USD/CAD Weekly Forecast: Canada’s Eased Inflation To Weigh

- The Canadian economy expanded by 0.1% in October.

- Canada’s annual inflation rate decreased to 6.8% in November.

- Figures showed that the U.S. economy is slowing down, supporting forecasts of a more gradual Federal Reserve.

The USD/CAD weekly forecast is mildly bullish as Canada’s inflation decreased in November. However, the decrease was slighter than expected.

Ups And Downs Of USD/CAD

According to figures released on Friday, the Canadian economy expanded by 0.1% in October and is projected to grow at a similar rate in November, indicating that the full effects of this year’s seven straight interest rate hikes have yet to be seen.

According to Statistics Canada, October’s rise was slower than September’s 0.2% gain, which was an upward revision from the 0.1% increase that had previously been published. The growth in October was consistent with the median prediction of analysts.

To combat inflation far higher than its 2% target, the Bank of Canada increased rates at a record pace of 400 basis points in just nine months, to 4.25%. This level was previously reached in January 2008.

According to data published earlier this week, Canada’s annual inflation rate decreased to 6.8% in November. Still, it was slightly higher than anticipated due to broad-based pricing pressures, opening the possibility of another rate increase in January.

The dollar went down against most major currencies on Friday in turbulent, thin trading as data showed that the U.S. economy is slowing down, supporting forecasts of more gradual Federal Reserve interest rate increases and boosting the Canadian dollar.

Next Week’s Key Events For USD/CAD

Due to the Christmas holiday, there won’t be any key economic releases in the coming week.

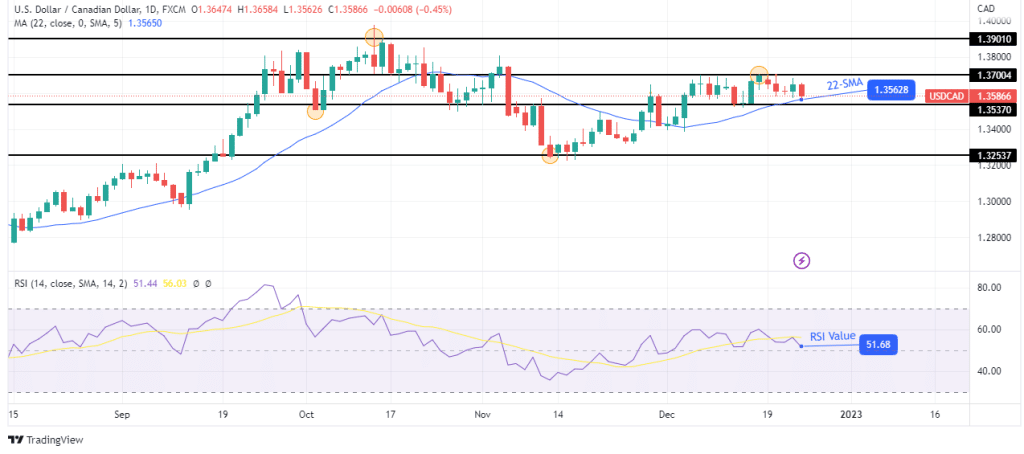

USD/CAD Weekly Technical Forecast: Bulls Leading In A Tight Consolidation

(Click on image to enlarge)

USD/CAD is trading within a tight range with support at 1.3537 and resistance at 1.3700. The price is also trading above the 22-SMA, with the RSI supporting bullish momentum above 50. Since bulls are in control, there is a high chance that the price will break above the range resistance.

It is harder to break lower as the support comprises the 1.3537 and the 22-SMA. Bulls will look to the next resistance at 1.3901 if the price breaks above the resistance range. The bullish trend will continue if the price stays above the 22-SMA and the RSI above 50.

More By This Author:

EUR/USD Price Surging Amid Dollar Weakness, Eying 1.066GBP/USD Price To Gauge Buyers Above 1.2153

USD/CAD Forecast: Wall Street Banks Warn Of A Recession

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more