USD/CAD Trades Close To Weekly Low Around 1.4030 As Fed Rate Cut Bets Remain Firm

Photo by Michelle Spollen on Unsplash

The USD/CAD pair holds onto Wednesday’s losses around 1.4030 during the Asian trading session on Thursday. The Loonie pair has been under pressure as the US Dollar (USD) remains fragile due to firm expectations that the Federal Reserve (Fed) will cut interest rates again this year.

At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.12% to near 99.45. This is the lowest level seen in over a week.

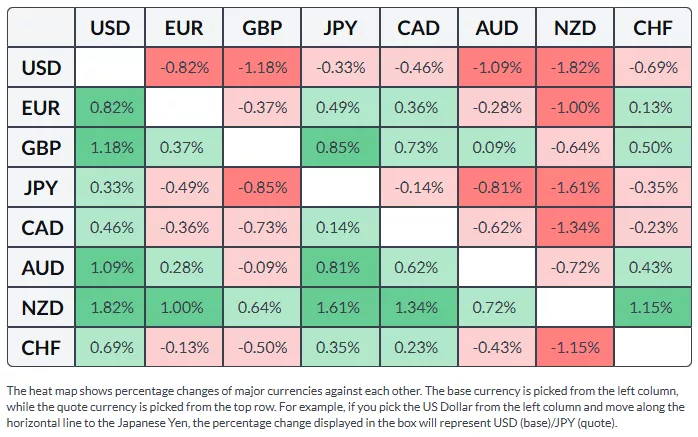

US Dollar Price This week

The table below shows the percentage change of the US Dollar (USD) against the listed major currencies this week. The US Dollar was the weakest against the New Zealand Dollar.

The CME FedWatch tool shows that the probability of the Fed to cut interest rates in the December policy meeting has increased to 84.7% from 30.1% seen a week ago.

Traders have become increasingly confident about the Fed reducing interest rates in the December policy meeting, following dovish comments from New York Fed Bank President John Williams, who is the permanent Federal Open Market Committee (FOMC) voting member.

Last week, Fed’s Williams supported the need of further interest rate adjustment for the year, citing downside labour market risks.

In Thursday’s session, the action in the US Dollar is expected to remain light as the United States (US) markets will be closed on account of Thanksgiving Day.

Going forward, investors will focus on the US ISM Manufacturing Purchasing Managers’ Index (PMI) data for November, which will be released on Monday.

Meanwhile, the Canadian Dollar (CAD) trades broadly calm ahead of the Q3 Gross Domestic Product (GDP) data, which is scheduled for Friday. Statistics Canada is expected to show that the economy expanded by 0.5% on an annualized basis after declining 1.6% in the previous quarter.

More By This Author:

Indian Rupee Opens Cautiously Against US Dollar Despite Fed Dovish Bets SwellAUD/NZD Tumbles To Near 1.1430 As RBNZ Cuts OCR By 25 BPS To 2.25%, As Expected

Pound Sterling Drops After Weak UK Retail Sales, PMI data