USD/JPY Price Accumulating Bullish Energy Ahead Of US ISM

The USD/JPY price is trading at 148.02 at the time of writing and looks overbought in the short term. After the recent rally, the pair may correct lower amid profit-taking.

The price edged higher yesterday as the Chicago PMI, Pending Home Sales, and Unemployment Claims came in better than expected, while Core PCE Price Index, Personal Income, and Personal Spending aligned with expectations.

Today, the price retreated a little as the Japanese Unemployment Rate came in at 2.5% versus 2.6% expected, Final Manufacturing PMI was reported higher at 48.3 points versus 48.1 points forecasted, while Capital Spending matched expectations.

Later, the US data should move the market. The ISM Manufacturing PMI is expected to jump from 46.7 points to 47.9 points, Final Manufacturing PMI could remain steady at 49.4 points, ISM Manufacturing Prices could jump to 46.1 points, while Construction Spending may announce a 0.4% growth again. In addition, the Fed Chair Powell’s speeches and the US Wards Total Vehicle Sales should have an impact.

USD/JPY Price Technical Analysis: Leg Higher

USD/JPY 1-hour chart

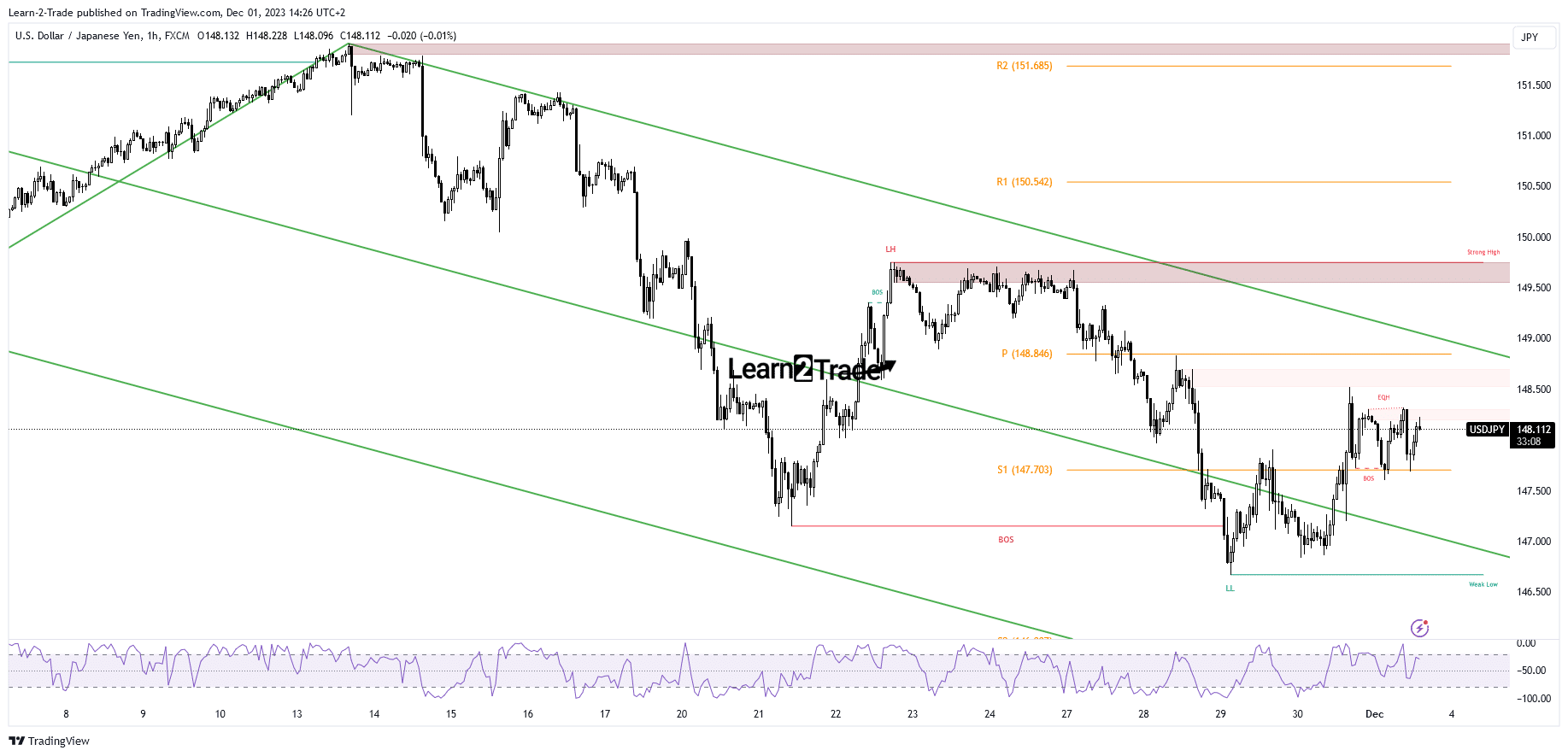

Technically, the USD/JPY price moves sideways, above the weekly S1 of 147.70, trying to accumulate more bullish energy before jumping higher. The current range could represent an accumulation, a bullish continuation pattern.

Still, only making a new higher high activates more gains ahead. The descending pitchfork’s upper median line represents the next major upside target. This stands as a dynamic resistance.

A larger growth could be activated only after taking out this upside obstacle. I believe the upside continuation could be invalidated only if the rate makes a new lower low, if it drops and closes below the S1.

More By This Author:

EUR/USD Price Analysis: Euro Struggling After Overnight LossesUSD/CAD Outlook: Bearish Amid Optimistic Canadian GDP

EUR/USD Forecast: Dollar Recovers on Robust US GDP Growth

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more