USDCAD: Market Patterns Calling The Move Higher

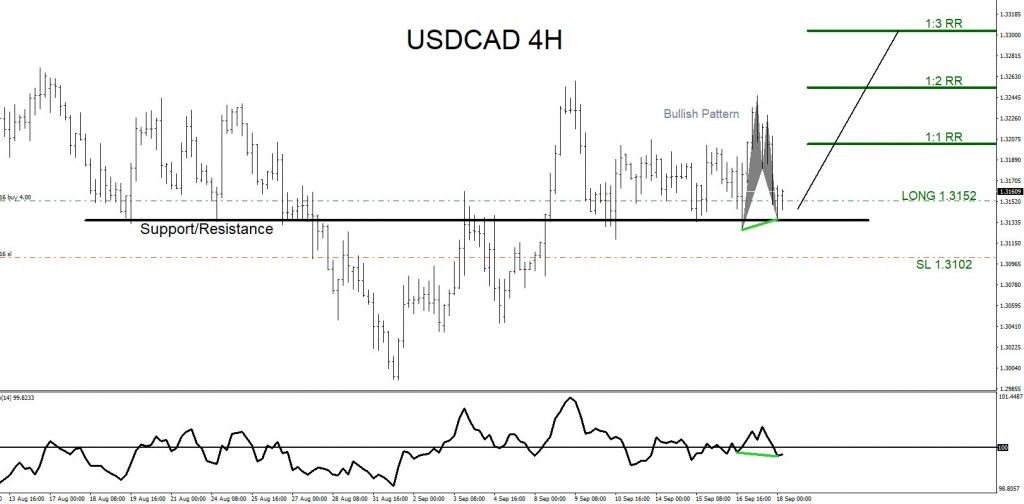

On September 17, I posted on social media that “USDCAD will be looking for 'buys' as long as price stays above 1.3126.” The chart below was also posted, showing that bullish market patterns were visibly calling for a move higher.

The Bullish Pattern (grey) triggered buy signals, along with a combination of a bullish divergence pattern formation (light green) and a key support/resistance level (black). This triple bullish confirmation allowed me to call the move higher and advise traders that the pair would push higher.

USDCAD Four-Hour Chart September 17, 2020

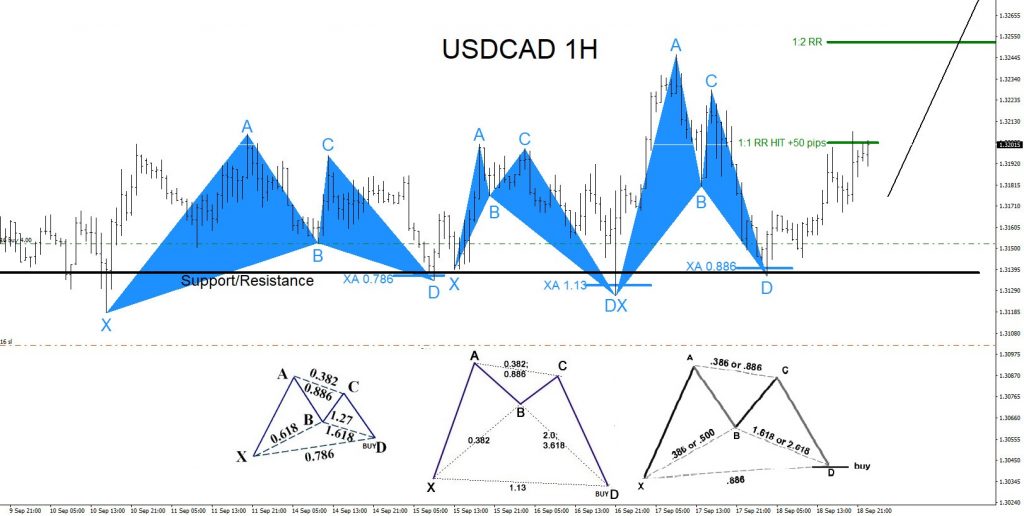

Shifting to the one-hour chart below, USDCAD was already signalling bulls that the support/resistance (black) was a key level where price can bounce higher from. There was a couple of previous bullish patterns that also triggered buy signals near the support level. By using the support level as a key area to look for buys, the final bullish pattern was easier to spot -- which triggered buyers at the XA 0.886% Fib. retracement level.

USDCAD One-Hour Chart September 18, 2020

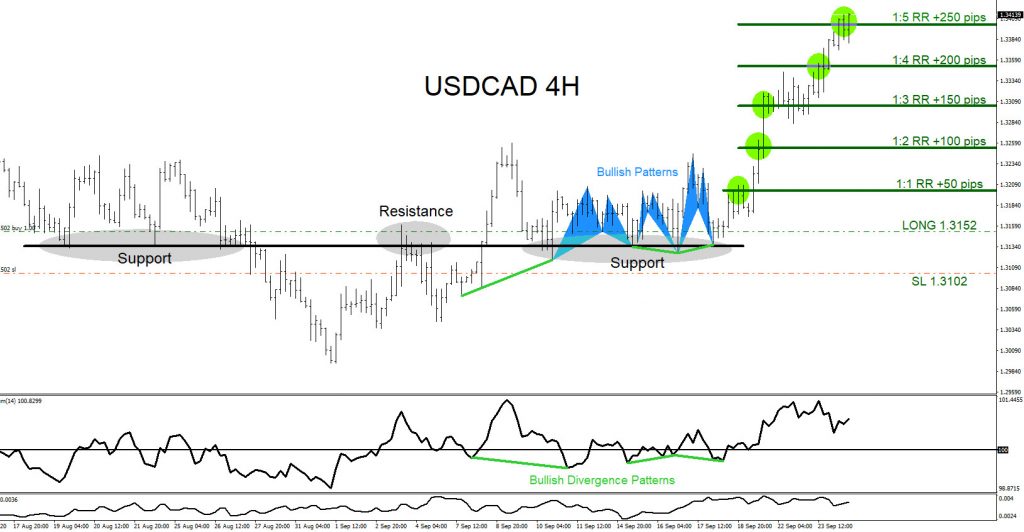

USDCAD eventually rallied higher and hit the 1:5 RR buy target at 1.3402 from 1.3152, for +250 pips. A trader should always use multiple time frame charts to look for possible trade entries and always use multiple trading strategies to confirm the trade.

USDCAD Four-Hour Chart September 24, 2020

Like any strategy, there will be times when the approach or technique fails, so proper money/risk management should always be used on every trade.

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

moreComments

No Thumbs up yet!

No Thumbs up yet!