USD/JPY Weakens As US Shutdown Fears Weigh On Greenback

Image Source: Pixabay

- USD/JPY weakens as market jitters over the US shutdown and the Fed's outlook pressure the Greenback.

- US President Donald Trump is set to meet congressional leaders on Monday in a last-minute bid to avert a funding lapse.

- BoJ’s Noguchi turns hawkish, says “need for rate hike increasing more than ever” as Japan nears 2% inflation goal.

The Japanese Yen (JPY) strengthens against the US Dollar (USD) on Monday, with USD/JPY extending losses for a second day as the Greenback trades defensively. At the time of writing, the pair is trading near 148.60, down about 0.60% on the day, retracing a good portion of last week’s gains.

The US Dollar’s weakness comes as investors grow cautious ahead of a potential US government shutdown, with just days left before the October 1 funding deadline. Political leaders are set to meet at the White House on Monday for last-minute negotiations, after US President Donald Trump called the meeting to strike a deal and avert a lapse in government funding.

The White House said on Monday that the President is giving Democrats “one last chance to be reasonable” on passing a short-term continuing resolution, while House Minority Leader Hakeem Jeffries signaled Democrats are open to compromise but will not accept cuts to healthcare programs. Republicans argue the Senate must act on the stopgap bill already passed by the House.

Market sentiment has turned cautious amid fears that a prolonged shutdown could weigh on growth and prompt the Federal Reserve (Fed) to adopt a more accommodative stance.

Last week’s US Personal Consumption Expenditures (PCE) inflation report came in broadly as expected. The data reassured investors that price pressures are not re-accelerating, keeping rate-cut expectations alive. Market attention now shifts to Friday’s US Nonfarm Payrolls (NFP) report, with investors increasingly focused on signs of labor-market softness.

The Fed cut rates earlier this month to cushion employment as hiring momentum slowed, and a weak NFP print would reinforce concerns that labor conditions remain the main downside risk to the economy and could keep the Fed on an easing path.

Adding to the Yen's strength, Bank of Japan (BoJ) board member Asahi Noguchi, typically seen as a dovish policymaker, said on Monday that the need for a rate hike is now “increasing more than ever” as Japan makes steady progress toward its 2% inflation target. Noguchi pointed to rising wages and firms passing on higher costs as signs that upside price risks are gaining traction, though he cautioned that global headwinds, including US tariffs, still warrant attention.

US Dollar Price Today

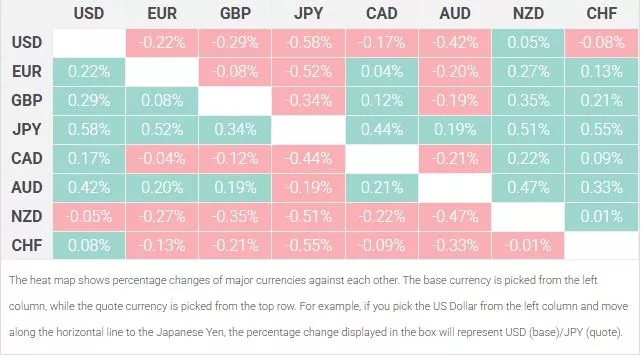

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

More By This Author:

Gold Rallies To Record Highs Above $3,800 On US Dollar Weakness And Shutdown Risk

AUD/USD Lifts From Three-Week Lows Amid U.S. Dollar Softness, RBA In Focus

EUR/CHF Price Forecast: Consolidates Near 0.9330, Downside Bias Intact Below Key Resistance

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more