USD/CAD Forecast: BoC’s Pause Boosts Loonie

- The USD/CAD forecast suggests solid bearish sentiment.

- Canada’s GDP expanded by 2.2% in the first quarter, beating estimates of a 1.7% increase.

- Trump threatened to increase tariffs on aluminium and steel imports to 50%.

The USD/CAD forecast suggests solid bearish sentiment as the Canadian dollar extends gains after an upbeat GDP report. At the same time, the dollar remains weak amid Trump tariff tensions. However, cooler-than-expected US inflation figures eased Fed rate cut expectations.

The Canadian dollar strengthened on Friday after data revealed a better-than-expected performance in Canada’s economy. The GDP expanded by 2.2% in the first quarter, beating estimates of a 1.7% increase. The upbeat figures eased economic worries, lowering expectations for a Bank of Canada rate cut this week.

At the last meeting, the Bank of Canada paused its aggressive rate-cutting cycle. However, experts had expected the central bank to resume its rate cuts. Nevertheless, the economy has performed better than expected. Consequently, market participants are pricing a 75% chance of the Bank of Canada pausing again this week.

On the other hand, the dollar was fragile as market participants worried about Trump’s aggressive tariffs. The US president threatened to increase tariffs on aluminium and steel imports to 50%. Such a move would increase trade tensions with its partners. At the same time, tensions with China over tariffs on critical minerals have dampened appetite for US assets.

Elsewhere, data revealed that inflation in the US eased to 2.1% in April from the previous reading of 2.3%. The report eased Fed rate cut expectations.

USD/CAD key events today

- ISM Manufacturing PMI

- Fed Chair Powell Speaks

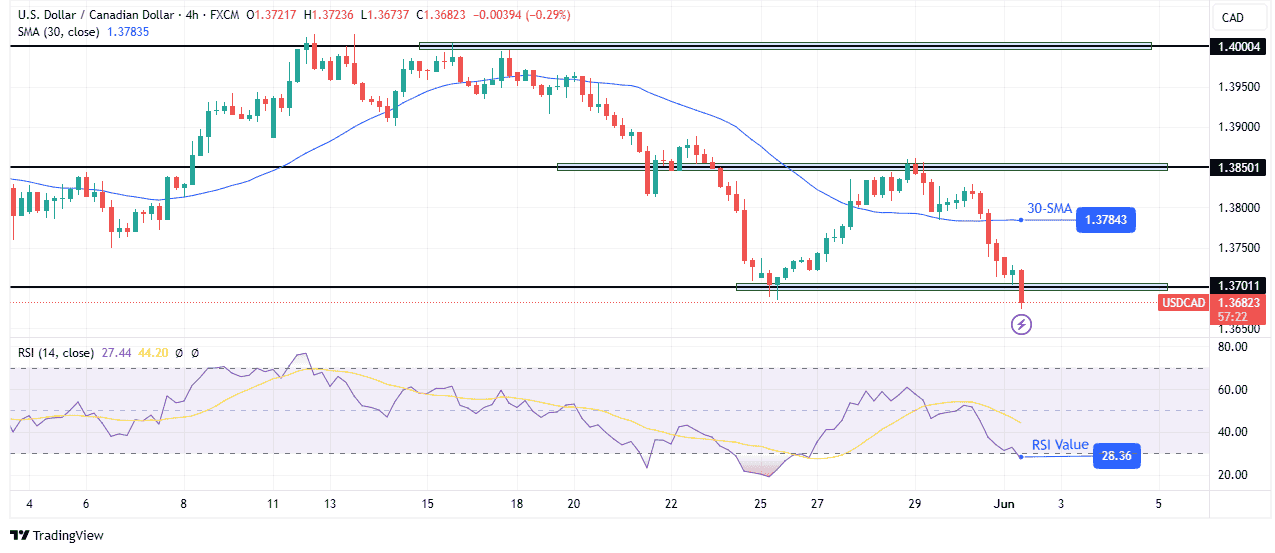

USD/CAD technical forecast: Overwhelming bearish pressure

(Click on image to enlarge)

USD/CAD 4-hour chart

On the technical side, the USD/CAD price has broken below the pivotal 1.3701 support level, strengthening the bearish bias. The price trades well below the 30-SMA, with the RSI in the oversold region, showing bears have a strong lead. Initially, the price reversed to the downside when it met the 1.4000 key resistance level.

However, the downtrend paused when the price reached the 1.3701 support level, allowing bulls to return. As a result, the price rebounded and broke above the 30-SMA. However, bulls were not strong enough to sustain a move above the SMA. Consequently, the price broke back below the SMA.

Currently, bulls have reached a lower low, confirming a continuation of the downtrend. A clean break below 1.3701 will allow USD/CAD to retest lower support levels.

More By This Author:

EUR/USD Outlook: Cautious Bullishness After Neutral Core PCEEUR/USD Forecast: Sellers Pounce 1.13 Level Ahead Of US GDP

GBP/USD Outlook: US Court Blocks Tariffs, Eyes On US GDP, PCE

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more