USD/JPY Outlook: China’s Yuan Guidance Weakens The Dollar

On Tuesday, the USD/JPY outlook was bearish, driven by the dollar’s decline to new lows against the yen. This movement came due to China’s upward guidance of the yuan, contributing to a more widespread weakness in the dollar’s value. As such, the yen strengthened over 0.5%, reaching its highest point in seven weeks at 147.5 per dollar.

Moreover, a Bloomberg News report on upcoming support for the property sector in China boosted risk appetite, hurting the dollar.

Meanwhile, US yields declined amid expectations that US interest rates have peaked. Markets have nearly ruled out the risk of further US rate hikes in December or the next year. On a different note, investors are anticipating the release of Fed minutes at 1900 GMT.

The yen has shown signs of a turnaround. After decades of falling prices, global inflationary pressures gradually impact Japan’s economy. Consequently, investors are reassessing their Japan-related investments as the Bank of Japan considers a significant policy shift. Friday’s inflation data will likely reveal an acceleration in core consumer prices in October in Japan.

Mizuho Bank’s head of economics, Vishnu Varathan, emphasized the need for a reality check on the Fed’s hawkish bias. He stated that it is not independent of yield movements. Furthermore, he noted the potential for a self-checking mechanism if yields fall too much, suggesting that the dollar’s decline might stop. Finally, Varathan cautioned against premature declarations until the December Fed meeting.

Today’s minutes could be significant if language changes concerning the bond market.

USD/JPY key events today

- Existing US home sales

- FOMC meeting minutes

USD/JPY technical outlook: Prices tumble as bearish momentum strengthens

USD/JPY 4-hour chart

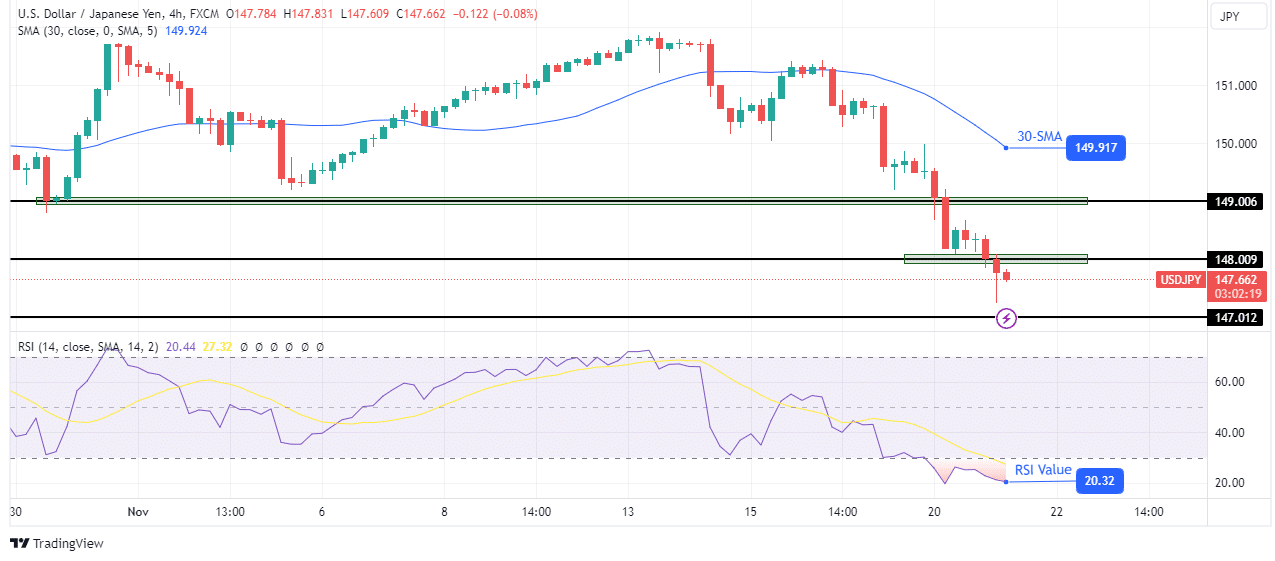

On the charts, the USD/JPY price is on a downward spiral, with the price leaping over support levels. The bearish trend started when the price crossed below the 30-SMA. Moreover, bears confirmed the new direction when the price retested and respected the 30-SMA resistance.

Since then, the price has fallen and crossed below key support levels. Recently, bears broke below the 148.00 support level. However, with the RSI in the oversold region, the price might finally pause for a retracement. Still, before that, we could see it fall to the 147.01 support level.

More By This Author:

GBP/USD Outlook: Pound Peaks at 1.25 Amid Softer DollarGold Weekly Forecast: Buying Intensifies As Dollar Tumbles

GBP/USD Weekly Forecast: Poised To Gain In Thanksgiving Week

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more