USD/CAD Price Analysis: Battles At The 20-Day EMA, Drops Toward 1.3530

Photo by Michelle Spollen on Unsplash

- The USD/CAD currency pair has been struggling at the 20-day EMA and tumbled towards the 1.3530 area.

- Oscillators have been offering mixed signals, but price action had stalled at crucial EMAs to keep the pair range-bound.

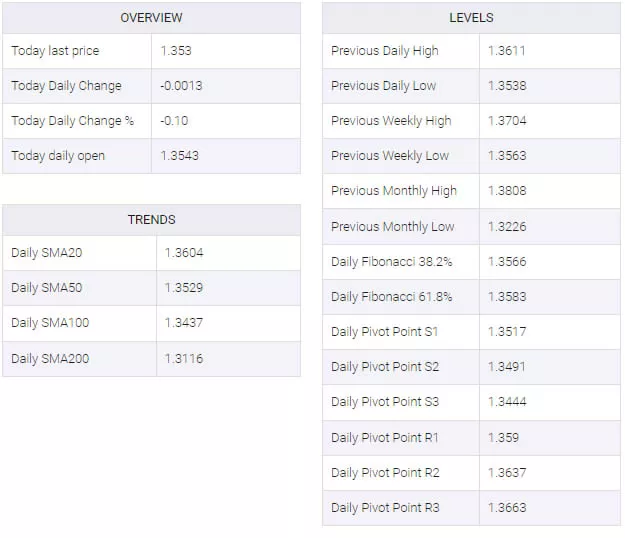

The USD/CAD currency pair's advance stalled at the 20-day Exponential Moving Average (EMA) at 1.3570 and dropped toward the 50-day EMA as the US dollar weakened, while crude oil extended its recovery, which is a tailwind for the Canadian dollar. At the time of writing, the USD/CAD pair was seen trading at around 1.3530.

USD/CAD Price Analysis: Technical Outlook

From a daily chart perspective, the USD/CAD pair dropped to fresh two-day lows, just shy of the weekly low of 1.3484. During the last five trading days, the 20-day Exponential Moving Average (EMA), around 1.3570, capped the USD/CAD pair's recovery towards the 1.3700 figure. And since mid-December, the USD/CAD pair embarked on successive series of lower highs/lows as the major currency consolidated ahead of the year’s end.

The Relative Strength Index (RSI), which is in bearish territory, keeps USD/CAD sellers hopeful for further downside, while the Rate of Change (RoC), suggests selling pressure is waning. Therefore, unless the USD/CAD duo decisively breaks below 1.3484, that could open the door for further losses. The next support would be the 100-day EMA at 1.3416, ahead of the 1.3400 figure, and the 200-day EMA at 1.3215.

As an alternative scenario, the USD/CAD pair's first resistance would be the 20-day EMA at 1.3570. Once cleared, the next resistance would be 1.3600, followed by the 1.3700 mark.

USD/CAD Key Technical Levels

More By This Author:

GBP/USD advances steadily towards 1.2080s on a weak USD

USD/JPY Price Analysis: Stumbles To Fresh Weekly Lows Around 132.10s

GBP/USD Capped Below 1.2075, Treading Water At Around 1.2050

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more