When Can The Bank Of Japan Be Confident That Inflation Is Sustainable?

The Bank of Japan will likely stay dovish for an extended period despite a solid recovery in economic growth and inflation being above target. But we think the BoJ could still adjust its yield curve control policy this Friday.

The Bank of Japan remains cautious about its policy changes despite more than a year of above-target inflation and a rebound in growth. There are growing signs of an end to disinflation and above-potential growth in 2023 and 2024, but the BoJ is still not confident enough and seems to be concerned that premature policy changes could mean a return to disinflation. For this reason, we expect the BoJ not to raise its policy rate until the first quarter of next year but tweaking its YCC policy is a possible option, as it aims to improve market functionality and reduce the burden of asset purchasing.

Japanese inflation was above the BoJ’s target in June for a fifteenth straight month

Compared to other major economies, Japanese inflation remained relatively low during the pandemic period despite its high dependence on foreign fossil fuels and a weak currency. This was due to a wide range of government energy subsidies. In addition, with a quite conservative stance on Covid, mobility restriction measures were lifted relatively late by the end of last year, thus inflationary pressures led by the reopening only really began early this year.

Against this backdrop, headline inflation hit a high of 4.4% in January and has been around 3.3% throughout the first half of the year while core inflation excluding fresh food & energy only peaked in May. We expect inflation to decelerate over the remainder of the year and eventually come down to the 2% range mainly due to some stabilization in commodity prices. But core inflation will likely exceed the headline rate for a considerable time with a modest gain in service prices. Key leading indicators for energy and food prices have already dropped quite sharply in the past few months, however, the government’s energy subsidies will expire in the second half of the year, and thus the decline in energy prices is expected to be modest. Meanwhile, service prices will remain above average for a longer period, aided by the economic recovery and better-positioned household consumption from positive wealth effects.

Inflation is expected to stay above 2% until 2024

CEIC, ING estimates

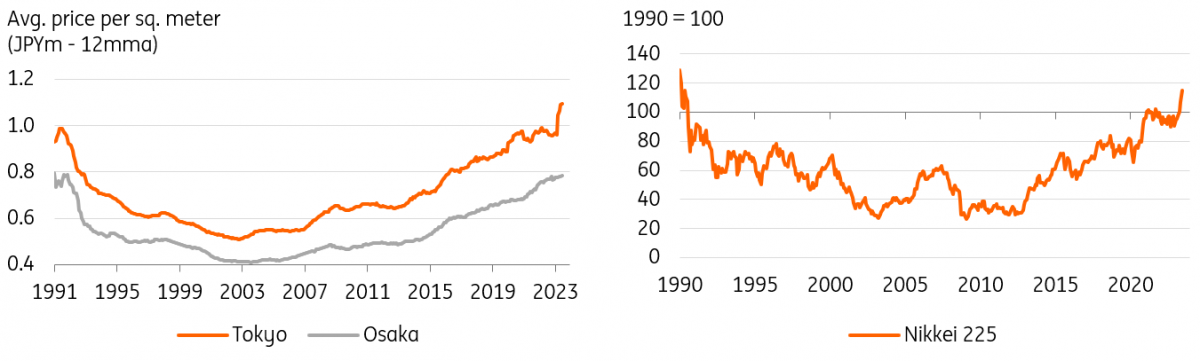

Tight labor conditions and a recent revival of asset prices will support consumer purchasing power

Japan’s unemployment rate has stayed around the 2%+ range since November 2020 while the labor participation rate has already surpassed the pre-pandemic level. Business surveys show that companies expect a shortage of labor, which will likely support the tight labor market in the near future. In addition, it is already known that wage conditions have improved, including a 3.6% rise in salaries after this year’s spring wage negotiations. Despite solid nominal wage growth, real cash earnings are still negative due to higher inflation, which should be a concern for the BoJ. But if inflation stabilises around 2% and nominal wage growth accelerates to about 3%, it will support sustainable inflation which the BoJ has been looking for. In addition, given the positive wealth effects of the real estate and equity market recovery, the household income situation will likely improve even more.

Asset prices are on the rise

CEIC

Japan’s GDP is expected to stay above its potential level throughout 2023

Japan’s private consumption accounts for more than 55% of GDP, so if the recovery here continues in the second half of this year, overall growth will likely exceed its potential level. PMI data clearly shows the service sector-led recovery continuing in the second half of the year. Although the service PMI edged down a bit from the recent peak of 55.9 in May, it is still near an all-time high. Booming tourism and a revival of the services sector are expected to support overall growth meaningfully. Also, a sharp decline in commodity imports will likely improve trade conditions in the second half of the year.

PMI suggests service-driven recovery in 2H23 while net export contribution may turn positive

CEIC

We also believe that robust investment will likely continue for a while, catching up after the disruption of global supply conditions and the increasing trend of friend-shoring of tech investment. The recent announcement of new investment of TSMC in Kumamoto and other semiconductor-related projects will have a positive impact on the economy while strong government support will likely boost this even more.

