USD/INR Trades Higher Ahead Of India’s Retail Inflation Data

Image Source: Unsplash

The Indian Rupee (INR) faces selling pressure against the US Dollar (USD) on Wednesday. The USD/INR pair rises to near 88.80 as the Indian Rupee underperforms ahead of the release of India’s Consumer Price Index (CPI) data for October at 10:30 GMT.

Economists expect India’s retail inflation to have grown 0.48% on an annualized basis, slower than the 1.54% growth seen in September. The expectations of a soft CPI figure are driven by a sustained fall in food prices.

According to analysts at Bank of America (BofA), “Base effects are most supportive in this month, as it mirrors the sharp increase in vegetable prices we had seen in October last year”.

Signs of price pressures cooling would boost expectations of further monetary policy easing by the Reserve Bank of India (RBI) this year. So far this year, the RBI has already reduced its Repo Rate by 100 basis points (bps) to 5.5%.

Meanwhile, the continuous outflow of foreign funds from the Indian stock market due to an absence of a United States (US)-India trade deal announcement has been keeping the Indian Rupee on its back foot. On Tuesday, Foreign Institutional Investors (FIIs) turned out to be net sellers again and sold shares worth Rs. 803.22 crore.

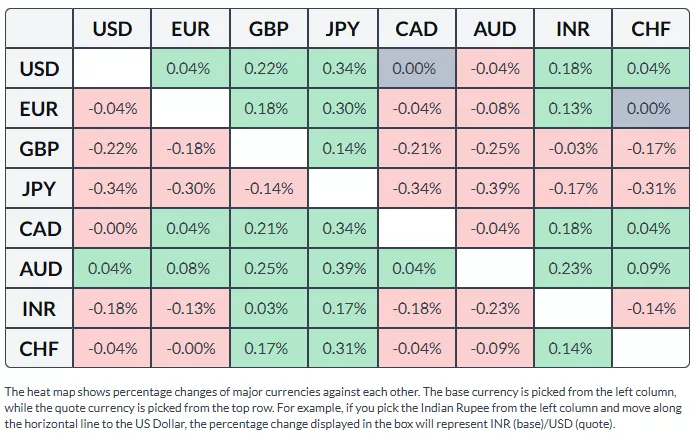

The table below shows the percentage change of Indian Rupee (INR) against listed major currencies today. Indian Rupee was the weakest against the Australian Dollar.

Daily digest market movers: Accelerating Fed dovish bets weigh on US Dollar

- The Indian Rupee trades lower against the US Dollar, even as the latter trades cautiously due to intensifying market expectations of an interest rate cut by the Federal Reserve (Fed) in the December policy meeting.

- According to the CME FedWatch tool, the probability of the Fed cutting interest rates by 25 basis points (bps) to 3.50%-3.75% in the December meeting has increased to 68% from 62.4% seen on Monday.

- At the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades marginally higher to near 99.55. On Tuesday, the USD Index fell sharply after the release of the soft ADP Employment Change four-week average data, which prompted Fed dovish expectations.

- Private payroll processor ADP reported that employers laid off 11.25K workers each week through late October, demonstrating a weak job trend. "The labor market struggled to produce jobs consistently during the second half of the month," said Nela Richardson, ADP’s chief economist.

- The impact of the job data has been significant on the Fed’s interest rate projections lately as officials have warned of downside labor market risks.

- Going forward, investors will focus on a slew of US economic releases, which were halted due to the government shutdown. On Tuesday, the US Senate advanced the federal funding bill to the Republican-controlled House of Representatives, which is expected to be passed on Wednesday.

Technical Analysis: USD/INR aims to revisit all-time high above 89.00

USD/INR rises to near 88.80 at open on Wednesday. The near-term trend of the pair remains bullish as it stays above the 20-day Exponential Moving Average (EMA), which trades around 88.65.

The 14-day Relative Strength Index (RSI) strives to return above 60.00. A fresh bullish momentum would emerge if the RSI (14) manages to do so.

Looking down, the August 21 low of 87.07 will act as key support for the pair. On the upside, the all-time high of 89.12 will be a key barrier.

More By This Author:

Pound Sterling Slumps As UK Unemployment Rate Rose To Four-Year High At 5%Pound Sterling Trades Cautiously On Intensifying BoE Dovish Speculation

Pound Sterling Ticks Up Against US Dollar As Senate Advances Stopgap Bill

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more