USD/JPY Forecast: Chinese Deflation Data Pushes Dollar Back

Today’s USD/JPY forecast is slightly bearish.

![]()

On Wednesday, the dollar pulled back marginally following the data release indicating that the Chinese economy experienced a period of deflation in the previous month. Consequently, the government is likely to implement additional stimulus measures. This pushed investors towards riskier assets.

Meanwhile, US inflation data is scheduled for release on Thursday. This impending data is likely to hold more importance for investors compared to the decline in price pressures witnessed in China.

Elsewhere, Japanese real wages declined for the 15th consecutive month in June. Nominal pay growth also decelerated, indicating that companies must further increase salaries to stimulate a positive growth cycle. This would enable the central bank to consider easing its policies.

Moreover, separate data revealed that Japan’s consumer spending contracted for the fourth month in June. This underscores policymakers’ challenge, as the economy remains sluggish even after lifting COVID restrictions.

Notably, the global financial markets closely monitor Japan’s wage trends. The Bank of Japan has stressed that sustainable pay increases are a prerequisite for scaling down its substantial monetary stimulus.

Chief Economist at Norinchukin Research Institute, Takeshi Minami, commented, “Japanese wage growth tends to slow once the annual spring wage negotiations conclude. The rise isn’t robust enough to bolster consumption and meet the BOJ’s 2% inflation target.”

Adjusted for inflation, real wages, which reflect consumers’ purchasing power, fell by 1.6% compared to the previous year.

USD/JPY Key Events Today

The US and Japan will not release major economic reports today. Therefore, investors will keep speculating on the looming US inflation report.

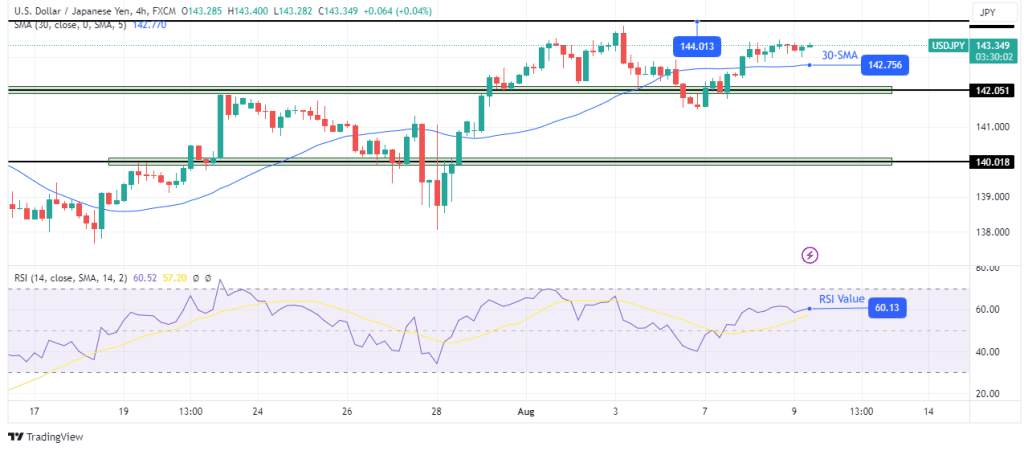

USD/JPY Technical Forecast: Bulls Pause Briefly, Eyeing A Retest Of 144.01.

USD/JPY 4-hour chart

On the technical side, USD/JPY has paused slightly above the 30-SMA. The bulls broke above the SMA with solid momentum. However, the climb has weakened, as seen in the small-bodied candles.

The bias is still bullish as the pause is above the 30-SMA. Moreover, the RSI indicates stronger bullish momentum above 50. Therefore, bulls might just be resting before they retest the nearest resistance at 144.01. However, if bears show strength at this point, the price will likely break below the 30-SMA to retest 140.01.

More By This Author:

GBP/USD Price Analysis: Pound Dips After Slow Retail GrowthUSD/CAD Outlook: Fitch’s Downgrade Triggers CAD Sell-Off

EUR/USD Forecast: Dollar Unfazed By Fitch’s Downgrade