What To Expect From Bank Of Canada Tonight?

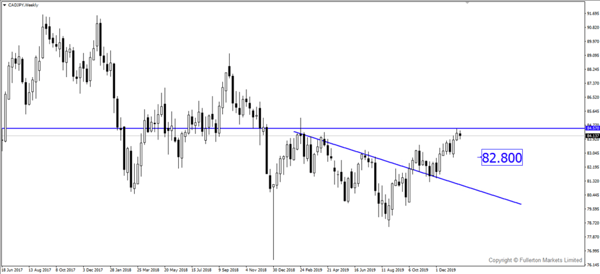

Despite a rebound in Canada’s employment, sluggish productivity and lower oil prices could cause BoC to lean towards dovishness. CAD/JPY could be a good pair for shorts.

CAD was one of the stronger currencies last year against the greenback with a rise of 5% against dollar.

However, it has weakened 0.6% against dollar so far this year due to trade relief, geopolitical tension and positive US economic data.

Bank of Canada is expected to keep rates unchanged tonight though they may not be as bullish as at the previous meeting in December.

Bank of Canada has kept its interest rate on hold for more than a year even as its peers move to cut rates and loosen monetary policy.

Furthermore, in its previous meeting, Bank of Canada was very bullish after talking about the resilience of consumers and stabilisation in the global economy.

Since then, Canada’s economy has weakened from consumer spending to the housing market.

If Bank of Canada focuses on its weakness tonight, we could see CAD slide further.

However, if Bank of Canada chooses to ignore weaknesses and stand by the resilience of the market, CAD will soar higher.

CAD/JPY is currently at a very strong resistance and could head lower towards 82.80 if Bank of Canada is dovish tonight.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more