Why is the BoJ hesitant to normalize policy?

Maybe history can explain why the BoJ is taking its time to normalize policy. In the 2000s, the BoJ raised its policy rates, once by 25bp in 2000 and then by a total of 50bp in 2006-2007. But in retrospect, these attempts were too early; neither of them helped the economy to escape from deflation and they even triggered economic downturns.

1999 and 2006 : BoJ policy moves

CEIC, IMF

In both cases, GDP growth was recovering but inflation conditions were subdued. The zero-interest rate policy (ZIRP) was not conventional at all back then, and the BoJ was eager to end it. But with no real bank reform and a lack of restructuring in the major industries, price elasticity was hampered quite severely during the post-bubble era and the economy tipped into a deflationary stagnation phase. The Global Financial Crisis in 2008 further dampened Japan’s economy and was then followed by the great earthquake in 2010. The last two attempts of the BoJ to start policy normalization therefore ended in failure. We think the BoJ does not want to repeat the same mistakes again. So they are being extremely cautious about policy change and prefer to be patient on any inflation overshoot, at least for a short period of time.

However, we think the macroeconomic conditions today are quite different from the past as mentioned earlier. Specifically, inflation has now been above 2% for more than 15 months. Similar to other economies, Japan’s inflation was also driven by supply-side issues, though the inflationary pressures broadened to service prices. This also coincided with fiscal stimulus and the timing of the reopening. The policy focus on wage growth is supporting sustainable inflation, and business behavior on wages and price setting has been gradual so we saw the largest gain in wage growth in FY2023 and a higher-than-usual pickup in consumer goods prices.

But why not this year?

As we have seen in the BoJ’s potential GDP data, despite the recent recovery, the GDP output gap still remains negative. We believe this will turn positive by the end of this year or early next, which will be another reason for the BoJ to make the first rate hike in 2Q24. The BoJ would also like to see that solid wage growth can be sustained, thus after next year’s Spring Wage Negotiation season, it may be the right time for the BoJ to start tightening.

Output gap is expected to turn positive by the end of this year

CEIC

YCC adjustment is expected soon as a gradual course of normalization

Last week, there was a media report that the BoJ may keep its current policy settings unchanged at this Friday’s meeting. But we still think there is a chance of the Bank adjusting its YCC policy this week, with it likely shortening the yield target from the 10-year to 5-year tenor. We think the BoJ will want to take action when other major central banks remain on a hiking path, which will limit the impact on the JGB and currency markets.

Even if the BoJ keeps its YCC policy as it is but hints at possible future policy adjustments, market expectations will likely grow again ahead of its October meeting and the burden on the BoJ to keep capping the upper limit on 10Y JGB yields will increase for a few months. To maximize the impact of the policy adjustment and to reduce the burden on the BoJ, we still think the BoJ could surprise the market. If we are wrong, then the next possible opportunity will be at its October meeting.

Market implications for JPY and JGBs

If the BoJ decides to leave the current policy settings unchanged, then USD/JPY looks as though it can push back to the recent high at 145 - coincidentally the first level at which Japanese authorities sold FX during their US$70bn FX intervention campaign last September-October. While we cannot rule out a brief foray above 145 this summer, we doubt gains would be sustained - largely because US disinflation bells will ring increasingly louder during the summer and by September we would expect a broad dollar bear trend to be underway.

If the BoJ surprises the market with a YCC tweak as we forecast, or gives a hint of possible policy adjustment in the near future, then USD/JPY could break lower - perhaps even lower than the recent low of 137 as the market would be taken by surprise. We have 3Q23 and 4Q24 USD/JPY forecasts at 135 and 130, respectively.

In terms of Japanese Government Bonds, we can see in the forwards market that very few YCC changes are priced. JGB 10-year yields (now 0.46%) are priced at 0.51% and 0.55% in three and six months' time. Were the BoJ to shorten its yield curve target to the 5-year from the 10-year tenor, we think the 10Y JGB yield can rise to the 0.80% area, but stay below 1%. We believe that Japanese investors such as lifers, banks, and pensions will likely support the JGB market. For example, Japanese lifers invest about 30% of their assets overseas but have become net sellers of foreign bonds since March 2022 mainly due to steep rate rises in US Treasuries and soaring FX hedging costs. With normalized market rates expected, we think domestic investors will likely return to the JGB markets.

But certainly, a YCC tweak to target 5-year JGB yields would leave the topside exposed for both 10- and 30-year JGB yields.

More By This Author:

Indonesian Central Bank Extends Pause Again To Preserve FX Stability

The Commodities Feed: Supply Risks Grow

FX Daily: European Pessimism, Chinese Optimism

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more