize. The world’s most widely-traded currency pair is currently testing its long-term 200-day EMA, as well was the topside of a multi-year bearish channel. Meanwhile, the RSI oscillator is approaching overbought territory after starting this vicious rally from its most oversold levels in years less than two weeks ago:

(Click on image to enlarge)

Source: TradingView, GAIN Capital

In terms of specifics, bearish traders will want to watch for signs that price action is starting to reverse, perhaps in the form of a reversal candlestick pattern on the 4-hour or 1-hour chart, before considering sell traders against the strong bullish momentum. Positive global economic news, even if it comes in the form of a Fed rate cut, could also help EUR/USD find a near-term top. On the other hand, a break through the current resistance levels would suggest that the buyers remain in control and open the door for a continuation toward the New Year’s Eve highs above 1.1200 next.