USD/JPY Outlook: Upbeat US Wholesale Inflation Lends Support

The USD/JPY outlook shows a bullish wave today ignited by the dollar’s surge following encouraging wholesale inflation figures. However, there was a slight pullback as investors took profits ahead of policy meetings in the US and Japan.

Notably, US wholesale inflation rose more than expected in February, leading to a drop in rate cut expectations. Producer prices rose 0.6%, beating estimates of a 0.3% increase. This was the second inflation report in the week that showed inflation in the US remains high.

Other data from the US included weekly jobless claims, which fell, indicating tight labor market conditions. Additionally, US retail sales missed forecasts, showing a slowdown in consumer spending. Despite the mixed data, there was a decline in rate cut expectations as investors focused on inflation.

Next week, the Fed will meet to decide on interest rates. Markets expect the Fed to hold current rates. Moreover, traders will focus on what policymakers will say regarding the outlook for rate cuts, especially after the recent inflation reports.

Meanwhile, the yen was steady on Friday as investors awaited the final results of the wage negotiations. So far, most major companies in Japan have agreed to pay increases. Therefore, there is a high chance that the Bank of Japan will be ready to shift policy next week. Such a move would greatly boost the yen.

USD/JPY key events today

- US Empire State Manufacturing Index

- US preliminary UoM consumer sentiment

USD/JPY technical outlook: Bulls above strong resistance

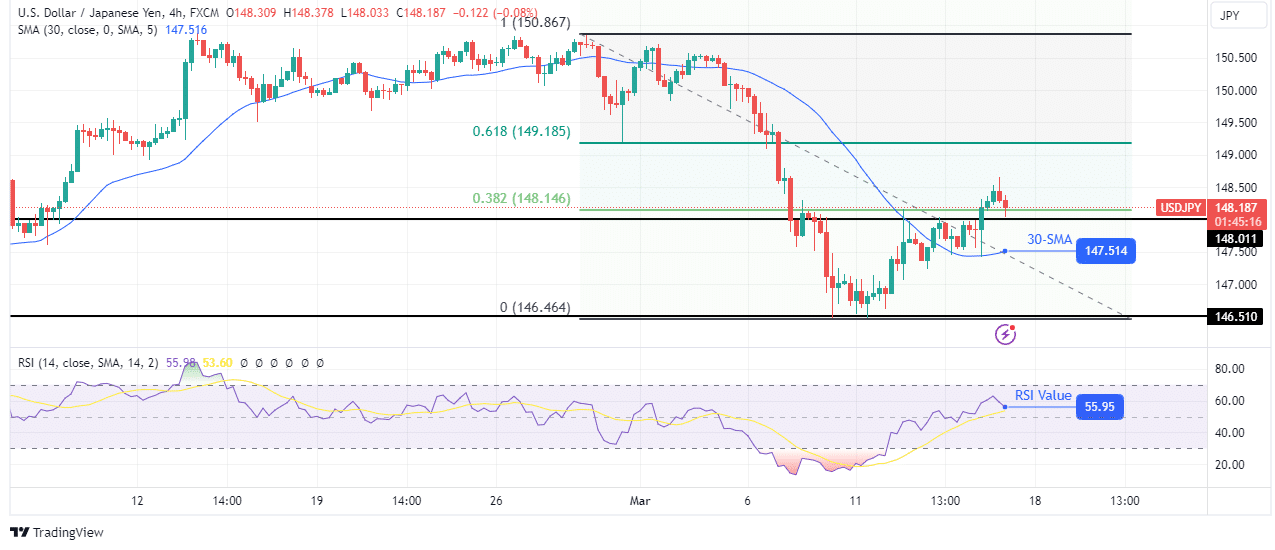

USD/JPY 4-hour chart

On the technical side, the USD/JPY pair has broken above the 148.01 key resistance level and the 0.382 Fib level. Moreover, the bias is bullish as the price trades above the 30-SMA while the RSI is above 50.

The recent shift in sentiment came when the price found support at the 146.51 key level. Bulls took over control when the price broke above the 30-SMA resistance. At the moment, the price is retracing the previous bearish move and might soon reach the 0.618 Fib level. However, the price might consolidate as the SMA catches up before continuing higher.

More By This Author:

USD/JPY Weekly Forecast: Hotter Inflation Fades Rate Cut OddsUSD/CAD Outlook: Loonie Strengthens Following Oil Price Surge

Gold Price Loses Strength, US Retail Sales, PPI In Focus

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more