USD/CAD Weekly Forecast: Safe-Haven Dollar Leading Rally To 1.3000

Photo by Michelle Spollen on Unsplash

- The USD/CAD exchange rate has risen to an eight-month high on fears of a worldwide economic downturn.

- WTI is down 8.8% this week and 17.2% lower from its high of $74.68 in July.

- At the Jackson Hole meeting, the Federal Reserve may hint at tapering.

The weekly forecast for USD/CAD is bullish despite Friday’s corrective move of more than 100 pips. The US dollar remains broadly strong. Due to foreign political events and concerns about slowing economic development, the USD/CAD pair soared to an eight-month high on Friday, marking a 2.4% gain for the week.

USD/CAD Fundamental Forecast

On Friday, the USD/CAD reached an eight-month high, following a week-long rise of 2.4%. Fears of global economic development stalling due to the Delta variant and growing international political tensions prompted a run to the US dollar as a safe-haven.

WTI Sinks

The week’s 8.8% drop in the price of a barrel of West Texas Intermediate (WTI) was particularly indicting for the Canadian economy, the world’s fourth-largest oil exporter. WTI has fallen 17.2% since hitting a high of $74.68 on July 5.

The greenback benefited on expectations that the Federal Reserve is moving closer to announcing a drop in its $120 billion per month bond purchases, but this is far from definite.

Delta COVID-19 Concerns

The outlook for the US dollar has improved dramatically over the previous two weeks, and the underlying reasons are unlikely to change anytime soon. While the Delta variant is not yet causing widespread lockdowns, it can significantly influence global economic development. The US dollar is the primary haven for assets in times of market stress, as it usually has been.

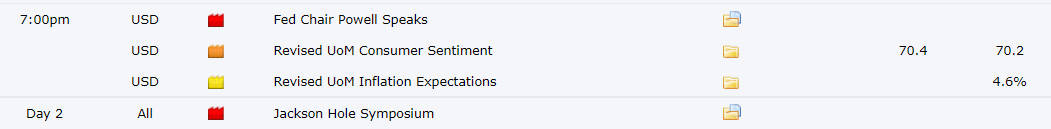

Key Data Releases from the United States During the Week of Aug. 23-27

On Thursday, Aug. 26, the Federal Reserve will kick up its annual three-day Jackson Hole conference in the United States. Even though the approaching taper talk has been widely reported in the media, Fed policymakers are expected to remain cautious in light of recent economic statistics, leaving their options open if US growth and job creation deteriorate.

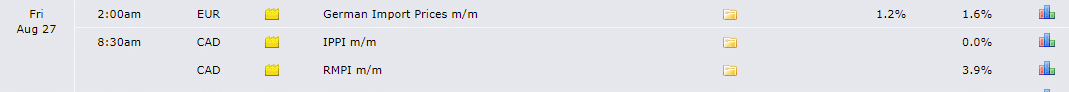

Key Data Releases from Canada During the Week of Aug. 23-27

Canadian statistics for the coming week are restricted to raw material and industrial price indices for July. So, there won’t be any big market repercussions.

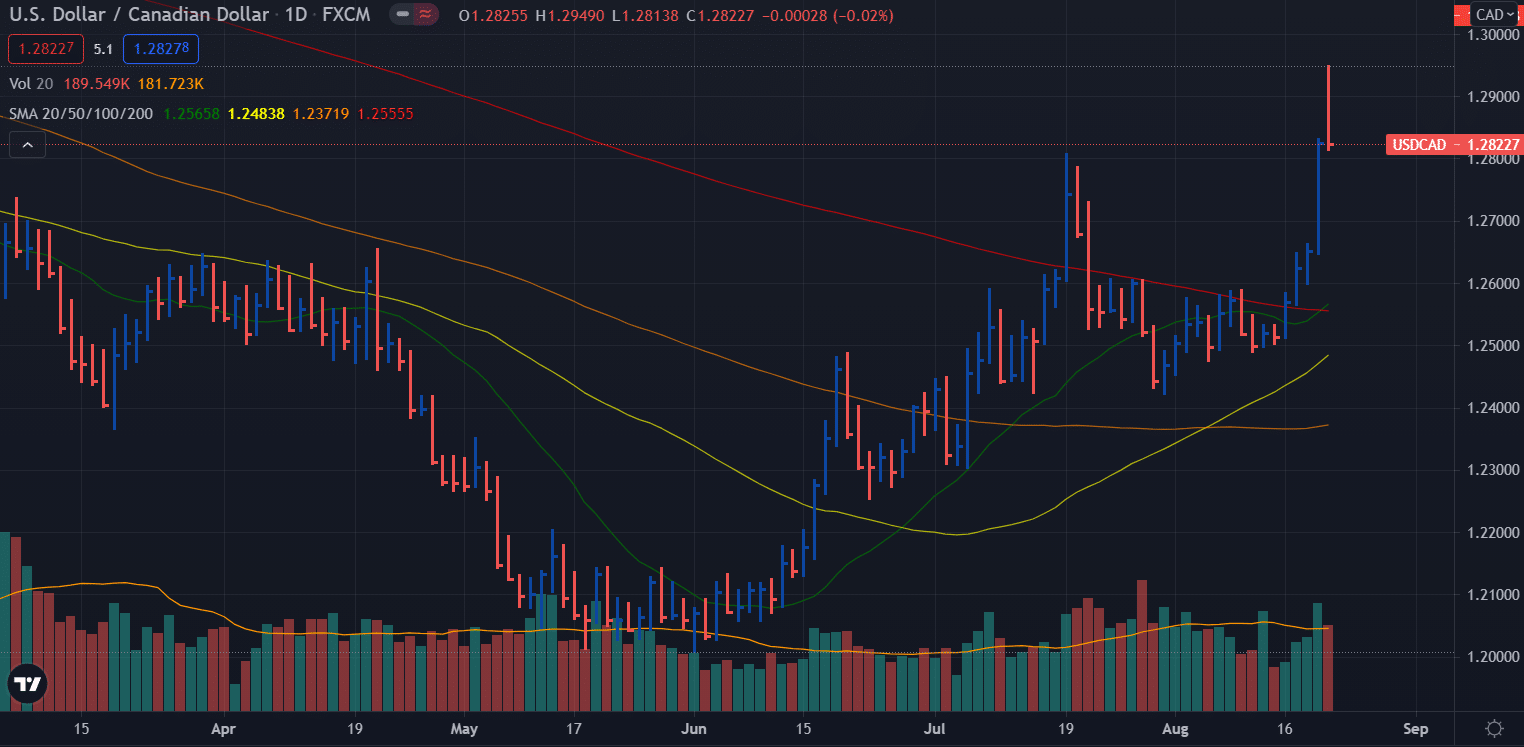

USD/CAD Weekly Forecast – Daily Chart

USD/CAD Technical Analysis: Key Levels in Action

The USD/CAD pair is attempting to stay above the 1.2850 support level. If this effort is successful, the USD/CAD pair will return to the resistance level of 1.2875. If the resistance level at 1.2875 is successfully tested, the following resistance level at 1.2920 will be tested. If the USD/CAD crosses over 1.2920, it will go towards the 1.2950 resistance level.

A fall below 1.2850 on the support side will push USD/CAD towards the 1.2820 support level. If the USD/CAD falls below this level, it will fall to 1.2790, the next support level. A break below 1.2790 will lead to a test of the 1.2765 support level.

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more