USD/JPY Technical Analysis: Limited Trading With Bullish Momentum

- For four trading sessions in a row, the price of the USD/JPY currency pair is moving in a narrow trading range.

- However, the trend is still bullish and settled around the 143.35 resistance level at the time of writing the analysis.

- This happened after its sharp gains last week, reaching the 144.95 resistance level, the highest in 24 years. The currency pair may remain in that range until the monetary policy decisions of the US Central Bank and the Bank of Japan are announced.

- The former will, as the markets priced it, raise US interest rates at a record pace to contain record inflation. The latter relies on a lot of intervention to prevent the further collapse of the Japanese yen.

The BoJ anomaly is expected to become more acute this week as central banks from the Federal Reserve to the Swiss National Bank are expected to raise borrowing costs. Bank of Japan Governor Haruhiko Kuroda and fellow board members were seen standing at the end of a two-day meeting in Thursday, which comes just hours after the Federal Reserve unleashed what could be its third consecutive rate hike of 75 basis points.

Clinging to the world's only negative policy rate, the pessimistic stance of the Bank of Japan may push the embattled yen to slide again. The authorities in Tokyo intensified their warnings about the rapid moves of the Japanese yen after it dealt with its lowest level in 24 years last week. The Minister of State Finance indicated that direct intervention is among the options presented, and if necessary, it will take place quickly and without warning.

Kuroda Remains Unaffected

The Bank of Japan’s governor said that the rapid weakening of the yen is not desirable. But even after the yen reached 144.99 earlier this month, the bank continues to hold the view that a weak yen is positive for the economy in general if it is stable, according to people familiar with the matter.

“The yen may break through the 145 barriers, but just stacking it to sell the currency can be like playing with fire,” commented Kiyohe Morita, chief economist at Nomura Securities, “The different thing this time is that investors will have to balance Kuroda’s easing stance against strong warnings from currency officials in Japan,” he added.

Kuroda noted that even if the BoJ tried to adjust policy in response to the Japanese yen, it would be largely futile. He said last July that massive increases would be necessary to halt the yen's decline and that this would end up wrecking the economy amid the pandemic. He added that raising interest rates to normalize policy can only come with sustainable inflation and that is why Japan needs strong wage growth.

However, the BOJ's stance comes at an increased cost. While it maintains its short-term interest rate at -0.1%, its 0.25% cap on 10-year government debt is under renewed pressure. The global bond sale pushed the yield this high last week for the first time since June. The central bank had to spend 1.4 trillion yen ($9.8 billion) buying bonds to defend yields on Wednesday and Thursday alone.

BoJ officials have already said that raising the yield ceiling would be equal to raising interest rates, essentially ruling it out as an option until sustainable inflation is achieved. And if it comes as a surprise, an adjustment to guidance on future prices would be the easiest option. The bank now expects prices to remain "at current or low levels".

Economists are expected to watch the BoJ's guidance this week, with nearly 80% of them expecting the BoJ to finish the remainder of its Covid financing program as scheduled. The central bank is currently linking part of the policy guidance to the pandemic, so the end of the program signals a possible change in wording. However, analysts are of the view that the key phrase regarding interest rates remains unchanged for the time being in favor of lower or lower rates.

On another note. Benchmark US yields jumped as much as 5.7 basis points to 3.506%. This happened as traders bet that another three-quarter point increase in the Fed's review this week is largely a done deal. There was talk of a 100bp move to curb price pressures which showed few signs of abating even after the latest round of interest rate increases. Investors are also raising expectations about how high the US central bank may eventually push interest rates as early as 2023. But fears are growing that the US economy may slip into recession and prompt policymakers to cut interest rates next year.

USD/JPY Forecast

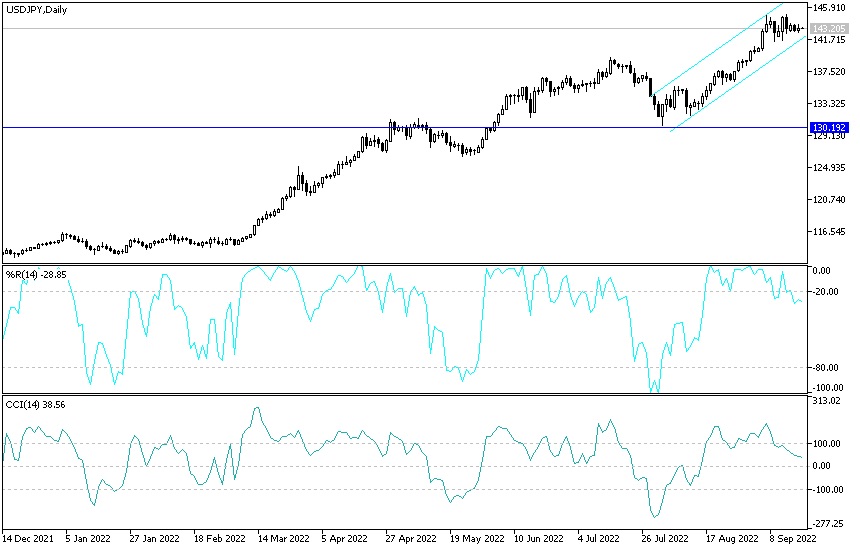

There is no change in my technical view of the performance of the USD/JPY currency pair. The general trend is still bullish, and its gains are still moving the technical indicators towards overbought levels, but investors prefer to wait until they react to the monetary policy decisions of both the Federal Reserve and the Japanese Central Bank to determine the future trend. According to the current move, the closest resistance levels for the currency pair are 143.85, 144.60, and 145.80, respectively.

On the other hand, according to the performance on the daily chart, the breakout of the dollar-yen pair will be important to the 142.20 and 141.00 support levels, for the bears to control the trend.

(Click on image to enlarge)

More By This Author:

EUR/USD Forex Signal: Looking WeakerEUR/USD Technical Analysis: Bears’ Control Continues

US CPI Rises In August, UK Inflation Down

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more