White House Rejects Intel Proposal To Add Semi Production Capacity In China

Days ago we wrote about how VC companies in the U.S. were making significant investments in Chinese semiconductor companies. Shortly thereafter, it was reported that the White House had rejected a plan by Intel (INTC) to bolster their chip production capacity in China, according to Bloomberg.

Intel had proposed "using a factory in Chengdu, China, to manufacture silicon wafers," the report said. It could have been online by 2022, but the White House, "strongly discouraged" the move. Intel likely had to listen since the company is seeking government support in helping expand its capacity for manufacturing semis in the U.S.

Intel told Bloomberg it was now looking at “other solutions that will also help us meet high demand for the semiconductors essential to innovation and the economy.”

The company continued: “Intel and the Biden administration share a goal to address the ongoing industry-wide shortage of microchips, and we have explored a number of approaches with the U.S. government. Our focus is on the significant ongoing expansion of our existing semiconductor manufacturing operations and our plans to invest tens of billions of dollars in new wafer fabrication plants in the U.S. and Europe.”

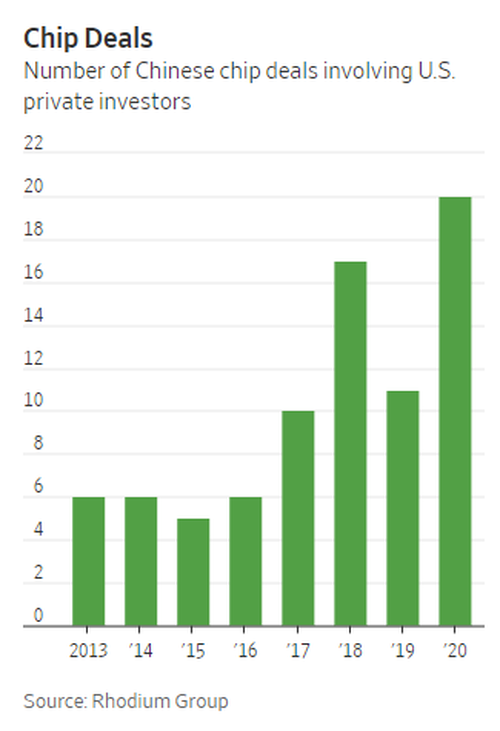

Recall, just days ago that we wrote how U.S. firms were splurging on Chinese semi deals, drawing scrutiny from the White House.

U.S. venture capital firms have been "ramping up investments" in Chinese semiconductor companies despite the obvious security conflicts, a report from the Wall Street Journal said. Cumulatively, U.S. firms have helped raise "billions" for Chinese chip startups, we noted.

There has been more than 58 deals in China's semiconductor industry from 2017 to 2020, we wrote. Among the "active investors" was Intel, who had invested in a Chinese company called Primarius Technologies Co., which makes chip-design tools that the U.S. currently holds the lead in making.

Intel told the WSJ last week that its China investments "are less than 10% of the deals in a global portfolio designed to support its business and generate return".

VC firms Sequoia Capital, Lightspeed Venture Partners, Matrix Partners, and Redpoint Ventures have also made "at least 67 investments" in Chinese chip companies since the beginning of 2020, the report said. Sequoia and Redpoint said their deals have been done "independent" of their U.S. offices in Silicon Valley.

The Journal wrote that "Sequoia Capital’s China unit has made at least 40 investments in Chinese chip-sector companies since 2020."

We noted last week that the massive tranche of deals had Washington alarmed, with national security adviser Jake Sullivan claiming this summer that the Biden administration is “looking at the impact of outbound U.S. investment flows that could circumvent the spirit of export controls or otherwise enhance the technological capacity of our competitors in ways that harm our national security.”

Now, it looks as though Intel is experiencing this scrutiny first hand.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Of course the motivation is to expand where the bulk of the production already is established. And China certainly is a better place as far as both costs and rules go. Even considering transportation and logistics costs, China is far more receptive to IC production that the US, ESPECIALLY California, with all of it's fears and rules and high costs. The cost of operation does need to be considered.