USD/INR Trades Cautiously As US Dollar Index Retreats From Five-Month High

Image Source: Unsplash

The Indian Rupee (INR) opens on a slightly positive note against the US Dollar (USD) on Thursday after Indian markets remained closed on Wednesday for the occasion of Prakash Gurpurb Sri Guru Nanak Dev.

The USD/INR drops to near 88.60 as the Indian Rupee gains on hopes that the Reserve Bank of India (RBI) would continue to intervene in both local spot and offshore markets to support the currency from extending its losses against the US Dollar beyond the all-time high around 89.10.

A report from Reuters showed that the RBI intervened on Tuesday, both in the NDF market before the local open and in the onshore spot market, reinforcing its intent to prevent the rupee from weakening further.

Meanwhile, the outlook of the Indian Rupee remains uncertain as overseas investors continue to pare their stake in the Indian stock market due to uncertainty over the trade deal between the United States (US) and India.

Foreign Institutional Investors (FIIs) have started the November series with selling in the Indian equity market. In the two trading days of November, FIIs have turned out to be net sellers, selling cumulatively Rs. 2,950.79 crore worth of shares.

US Dollar Index retreats despite Fed dovish bets easing further

- A cautious opening by the USD/INR is also driven by a slight pullback in the US Dollar. The US currency retraces after posting a fresh five-month high on Wednesday, following the US data releases.

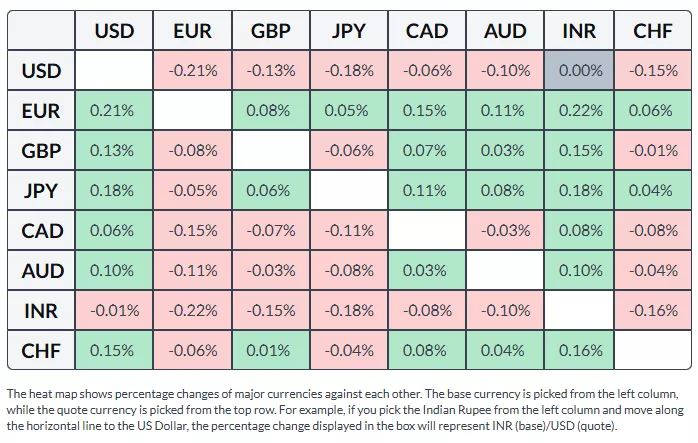

- At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades marginally lower to near 100.05 after correcting from its immediate highs of 100.35.

- On Wednesday, the US ADP Employment Change and ISM Services Purchasing Managers’ Index (PMI) data for October showed better-than-projected numbers. In October, the US private sector created 42K fresh jobs, higher than estimates of 25K. In September, employers laid off 29K workers.

- Meanwhile, the Services PMI came in at 52.4, beating estimates of 50.8 and the prior reading of 50.0. Upbeat US ADP Employment and Services PMI data have weighed further on market expectations for more interest rate cuts by the Federal Reserve (Fed) this year.

- The CME FedWatch tool shows that the probability of the Fed cutting interest rates by 25 basis points (bps) to 3.50%-3.75% in the December meeting has eased to 62.5% from 94.4% seen before the monetary policy announcement on October 29.

- Fed dovish speculation for the December policy meeting started receding after Chairman Jerome Powell commented in the press conference following the monetary policy announcement that the December rate cut is “far from a foregone conclusion”.

- Meanwhile, Fed Governor Stephen Miran has reiterated the need for more interest rate cuts amid labor market risks. “I think policy is too restrictive and that we’re too far above where neutral rates would be,” Miran said in an interview on Yahoo Finance’s website, Reuters reported.

Technical Analysis: USD/INR stays above 20-day EMA

USD/INR drops to near 88.60 on Wednesday. The pair continues to find support near the 20-day Exponential Moving Average (EMA), which trades around 88.58.

The 14-day Relative Strength Index (RSI) falls after failing to break above 60.00, suggesting selling pressure at higher levels.

Looking down, the August 21 low of 87.07 will act as key support for the pair. On the upside, the all-time high of 89.12 will be a key barrier.

More By This Author:

Pound Sterling Underperforms As UK Reeves Stresses To Bring Inflation Down

USD/INR Declines On Possible RBI’s Intervention Into Local Spot Market

Pound Sterling Trades With Caution At The Start Of BoE’s Policy Week

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more