USD/JPY Weekly Forecast: Bears Dominating After BoJ Surprise

The yen had a strong week, with the USD/JPY pair closing much lower. On Tuesday, the BOJ surprised the markets by adjusting its yield control and permitting long-term interest rates to climb more.

Market participants saw this action as a precursor to a further withdrawal of the BOJ’s enormous stimulus program. This saw the yen gaining on the dollar.

Haruhiko Kuroda, the BOJ governor, whose term will end in April, said that the bank had no intention of reducing stimulus because inflation was predicted to drop below 2% in 2023. However, the October minutes revealed how many of his fellow board members are now focusing on the possibility of a stimulus withdrawal and the risk of an inflation overshoot.

Data revealed that Japan’s core consumer inflation reached a new four-decade high as businesses continued to pass on rising costs to households. This was a sign that price increases were becoming more widespread and that the central bank might continue to face pressure to reduce its massive stimulus program.

According to figures released on Friday, the core consumer price index (CPI) for Japan, which includes energy costs but excludes volatile fresh food prices, increased by 3.7% from a year earlier in November, in line with market expectations and accelerating from a 3.6% increase in October.

Next Week’s Key Events For USD/JPY

There won’t be any significant events next week as markets will be closed for Christmas.

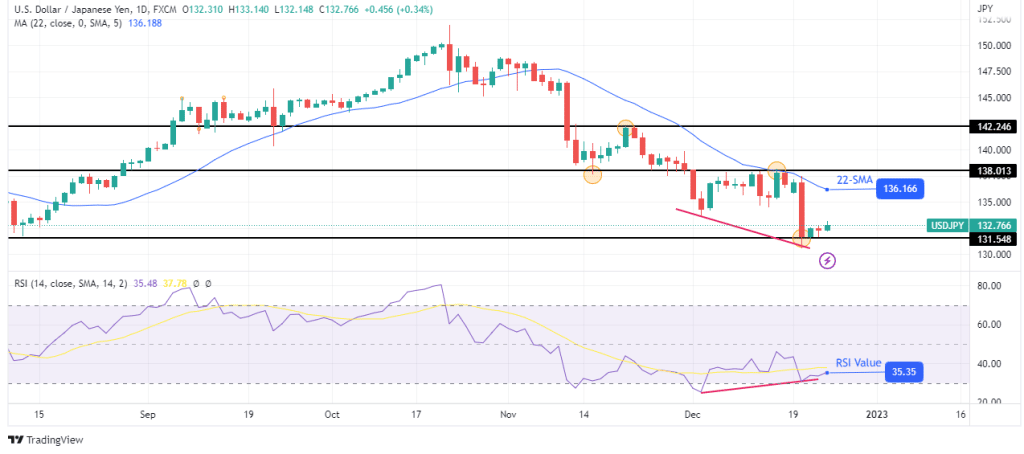

USD/JPY Weekly Technical Forecast: Bullish RSI Divergence

The daily USD/JPY chart shows the price trading far below the 22-SMA and the RSI below 50. This shows that the current trend is bearish. The price could not go below the 131.54 support level, where it paused.

A closer look at the RSI shows a bullish divergence with the price. This divergence shows weakness in the bears as they are losing momentum. It might allow for a retest and possible break above the 22-SMA.

More By This Author:

USD/CAD Weekly Forecast: Canada’s Eased Inflation To WeighEUR/USD Price Surging Amid Dollar Weakness, Eying 1.066

GBP/USD Price To Gauge Buyers Above 1.2153

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more