USD/JPY Technical Analysis: Chances Of Rising Are Strong

Yen. Image Source: Pixabay

Despite the halt of the recent gains in the USD/JPY currency pair, the general trend is still bullish, as last week’s gains reached the currency pair’s 129.40 resistance level, the highest in 20 years. The pair closed last week's trading at around the 128.53 level.

This is amid the continuation of the bullish momentum that is still supported by strong expectations for the future of raising US interest rates during the year. It will face the fiercest record inflation waves in the country, which were caused by the outbreak of the pandemic and the Russian-Ukrainian war.

On the economic side, the USD/JPY pair is also trading while influenced by the announcement that the Japanese Jubunk PMI for March exceeded expectations of 49 with a reading of 50.5, while the manufacturing PMI missed expectations by 55.7 with a reading of 53.4.

On the other hand, the Japanese national consumer price index for March lost expectations (on an annual basis) of 1.3% with a reading of 1.2%, while the national consumer price index excluding food and energy outperformed expectations by -1.1% with a record of -0.7% (on an annual basis). Elsewhere, March's imports beat expectations while exports fell.

From the US, the S&P Global Manufacturing PMI for April beat expectations of 58.2 with a reading of 59.7. On the other hand, both the Services PMI and the Composite PMI missed estimates. Last Thursday, the Philadelphia Fed Manufacturing PMI returned a reading of 17, compared to expected number of 21.

On the other hand, initial jobless claims for the week ending April 15 exceeded 180 thousand with a higher statistic of 184 thousand, while continuing claims for claims the period ended April 8 exceeded 1.455 million.

Amid the continued collapse of the Japanese yen in the forex trading market, the currency pair's performance is on a date this week with the monetary policy decisions of the Japanese Central Bank. The Bank of Japan is expected to forecast the fastest inflation in decades, outside of tax-raising years, while maintaining a stimulus stance that is increasingly out of sync with the Fed and other major central banks.

A growing number of economists are expecting the Bank of Japan to take some kind of action in response to the weak Japanese yen and higher prices later this year. Meanwhile, Japanese Prime Minister Fumio Kishida is expected to unveil measures to mitigate the impact of higher energy prices on businesses and consumers ahead of the central bank meeting.

In the near-term, and according to the performance on the hourly chart, it appears that the USD/JPY currency pair is trading within the formation of an ascending channel. This indicates slight, short-term, bullish momentum in market sentiment.

Therefore, the bulls will look to extend the current rally towards the resistance level of 128.732, or higher to the resistance level of 129.126. On the other hand, the bears will look to make profits at around 128.112, or lower at the 127,688 support.

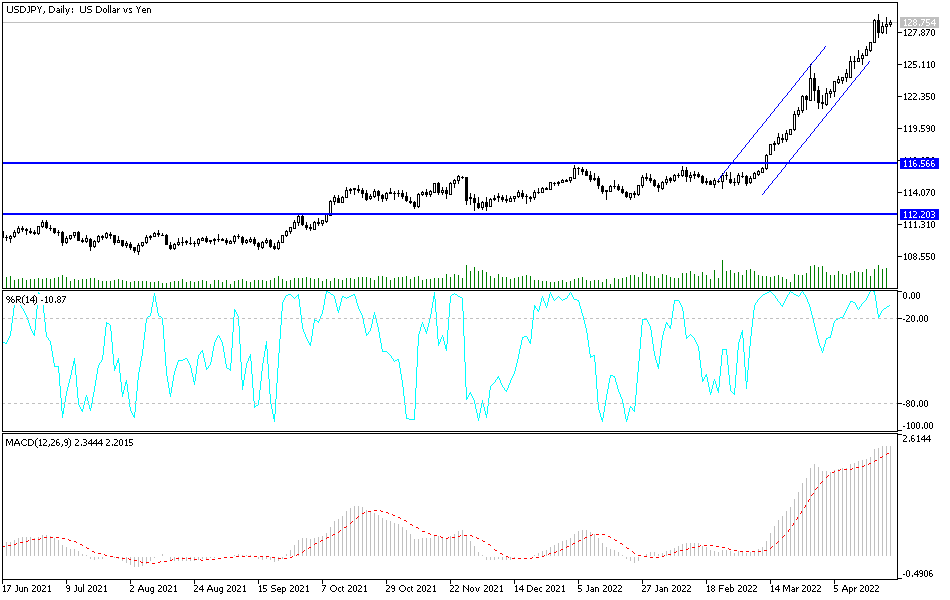

In the long-term, and according to the performance on the daily chart, it appears that the USD/JPY pair is also trading within the formation of a sharp bullish channel. This indicates a strong, long-term, bullish slope in market sentiment.

Therefore, the bulls will be looking to pounce on long-term profits around the 129.362 resistance, or higher at the 130.978 resistance level. On the other hand, the bears will target potential reversals at around the support of 126,896, or lower at the support of 125.365.

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more