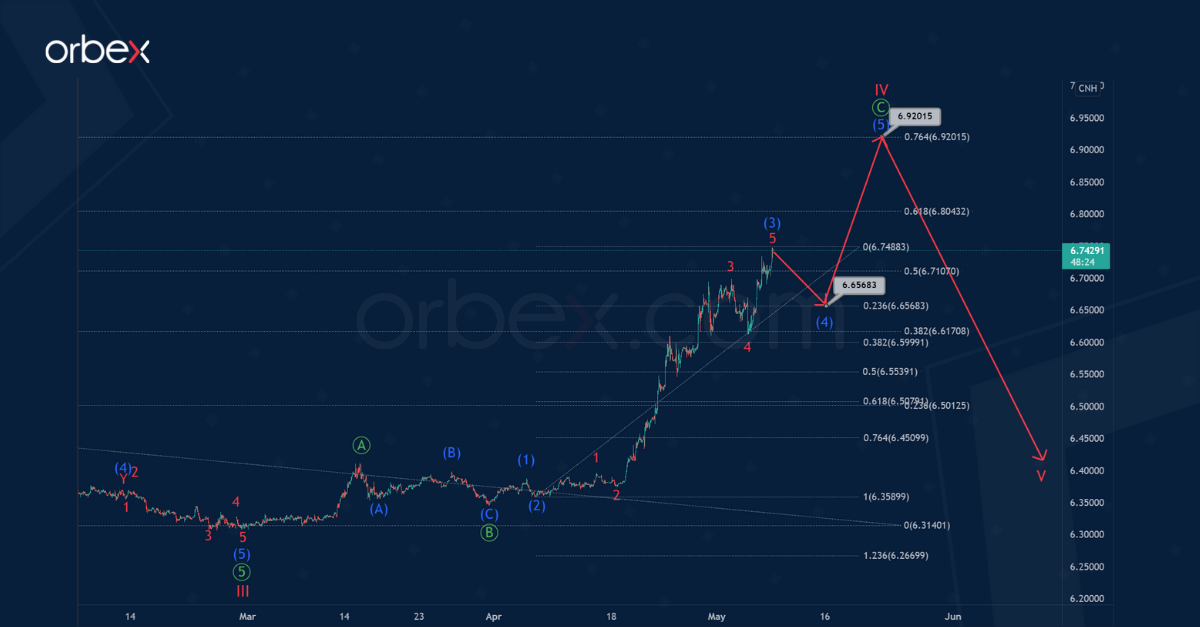

USDCNH Eyeing 6.920 Following Cycle Correction

The USDCNH formation hints at a zigzag consisting of primary sub-waves Ⓐ-Ⓑ-Ⓒ.

The last primary wave Ⓒ of this correction pattern takes the form of an intermediate 5-wave impulse (1)-(2)-(3)-(4)-(5).

The current structure indicates that the market has completed the bullish intermediate impulse (3). Soon, an intermediate correction (4) will form near 6.656, which will be at 23.6% of impulse (3).

After the end of sub-wave (4), prices are likely to rise to the level of 6.920. This is where wave (5) will be at 76.4% of impulse (3).

(Click on image to enlarge)

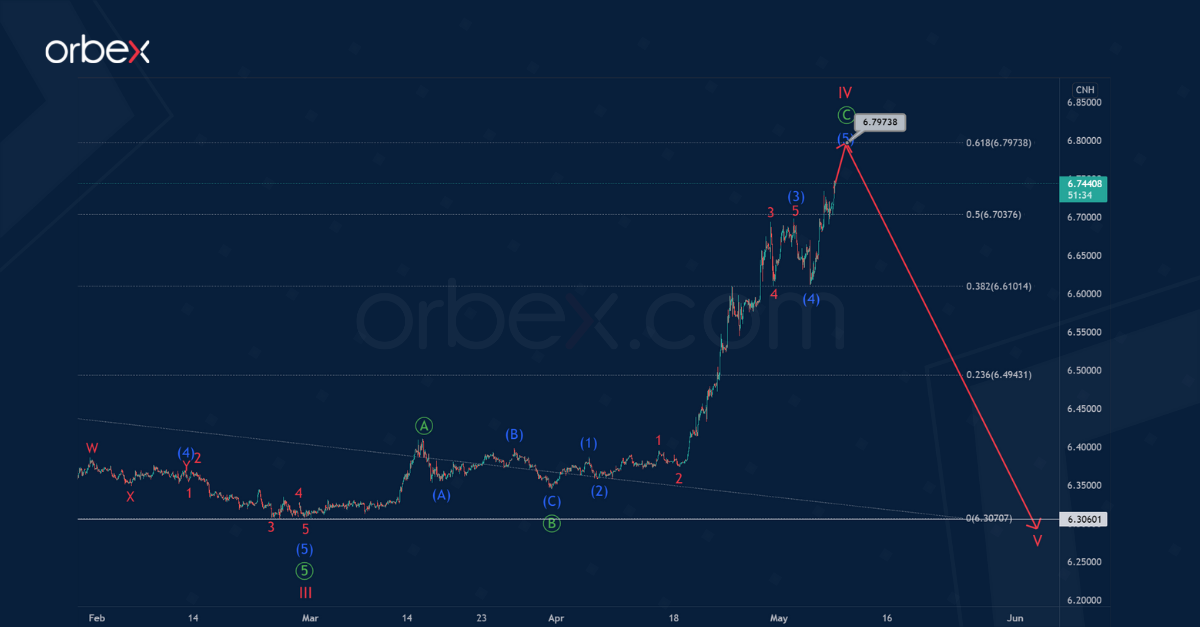

An alternative option assumes that the construction of a cycle correction IV will be completed much earlier than in the first option.

Most likely, in the primary impulse, sub-waves (1)-(2)-(3)-(4) have ended. It is possible that in the near future the bulls will continue to move the price up in the intermediate wave (5) to 6.797. At that level, wave IV will be at 61.8% of cycle impulse III.

After reaching the level of 6.797, a bearish trend is expected in the market within the cycle wave V. This could fall to the previous low of 6.306, or even lower.

Disclaimer: Orbex LIMITED is a fully licensed and Regulated Cyprus Investment Firm (CIF) governed and supervised by the Cyprus Securities and Exchange Commission (CySEC) (License Number 124/10). ...

more