USD/CHF Price Forecast: Appreciates Toward Nine-Day EMA Near 0.8850

Photo by Claudio Schwarz on Unsplash

- USD/CHF attempts to break above the 14-day EMA at the 0.8832 level.

- The daily chart analysis indicates a sustained bullish bias, with the pair trending higher within an ascending channel pattern.

- The pair may navigate the support region around the ascending channel’s lower boundary at 0.8750 level.

The USD/CHF pair retraces recent losses from the previous session, trading around 0.8830 during the Asian hours on Thursday. An analysis of the daily chart suggests an ongoing bullish bias as the pair moves upwards within the ascending channel pattern.

The 14-day Relative Strength Index (RSI) is slightly above 50 level, indicating a bullish market trend. Additionally, the nine-day Exponential Moving Average (EMA) remains above the 14-day EMA, suggesting a bullish bias in the short-term price movement.

On the upside, the USD/CHF pair tests the immediate 14-day EMA at 0.8832 level, followed by the nine-day EMA at 0.8847 level. A successful breach above these levels could further strengthen the bullish bias and support the pair to approach the upper boundary of the ascending channel at a psychological level of 0.8900.

In terms of support, the USD/CHF pair may navigate the region around the lower boundary of the ascending channel at the 0.8750 level. A decisive break below the channel may cause the emergence of the bearish bias and put downward pressure on the pair to approach its six-week low of 0.8606.

USD/CHF: Daily Chart

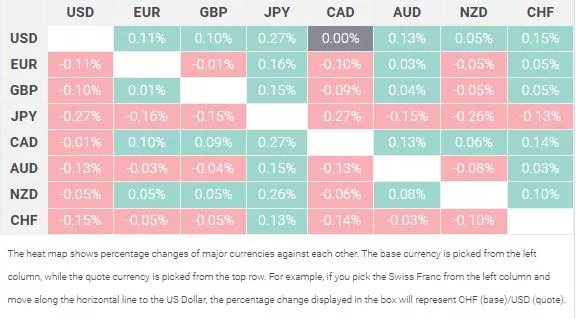

Swiss Franc PRICE Today

The table below shows the percentage change of Swiss Franc (CHF) against listed major currencies today. Swiss Franc was the strongest against the Japanese Yen.

More By This Author:

GBP/JPY Extends Losses To Near 191.00 Due To Increased Risk AversionSilver Price Forecast: XAG/USD Remains Below $30.50 After Paring Losses

Australian Dollar Extends Losses As Trump Plans To Increase 10% Import Tariffs On China

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more