Weekly Fundamental Gold Price Forecast: Rising Inflation Expectations Buoy Bullion

Weekly Fundamental Gold Price Forecast: Neutral

- Gold prices’ recent gains have come on the back of rising inflation expectations outpacing bond yields.

- The final week of October will see several central bank meetings and initial Q3’21 GDP readings, putting focus on how policymakers are planning on dealing with persistently higher inflation in context of a weaker growth environment.

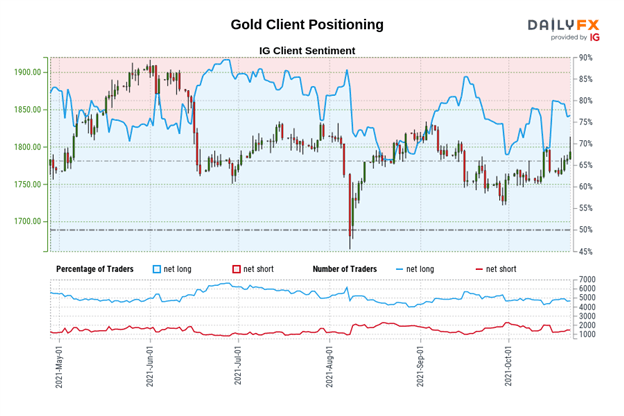

- The IG Client Sentiment Index suggests that gold prices in USD-terms (XAU/USD) have a bullish trading bias.

Gold Prices - Week in Review

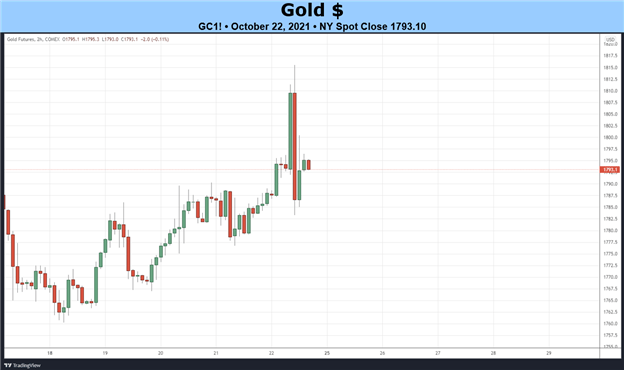

Gold gained across the board last week as rising G10 inflation expectations outpaced gains in sovereign bond yields – including US Treasury yields. Gold in USD-terms (XAU/USD) added +1.42%, which alongside gold in GBP-terms (XAU/GBP), was tied for the best performing gold-cross on the week.

Gold in CAD-terms (XAU/CAD) followed closely, gaining +1.38%, while gold in EUR-terms (XAU/EUR) rounded out gold-crosses that added more than +1% on the week, by adding +1.03%.

Economic Calendar for the Week Ahead

The final week of October will see several central bank meetings and initial Q3’21 GDP readings, putting focus on how policymakers are planning on dealing with persistently higher inflation in context of a weaker growth environment. For the main gold-cross, XAU/USD, focus will be less on the data and more on speeches made by Federal Reserve officials.

- On Monday, gold in EUR-terms (XAU/EUR) is in focus when the October German Ifo Business Climate survey is released.

- On Tuesday, gold in USD-terms (XAU/USD) is in the spotlight when the October US Conference Board Consumer Confidence reading is due.

- On Wednesday, gold in AUD-terms (XAU/AUD) will garner attention when the Q3’21 Australia inflation report is released. XAU/EUR is also in focus when the November German Consumer Confidence survey is due. Gold in GBP-terms (XAU/GBP) will see attention when the UK Autumn Budget is disclosed. XAU/USD will likely experience increased volatility when the September US Durable Goods Orders report is released. The October Bank of Canada rate decision will bring focus to gold in CAD-terms (XAU/CAD).

- On Thursday, gold in JPY-terms (XAU/JPY) will likely see its biggest move of the week when the October Bank of Japan rate decision concludes. XAU/EUR is back in focus when the October German unemployment report is released, as well as the October European Central Bank rate decision and press conference and finally the October German inflation rate report later in the day. Finally, XAU/USD should be on the move around the Q3’21 US GDP report is released.

- On Friday, XAU/EUR will see attention when the Q3’21 German, Italian, and Eurozone GDP reports are due, as well as the October Eurozone inflation report. XAU/USD will cap off the week with the September US PCE index and October US Michigan Consumer Sentiment reports are released.

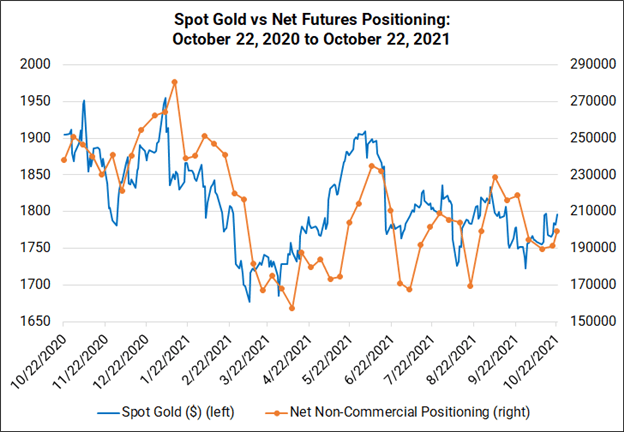

Gold Price versus COT Net Non-Commercial Positioning: Daily Timeframe (October 2020 to October 2021) (Chart 1)

Next, a look at positioning in the futures market. According to the CFTC’s COT data, for the week ended Oct. 19, speculators increased their net-long gold futures positions to 199,446 contracts, up from the 191,323 net-long contracts held in the week prior. The futures market is the most net-long over the past month.

IG Client Sentiment Index: Gold Price Forecast (Oct. 22, 2021) (Chart 2)

Retail trader data shows 76.07% of traders are net-long with the ratio of traders long to short at 3.18 to 1. The number of traders net-long is 8.85% lower than yesterday and 10.19% lower from last week, while the number of traders net-short is 6.42% lower than yesterday and 5.92% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests gold prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current gold price trend may soon reverse higher despite the fact traders remain net-long.