USD/CAD Forecast: CAD Dips With Oil, Weaker Manufacturing

Today’s USD/CAD forecast is bullish. On Wednesday, the Canadian dollar weakened against the US dollar due to a decline in oil prices and a slowdown in domestic factory activity in June.

Notably, the contraction in Canada’s manufacturing sector deepened slightly. It was affected by an uncertain economic outlook that impacted domestic and foreign demand. The S&P Global Canada Manufacturing Purchasing Managers’ Index decreased from 49.0 in May to 48.8 in June.

Elsewhere, the upcoming release of Canada’s employment report for June, scheduled for Friday, could provide insights for the Bank of Canada’s interest rate decision next week. Currently, money markets indicate a 57% chance of the BoC raising its benchmark interest rate by an additional 25 basis points. In June, the rate increased to a 22-year high of 4.75%.

Meanwhile, oil benchmark Brent experienced a decline on Wednesday. Consequently, it partially reversed previous gains made after Saudi Arabia and Russia announced an extension and deepening of output cuts into August. Concerns about a global economic slowdown weighed on market sentiment.

Tomomichi Akuta, a Mitsubishi UFJ Research and Consulting senior economist, stated, “Oil prices came under pressure again due to lingering worries over a slowdown in the global economy. Additionally, there were concerns about further interest rate hikes in the United States and Europe.”

Furthermore, a private sector survey revealed that China’s services activity expanded at its slowest pace in five months in June. A weak recovery in China is bad for oil demand.

USD/CAD Key Events Today

Market participants eagerly await the release of minutes from the Federal Open Market Committee meeting held on June 13-14. The minutes will likely provide further insights into the US central bank’s outlook.

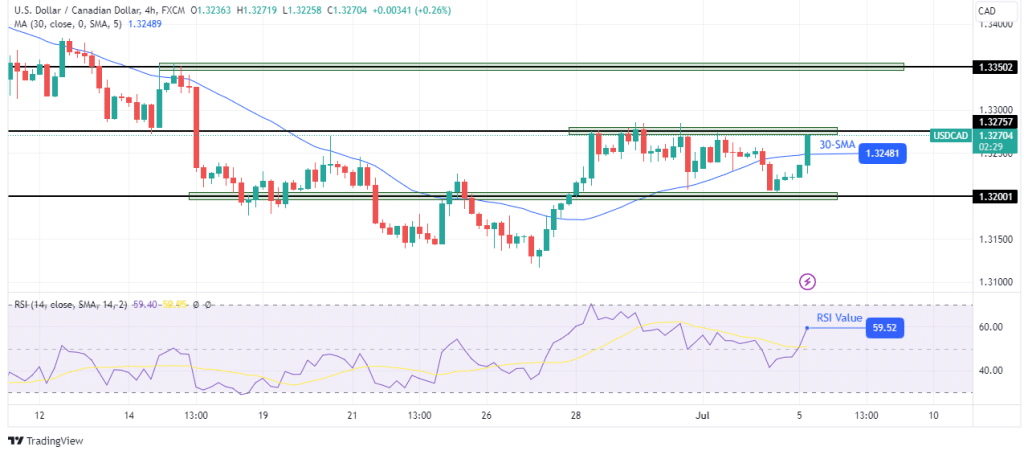

USD/CAD Technical Forecast: Bulls Register A Sudden Surge In Momentum.

USD/CAD 4-hour chart

On the charts, USD/CAD has bounced higher after retesting the 1.3200 support level. The bulls have broken above the 30-SMA and hit the 1.3275 resistance level. At the same time, the RSI has shot up, breaking above 50. This indicates a sudden surge in bullish momentum.

Therefore, if this strong momentum continues, the price will soon breach the 1.3275 resistance level. With such a break, nothing stops bulls from retesting the 1.3350 resistance level.

More By This Author:

USD/JPY Price Analysis: Yen Gains Amidst Hopes of InterventionUSD/JPY Weekly Outlook: Policy Divergence Weighing On The Yen

EUR/USD Forecast: Lagarde’s Hawkish Remarks Send Euro Higher