Key Events In Developed Markets And EMEA For Week Of Nov. 14

Shutterstock

US: Fed officials will have to tread carefully regarding hiking expectations

The low CPI print from the US this week has boosted expectations that the Federal Reserve will raise interest rates by “only” 50bp in December after four consecutive 75bp hikes. However, the Fed will be nervous that Treasury yields fell so far as some market participants interpreted the number as an indication that the Fed’s work is nearly done. However, Fed officials won't want to signal that yet as it will reinforce a loosening of financial conditions that could undermine all the hard work in trying to constrain inflation. We expect to hear some fairly hawkish rhetoric over the coming days, messaging that while there likely will be a moderation in the size of rate hikes, inflation is not defeated and there is likely to be a higher terminal interest rate than the central bank signalled in September.

In terms of data, we have retail sales, industrial production, producer price inflation, housing starts and existing home sales. Moderate growth is likely to be the order of the day in the activity reports, while the housing numbers will be soft due to the rapid rises in mortgage borrowing costs that have prompted a collapse in demand. PPI should come in on the softer side of expectations, thanks to falling commodity prices and freight costs plus the strong dollar and easing supply chain pressures.

UK: Autumn Statement in focus amid busy data week

Markets have generally given new UK prime minister Rishi Sunak and his chancellor Jeremy Hunt the benefit of the doubt when it comes to next week’s Autumn Statement. That’s partly because these announcements will be accompanied by new forecasts from the Office for Budget Responsibility – something that was lacking when the ill-fated mini-budget was announced in September. Investors no doubt expect the Chancellor to do enough to convince the OBR that debt will fall across the medium-term, closing a fiscal deficit that would probably otherwise be £30-40bn/year by 2026-27. Exactly how that will be achieved remains somewhat uncertain, and pretty much every possible lever available to the Chancellor has been touted in the press at some point over the past few weeks.

Recent reports suggest the Treasury will rely more on spending than taxes to do the heavy lifting. But given the real-term cuts (in some cases sizable) already facing certain government departments, it may be that this means more noticeable cuts to investment spending.

For the economy, much will depend on how much of the burden is placed on consumers via higher taxation, and how immediately those changes come through. But we’ll also be looking out for further detail on how the government intends to re-structure its flagship Energy Price Guarantee. The price cap, which had been due to last for two years, will be scaled back from April. Our working assumption is that most households will be shifted back to the Ofgem regulated price, which we estimate will average £3,300 annually based on current futures prices, up from £2,500 at the current government-guaranteed level.

We also have a few key pieces of data:

- Jobs (Tue): Hiring indicators have begun to turn lower, but so far there’s been little-to-no sign of increased redundancies. Firms continue to face material staff shortages, driven in part by rising rates of long-term sickness in older workers. We expect the unemployment rate to remain low next week, and greater scope for "labour hoarding" compared to previous recessions could feasibly limit how far and fast unemployment rises over the coming month.

- Inflation (Wed): Famous last words but October’s inflation data is likely to mark the peak in UK CPI – or there or thereabouts. This data will include the latest rise in electricity/gas prices, but given they’re now being fixed by the government until at least April, their contribution has probably peaked. Still, headline inflation is unlikely to slip back into single digits until March/April next year.

- Retail sales (Fri): We expect a third consecutive month-on-month fall in sales as the cost of living squeeze continues to bite.

Poland: inflation remains broad-based and core inflation momentum is high

Current account (Sep): €-3025mn

The external position remains under pressure and we expect another wide current account deficit for September amid a deep foreign trade imbalance and unfavourable secondary income balance, as September was a month when Poland paid more to the EU budget than received from it. On a 12-month cumulative basis, the current account is projected to have expanded to 4.1% of GDP vs. 3.9% of GDP in August.

CPI (Oct): 17.9% YoY

We expect the flash estimate of 17.9% year-on-year to be confirmed by the final data. Prices of petrol went up by 4.1% month-on-month and energy for housing by 2.0% MoM, so the energy crisis is not over yet. At the same time, prices of food and non-alcoholic beverages jumped up by 2.7% MoM as farmers, food manufacturers and retailers continue to pass on higher costs of energy and transport onto their final products. Inflation remains broad-based and core inflation momentum is high. We estimate that core inflation excluding food and energy prices went up by 1.2% MoM i.e. 11.2% YoY in October vs. 10.7% YoY in September.

GDP (3Q22): +3.5% YoY

The recent revision of national accounts point to an even stronger 1H22 and increases the upside risk to our forecast of 2022 GDP at 4.3%. We forecast that in 3Q22, GDP bounced back after declining by 2.1% quarter-on-quarter seasonally-adjusted in 2Q22, but annual growth moderated toward 3.5% YoY. The Polish economy is clearly slowing down and a strong performance in 1H22 has created a high reference base for 2022 so we expect dismal annual GDP figures at the beginning of 2023 and risks to our 1.5% forecast for the next year are increasingly skewed to the downside.

