Weekly Fundamental Gold Price Forecast: World War 3 Or Bust

Weekly Fundamental Gold Price Forecast: Neutral

Unless NATO is drawn into the Russia-Ukraine conflict, there’s good reason to believe that gold prices have hit their high for 2022.

Gold price rallies may not have much lasting power in an environment defined by rising real interest rates; the Federal Reserve will start hiking rates in March.

The IG Client Sentiment Index suggests that gold prices in USD-terms (XAU/USD) have a bearish trading bias.

Gold Prices Week In Review

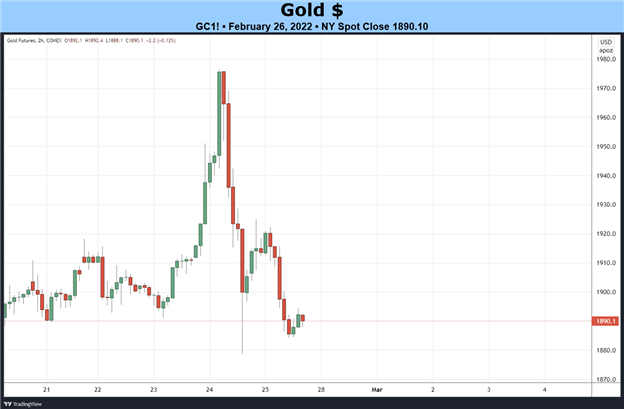

Gold prices had an exceptionally volatile week as Russia-Ukraine headlines dominated the news flow. Gold in USD-term terms closed down by -0.64% at 1890.10, but not before trading in a 5.2% range, reaching as high as 1976.50. This was the largest weekly price range for XAU/USD since the second week of August 2021.

This price action was par for the course: gold prices in EUR-terms (XAU/EUR) closed higher by +0.04%, but traded in a 6.5% price range; gold in GBP-terms (XAU/GBP) finished up by +0.87%, but not before carving out a 6.3% price range; and perhaps most noteworthy, gold in RUB-terms (XAU/RUB) gained +7.6%, but gained as much as +17.1% at their highs.

The path for gold prices is clear from here: it’s World War 3 or bust. If gold prices are going to run higher from this point, there needs to be a significant escalation in the Russia-Ukraine conflict, ultimately drawing in the European Union, the United States, and more broadly, the NATO alliance. Otherwise, in an economic environment defined by slowing growth among G7 countries and more hawkish central banks – which is pushing up real interest rates – gold prices are not well-suited to sustain a meaningful rally.

Economic Calendar Week Ahead

Gold prices will continue to be highly sensitive to Russia-Ukraine headlines, dwarfing the usual importance that the economic calendar has in the coming days. That said, two central bank decisions and the latest US labor market report will draw financial markets' attention, if only temporarily.

- On Monday, February 28, gold in AUD-terms (XAU/AUD) will be in focus around the March Reserve Bank of Australia rate decision.

- On Tuesday, March 1, gold in CAD-terms (XAU/CAD) will garner attention when the 4Q’21 Canada GDP report is released. After the US cash equity open, gold in USD-terms (XAU/USD) will see volatility around the February US Markit manufacturing PMI and February US ISM manufacturing PMI releases. Later in the day, gold in AUD-terms (XAU/AUD) will be back in focus around the releases of the 4Q’21 Australia GDP report and RBA chart pack.

- On Wednesday, March 2, gold in EUR-terms (XAU/EUR) will be in the spotlight when the February Eurozone inflation rate report (HICP) is released. Gold in CAD-terms will return to focus around the March Bank of Canada rate decision.

- On Thursday, March 3, gold in USD-terms will be in focus around the release of the February US ISM non-manufacturing (services) PMI.

- On Friday, March 4, gold in USD-terms is back in the spotlight as the February US nonfarm payrolls report and US unemployment rate are due.

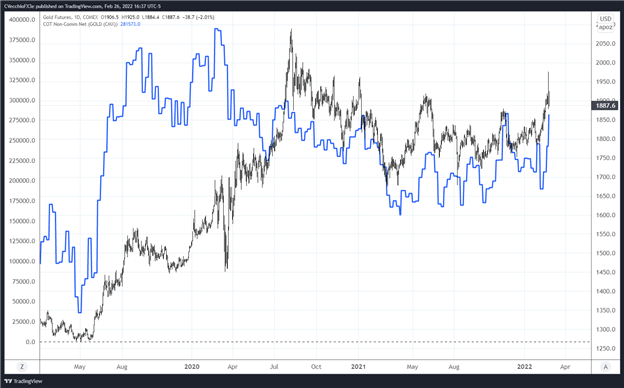

Gold Price Versus COT Net Non-Commercial Positioning: Daily Timeframe (February 2019 To February 2022) (Chart 1)

Next, a look at positioning in the futures market. According to the CFTC’s COT data, for the week ended February 22, speculators increased their net-long gold futures positions to 281,573 contracts, down from the 242,762 net-long contracts held in the week prior. The futures market is now the most net-long in three months.

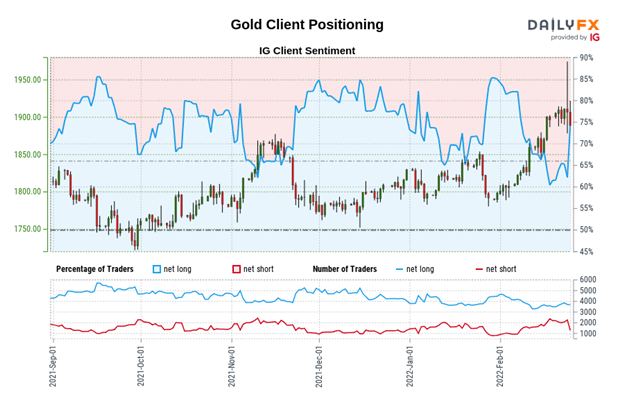

IG Client Sentiment Index: Gold Price Forecast (February 25, 2022) (Chart 2)

Gold: Retail trader data shows 74.64% of traders are net-long with the ratio of traders long to short at 2.94 to 1. The number of traders net-long is 5.16% higher than yesterday and 8.69% higher from last week, while the number of traders net-short is 0.95% higher than yesterday and 41.11% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Gold-bearish contrarian trading bias.