Weekly Forex Forecast - Sunday, Dec. 19

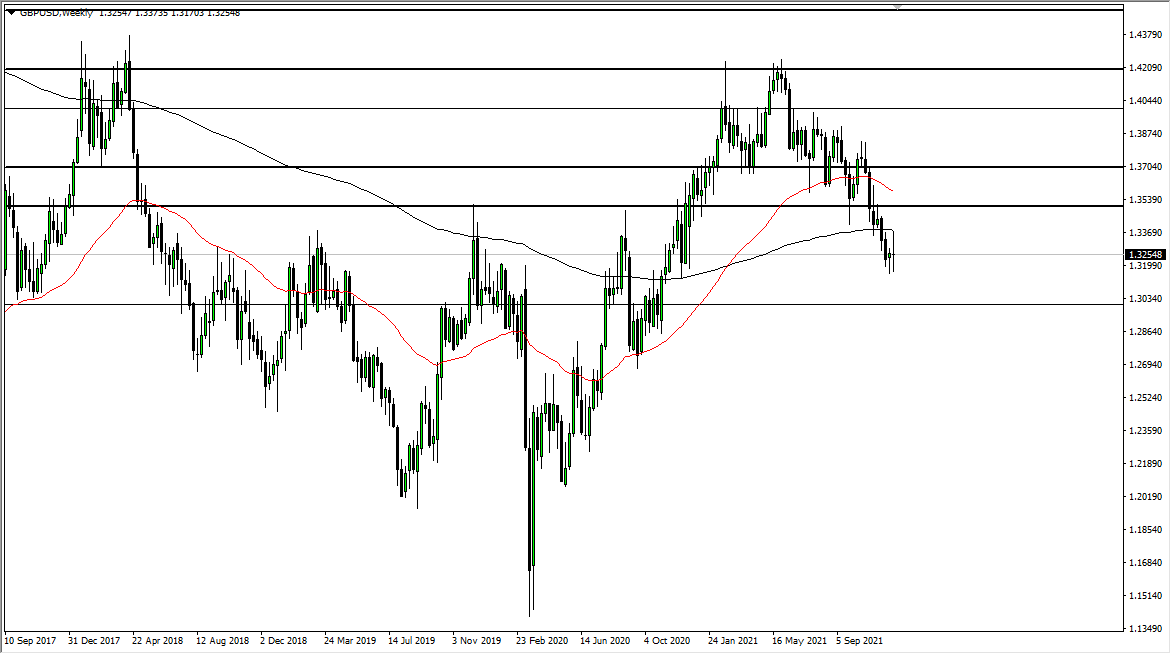

GBP/USD

The British pound was an interesting currency to follow last week, as it spiked after the surprise interest rate hike by the Bank of England. That being said, the market gave back those gains rather quickly, as they did not even last 24 hours.

Because of this, we ended up forming a bit of a neutral candlestick, and at this point it looks like the British pound is going to continue to be a “sell the rallies” type of situation. With a central bank raising interest rates you would usually anticipate a little bit more follow-through.

