USD/JPY Climbs Above 147.00 As U.S. Treasury Yields Rise, And BOJ Rate Hike Expectations Wane

Yen. Image Source: Pixabay

The US Dollar (USD) gains traction against the Japanese Yen (JPY) bolstered by a rise in US Treasury bond yields amid a risk aversion environment. That, along with Japanese economic data revealed during the month, brushing aside the chances for the Bank of Japan (BoJ) to raise rates has faded. Therefore, the USD/JPY trades at 147.18, gains 1.04%.

US Dollar gathers steam bolstered by yields, Fed’s Waller comments

The US 10-year Treasury bond yield is climbing more than ten basis points, up at 4.06%, sponsored by worldwide central bankers pushing back against rate cuts, a tailwind for the Greenback (USD). The US Dollar Index (DXY), a gauge of the buck’s value against a basket of rivals, climbs 0.70%, up at 103.39.

In the meantime, Federal Reserve’s Governor Christopher Waller said the Fed is closing to reach its 2% goal, and adding that even though he supports rate cuts, the US central bank shouldn’t rush to ease policy until it is clear that lower inflation would be sustained. He said the Fed should proceed “methodically and carefully,” adding that he “sees no reason to move as quickly or cut as rapidly as in the past.” Consequently, traders pared bets that the Fed would cut rates in March from 78.9% to 63%.

Data-wise, the US economic docket featured the New York Fed Empire State Manufacturing Index for January, which plunged to -43.7, below forecasts of -5 and a December reading of -14.5

On the Japanese front, prices paid by producers in December rose on a monthly basis by 0.3%, exceeding forecasts of 0%, and the annual basis slid to 0% from 0.3%. The data comes ahead of Friday’s inflation data, with the core Consumer Price Index (CPI) expected to cool down from 2.5% to 2.3% YoY, as foreseen by analysts. If the data continues to cool down, that might refrain the BoJ from normalizing monetary policy, despite BoJ’s Governor Ueda's comments that he’s confident that Japan would emerge from a deflationary mindset.

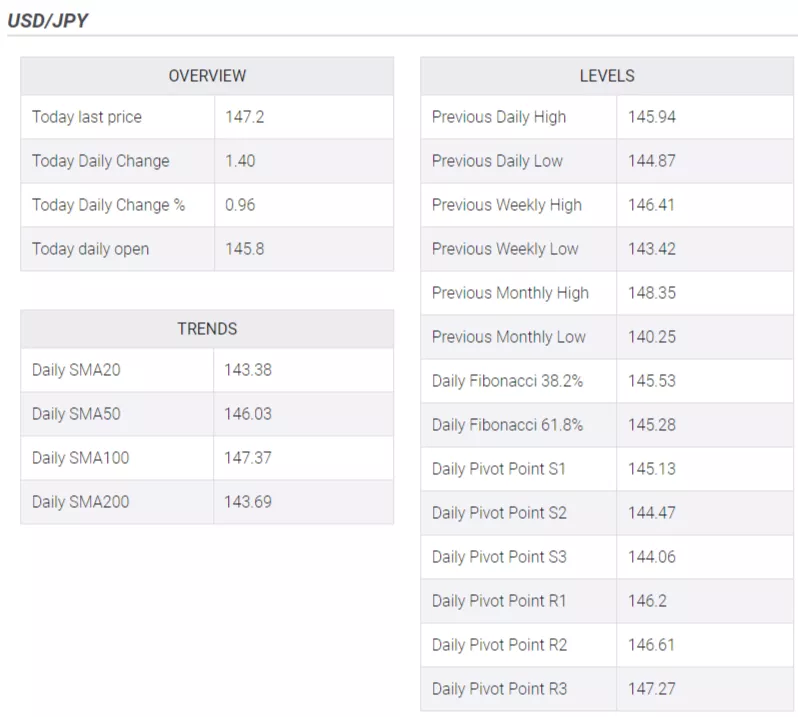

USD/JPY Technical Levels

More By This Author:

USD/CHF Looks To Surpass The Psychological Level Of 0.8600, Awaits Fed Waller’s Speech

USD/JPY Rallies To Near 146.60 As Fed Rate Cut Bets Decline Slightly

USD/CAD Rises To Near 1.3480 As Risk Aversion Emerges On Escalated Situation In Red Sea

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more