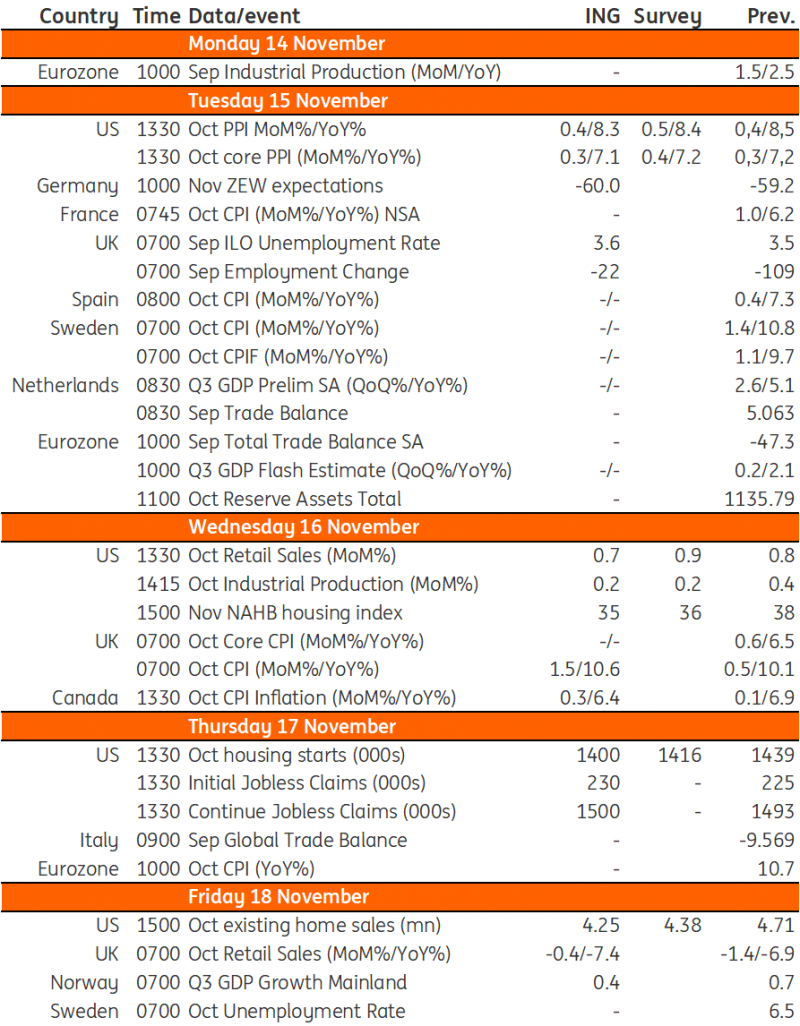

Developed Markets Economic Calendar

Source: Refinitiv, ING

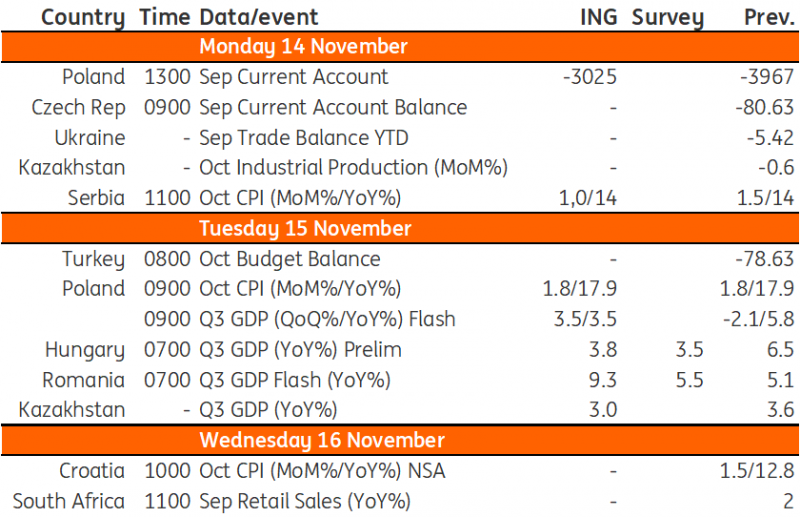

EMEA Economic Calendar

Source: Refinitiv, ING

More By This Author:

Asia Week Ahead: Central Banks In Indonesia And The Philippines To Hike Rates

UK Recession Coming As Economy Begins To Contract

US Midterms And The Challenges Ahead

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more