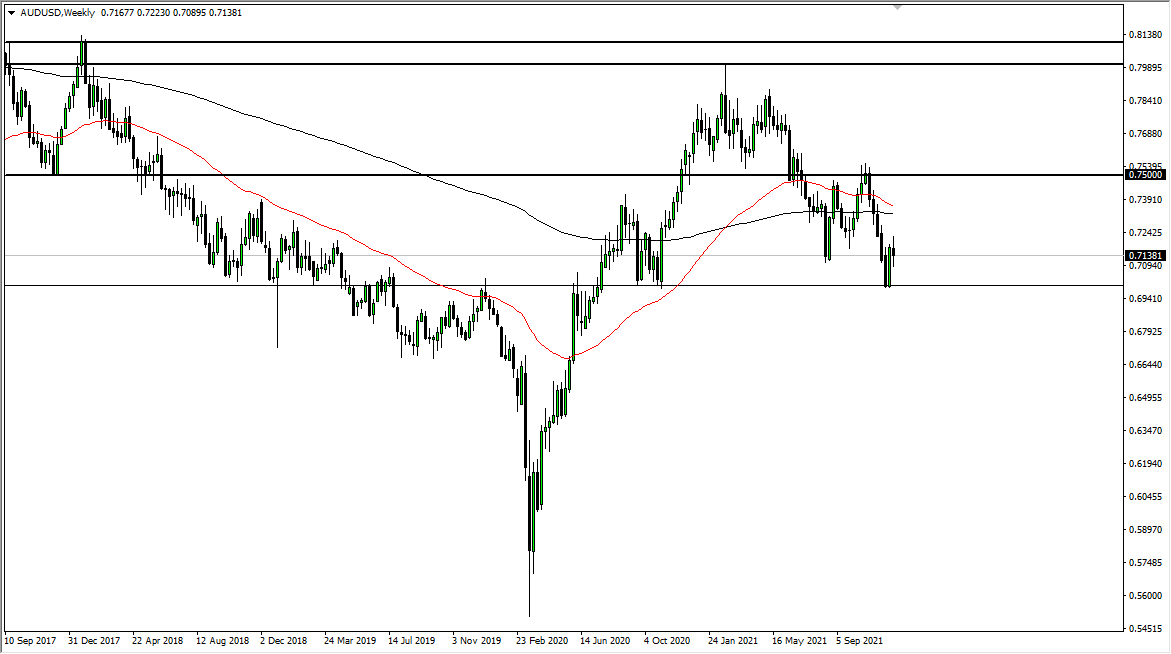

AUD/USD

The Australian dollar was slightly negative during what was a very volatile week. Because of this, I think we will continue to see more sideways action with a slight downward tilt, especially as we are heading into the holiday season and a serious lack of liquidity. If we can break above the highs of the week, then I think the market is more likely than not going to go looking towards the 0.73 handle.

Otherwise, I would fully anticipate that we bounce around between here and the 0.70 level, with the 0.70 level being a massive “floor in the market.” I expect a very sideways and choppy week for the Aussie dollar.

