USD/CHF Ticks Down To Near 0.7910 As US Dollar Falls Back

Photo by Claudio Schwarz on Unsplash

The USD/CHF pair edges lower to near 0.7910 during the Asian trading session on Tuesday. The Swiss Franc pair faces mild selling pressure as the US Dollar (USD) extends its correction, following a pullback on Monday.

As of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.12% to near 98.20. The DXY posted a fresh over-three-week-high at 98.86 on Monday as its safe-haven demand increased after Washington captured Venezuelan President Nicolas Maduro over drug-trafficking charges.

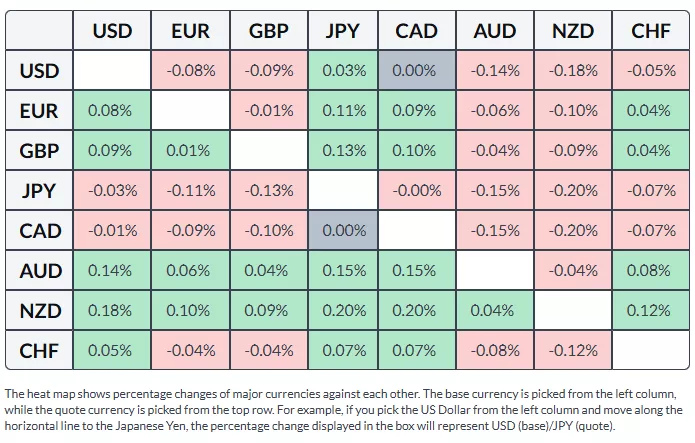

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the New Zealand Dollar.

The US Dollar has come under pressure amid a lack of supportive fundamentals on the domestic side. The US ISM Manufacturing PMI data, released on Monday, showed that the factory activity contracted again. The Manufacturing PMI came in at lower at 47.9 from 48.2 in November.

Investors brace for more volatility in the US Dollar with the US Nonfarm Payrolls (NFP) data due for release on Friday. The US official employment data will significantly influence market expectations for the Federal Reserve’s (Fed) monetary policy outlook, as almost every policymaker has warned of downside labor market risks.

Before the US NFP data, investors will focus on the ADP Employment Change and the ISM Services PMI data for December, and the JOLTS Job Openings data for November, which will be published on Wednesday.

Meanwhile, the Swiss Franc (CHF) trades broadly calm ahead of the Consumer Price Index (CPI) data for December, which will be released on Thursday. The inflation data will influence the Swiss National Bank’s (SNB) monetary policy expectations.

More By This Author:

Pound Sterling Drops As US Attack On Venezuela Dampens Market MoodPound Sterling Flattens Against US Dollar While Investors Await FOMC Minutes

USD/JPY Trades Higher To Near 156.30 Ahead Of FOMC Minutes

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more