USD/JPY Technical Analysis: Reacting To Japanese Intervention In The Markets

Yen. Image Source: Pixabay

I have often pointed out and warned that the collapse of the Japanese yen would not last long, despite the USD/JPY pair having crossed the psychological resistance level of 150.00. However, the bulls went even further towards the 151.94 resistance level, the highest for the currency pair in 32 years.

As I expected at the end of last week’s trading, the currency pair quickly collapsed amid profit-taking sales towards the support level 146.20 before closing trading around the 147.70 level.

Nikkei reported that the rise in the Japanese yen was due to another intervention by the Japanese authorities in the forex market, citing an unidentified person. It added that Deputy Finance Minister Masato Kanda, Japan's chief currency diplomat, told reporters that he would not comment on whether there had been interference. Another Treasury official contacted by Bloomberg News declined to comment on the intervention.

Speculation about further action followed a barrage of official warnings from Japan against testing its intervention strategy. The authorities have repeatedly said they will intervene to counter unilateral moves, although some analysts have warned that any intervention will have limited impact as long as the Bank of Japan maintains its ultra-low interest rate policy while peer central banks raise.

"This appears to have been a massive and ongoing selloff in the dollar, and it's much bigger than what we've seen previously in these latest efforts to stem the yen's losses," said Sean Osborne, senior FX analyst at Scotiabank.

Friday's rally was also supported by broader dollar weakness and lower US Treasury yields after The Wall Street Journal reported that some Fed officials were concerned about over-tightening. In September, the Japanese government intervened to support the currency for the first time since 1998 after it fell to 145.90 per dollar. The Finance Ministry spent nearly $20 billion that month to limit currency losses.

Speaking to reporters this week, Japanese Finance Minister Shunichi Suzuki assured that the country will take appropriate action against speculative moves. However, Bank of Japan Governor Haruhiko Kuroda made it clear that he has no intention of changing the low interest rate policy that is contributing to the yen's slide.

USD/JPY Technical Outlook

In the near-term and according to the hourly chart, the USD/JPY appears to be trading within a sharp bullish channel formation after bouncing back from the sharp decline on Friday. This indicates a very volatile trading session.

Accordingly, the bulls will look to extend the current rebound towards 148,381, or higher to the 149,076 resistance. On the other hand, the bears will look to continue profit-taking at around 146.993, or lower at the support at 146.330.

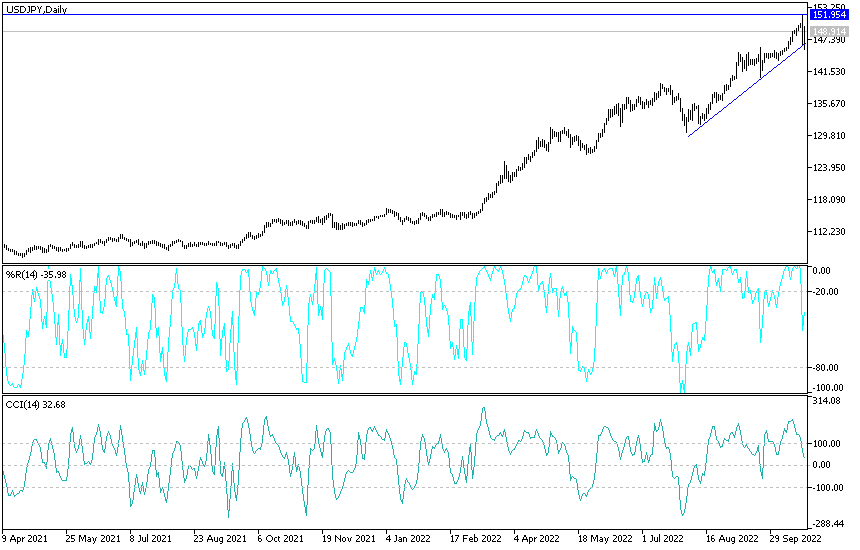

In the long-term and according to the performance on the daily chart, it appears that the USD/JPY pair is trading within the formation of an ascending channel. This indicates a significant long-term bullish momentum in market sentiment.

Therefore, the bulls are looking to extend the current rally towards the 150.123 resistance, or above to the 151.860 resistance. On the other hand, the bears will target long-term profits at around the 145.917 support, or lower at the 144.088 support.

More By This Author:

AUD/USD Forex Signal: Aussie Sell-Off Still UnderwayNZD/USD: Move Upwards As A Glimmer Of Optimism Sparkles Sky

AUD/USD Forex Signal: Technical Point To More Downside For The Aussie

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more