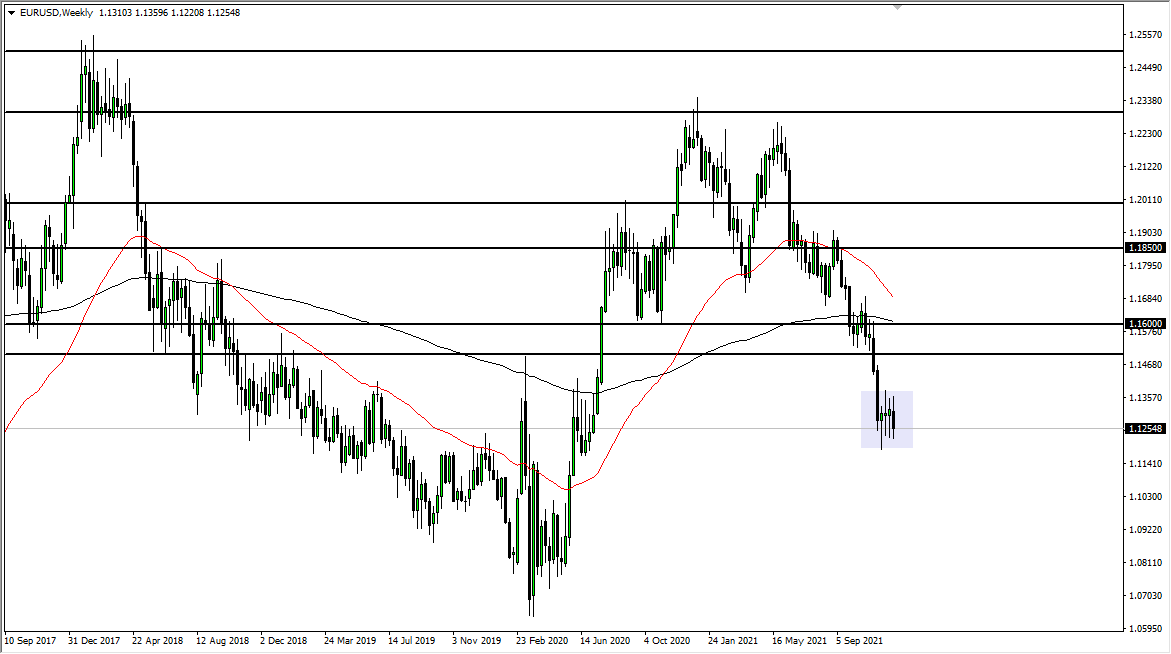

EUR/USD

The euro went all over the place last week, testing the 1.3775 level as resistance, but it failed to hang on to the gains. Since we cannot break out, it makes sense that we would have returned to the bottom of the overall range.

With this, I anticipate that the euro will continue to hang about in this range, but the fact that we are closing a little bit lower on the body than we had over the previous three weeks tells me that there is still a significant threat to the downside. Any break below the 1.12 level on a daily close could send the euro down to the 1.10 level rather quickly.

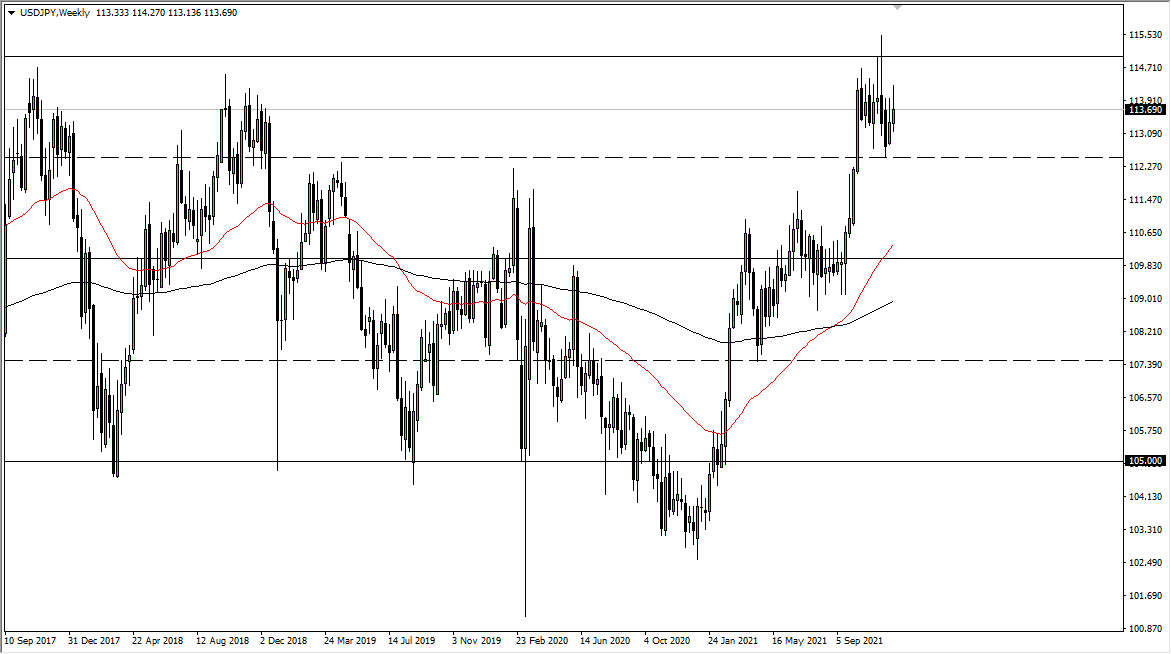

USD/JPY

The US dollar rallied again against the Japanese yen, but it did give back some of the gains. At this point, it looks like we are going to continue to grind higher only to find sellers again. Keep in mind that this pair does tend to fall in “risk off conditions,” something that we have seen quite a bit of as of late.

This is one of the main reasons why we have not been able to break out, and you have to look at the ¥115 level as a major barrier based upon weekly and monthly charts. To the downside, the ¥112.50 level should be your “floor.”

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more