Weak Automotive Sector Drags Down Czech Industry

Image Source: Pexels

Czech industrial production was down 2.7% in November compared to the same month a year earlier, coming in short of market expectations. Weakness was tangible in output, new orders, layoffs, and wage dynamics. Meanwhile, the construction sector emerged as an engine of expansion.

Industrial output declines

Czech industrial output dropped by 2.7% year-on-year in November and was down by 1.5% month-on-month when adjusted for the number of working days. The main driver of the slump was the manufacturing of motor vehicles, especially the production of car parts. The associated sector of rubber and plastic products also suffered, namely tyre production. The protracted decline in machinery and equipment production also continued. In contrast, activity in non-metallic mineral products and food segments increased over the year with an apparent pre-Christmas production boost.

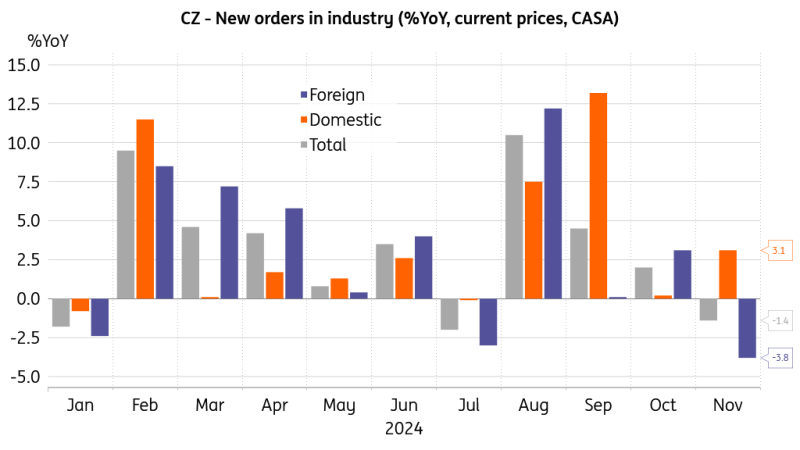

New orders at current prices fell 1.4% YoY in November, dragged down by the 3.8% YoY slump in new orders from abroad. Meanwhile, domestic new orders gained 3.1% from the previous year. Motor vehicle manufacturing was the main contributor to the annual fall in new industrial orders, but was partially affected by the high comparison base. Compared to the previous month, new orders fell 1.5%.

Foreign new orders suffer

Source: CZSO, Macrobond

The average monthly nominal wage growth in manufacturing decelerated to 4.3% YoY in November, while the average number of registered employees in the industry declined by 2.0% YoY. The average wage growth from January to November gained a robust 6.7% compared to the preceding year. However, given the protracted underperformance of the industry, firms likely will not be keen to continue with the lofty wage increases, although labour market conditions remain relatively tight. This interplay will be key to this year’s resilience of aggregate household budgets and their further willingness and ability to adhere to robust spending, keeping the Czech economic rebound alive.

Construction thrives

Construction output rose by 2.5% YoY in November and added 1.8% from the previous month. The indicative value of building permits picked up by 2.6% YoY, with 62.4% more dwellings started and 38.1% fewer dwellings completed. Average nominal wage growth in construction slowed down to 5.7% YoY in November, while the average number of employees dropped by 1.9% YoY.

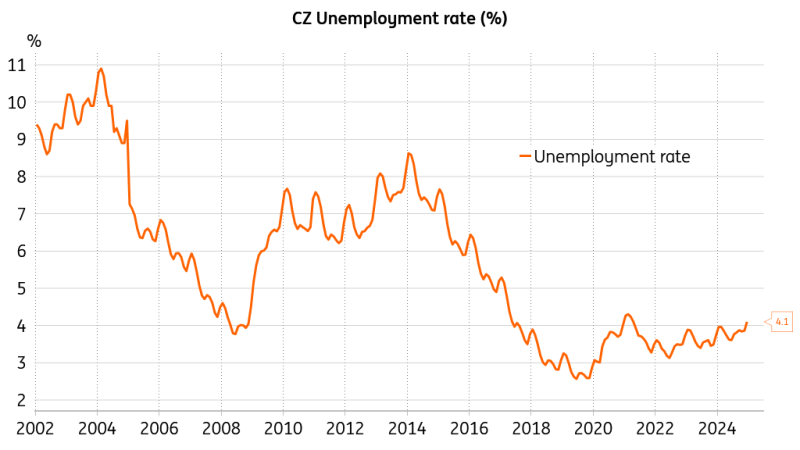

The labor market getting less tight

Source: Ministry of Labour, Macrobond

Unemployment rises

The unemployment rate picked up to 4.1% in December from 3.9% earlier, according to the latest data from the Czech Ministry of Labour. A December increase can be attributed to a common seasonal effect, with less worker demand in specific segments such as tourism. Nevertheless, with manufacturing under constant pressure, layoffs in the industry are set to contribute to a slightly more relaxed labor market in the coming quarters.

More By This Author:

FX Daily: Sterling Exceptionalism Hits A Speed BumpChina’s CPI Edged Down To End The Year

Rates Spark: A Quieter U.S. Can Help To Calm Things For A Bit

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more