USD/CAD Price Forecast: Wobbles Around 20-Day EMA

Photo by Michelle Spollen on Unsplash

- USD/CAD edges lower to near 1.3720 while the US Dollar has fallen sharply.

- US President Trump threatens to fire Fed’s Powell again.

- Risks of inflation undershooting BoC’s 2% target has paved the way for interest rate cuts.

The USD/CAD pair ticks down to near 1.3718 during Asian trading hours on Thursday. The Loonie pair trades slightly lower, while the US Dollar (USD) declines sharply as United States (US) President Donald Trump has reiterated threats to fire Federal Reserve (Fed) Chair Jerome Powell. The scenario reflects that the Canadian Dollar (CAD) is also under pressure.

Canadian Dollar PRICE Today

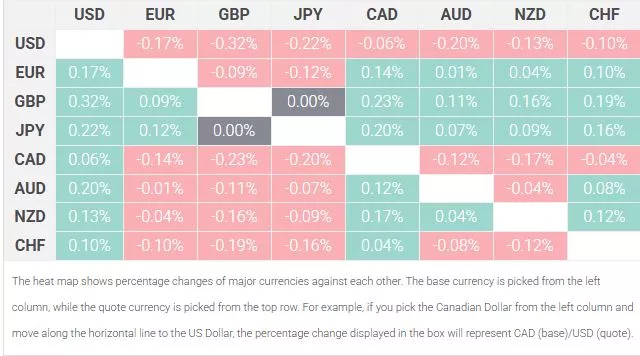

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the British Pound.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, refreshed the three-year low around 97.25.

Donald Trump floated the idea of replacing Fed’s Powell after his comments at his two-day semi-annual testimony before the Senate in which he stated that the central bank is “well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance”. Powell remained open to the possibility that “tariffs translating to inflation will be more or less than we think".

Meanwhile, the Canadian Dollar has been on the back foot as inflation remaining well below the Bank of Canada’s (BoC) 2% target has increased hopes of more interest rate cuts. The data showed on Tuesday that the headline Consumer Price Index (CPI) grew by 1.7% on year, which was in line with market expectations and the prior release. In the same, the BoC CPI core rose steadily by 2.5%.

USD/CAD wobbles near the 20-day Exponential Moving Average (EMA), which trades around 1.3717, is suggesting a sideways trend. The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, which indicates a sharp volatility contraction.

Going forward, an upside move above the May 29 high of 1.3820 by the pair would open the door towards the May 21 high of 1.3920, followed by the May 15 high of 1.4000.

On the contrary, the asset could slide towards the psychological level of 1.3500 and the September 25 low of 1.3420 if it breaks below the June 16 low of 1.3540.

USD/CAD daily chart

More By This Author:

Pound Sterling Holds Onto Gains Against US Dollar Driven By Israel-Iran TrucePound Sterling Surges Against US Dollar As Greenback Suffers From Israel-Iran Ceasefire

Pound Sterling Declines Against US Dollar As Greenback Gains Of US-Iran Tensions

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not ...

more