USD/JPY Trades Higher To Near 156.30 Ahead Of FOMC Minutes

Image Source: Pixabay

The USD/JPY pair trades 0.17% higher to near 156.30 during the Asian trading session on Tuesday. The pair gains as the Japanese Yen (JPY) is slightly under pressure, even as the Bank of Japan (BoJ) Summary of Opinions (SOP) for the December meeting, released on Monday, showed that policymakers advocated remaining on the monetary tightening path in 2026.

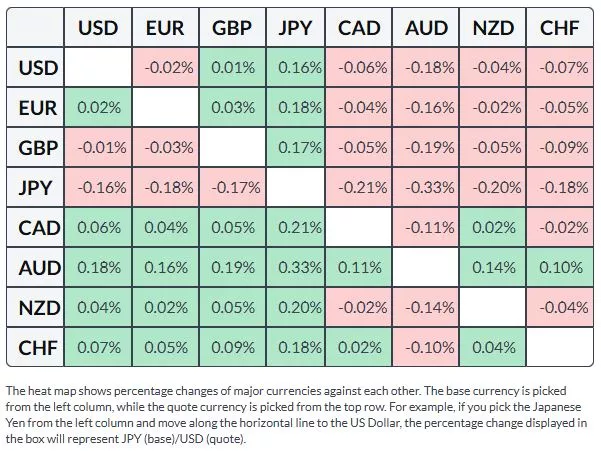

Japanese Yen Price Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the Australian Dollar.

“There is still considerable distance to levels deemed neutral," a BoJ member said, adding the central bank should raise rates "with intervals of a few months in mind for the time being", Reuters reported. A few BoJ members also stated that more interest rate hikes are necessary to strengthen the Yen.

In the policy meeting, the BoJ raised interest rates by 25 basis points (bps) to 0.75%, as expected.

Last week, BoJ Governor Kazuo Ueda also stressed on the need of additional interest rate hikes, citing that labor market conditions have tightened as wage and price-setting behaviour by firms have changed, and price pressures seems sustainably returned to the 2% target.

Meanwhile, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades flat around 98.00 at the press time, ahead of the release of Federal Open Market Committee (FOMC) minutes of the December meeting in late New York session.

In the policy meeting, the Fed reduced interest rates by 25 basis points (bps) to 3.50%-3.75% and signaled there will be only one in 2026. In 2025, the Fed delivered three interest rate cuts of quarter-to-a-percent.

More By This Author:

Pound Sterling Trades Stable In Thin Volume Session Ahead Of Year-EndPound Sterling Outperforms US Dollar Amid Firm Fed Dovish Bets For 2026

Pound Sterling Rises Further As BoE Looks To Follow Moderate Policy Easing Path

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more