US Mulls Additional Sanctions On Russia

Image Source: Unsplash

Wednesday was another strong day in the gold and silver markets. With the gold price up another $40 to $3,324, making the recent $3,156 low on May 15 almost a distant memory.

The silver futures were up another 54 cents today to $33.17, with silver's recent low being $31.78 on May 14.

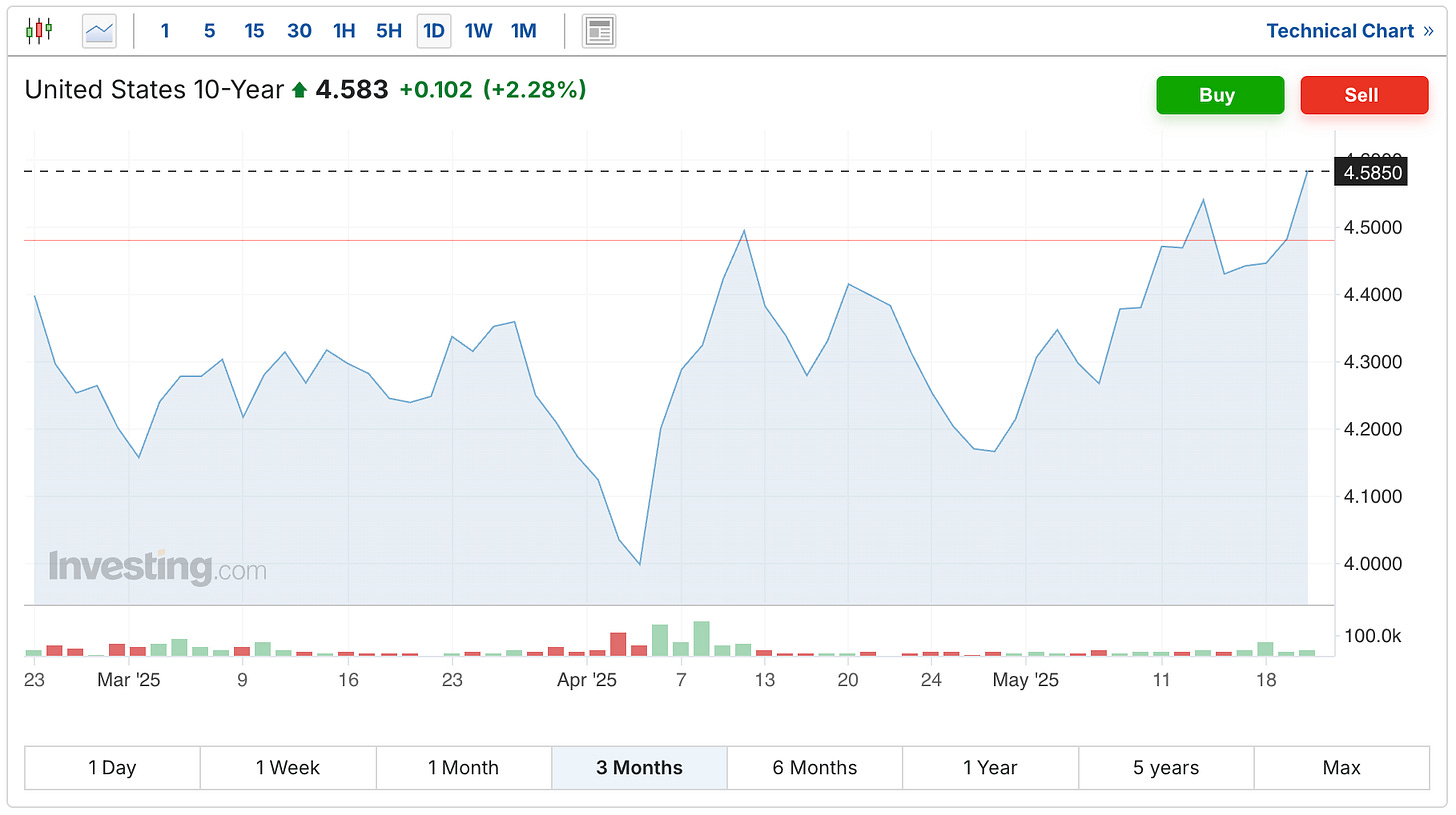

Treasury yields also climbed significantly higher on Wednesday, with the 10-year yield rising 10 basis points to 4.58%.

Meanwhile, the 30-year yield has really been surging, and was up another 11 basis points today to 5.07%.

We'll talk more tomorrow about some of the recent increases in global long-term yields. But you can see in the 30-year bond chart how the yield has basically now reached its high point of the last 5 years.

CNBC chalked up today’s stock market declines to the surge in yields.

Further complicating matters is that reports continue to emerge that the US has already prepared aggressive sanctions on Russia, to be ready in the case they should decide to use them.

Clearly, something changed in the dynamics a few weeks ago between Trump and Putin. And now the Telegraph’s latest headline reads ‘America mulls sanctions on Russia – here’s how they could do it.’

‘What would it mean for Russia, if the United States really did launch “harder” sanctions “than we’ve ever seen before” against its economy?

That was the threat issued by Lt Gen Keith Kellogg, the US special envoy to Ukraine, in an interview with Fox News on Tuesday.

Lt Gen Kellogg said Vladimir Putin had been warned that drastic new US sanctions were ready to go, should he come to be seen as the main obstacle to peace.’

From what I’ve heard, Putin doesn't seem like the kind of guy who takes too well to being warned. Especially if he feels he is right.

So if this is being reported accurately, it's not a good sign to read that statement.

‘The Sanctioning Russia Act’

The US is now exploring what would effectively be the “nuclear” option. Lindsay Graham, the US senator, has widespread support in Congress for the Sanctioning Russia Act of 2025. This would impose a 500% US tariff on goods from nations that buy Russian energy.

China, India, Turkey and Brazil would be forced to find alternative sources to retain access to the US market. The extension of sanctions on the central bank could further complicate trade. In effect, the move would mimic the “maximum pressure” sanctions imposed on Iran’s oil industry – and torpedo Moscow’s prime revenue source.

“This bill is a tool in President Trump’s toolbox,” Mr Graham, a close Trump ally, said earlier this month. When he believes that “we’ve reached an impasse, then watch for action”.

There is a team working on “hammer” sanctions in the US government that gained prominence recently over that figuring out “carrots” to offer to Moscow, says Tom Keatinge of the Royal United Services Institute, a London-based think tank, citing conversations with a source familiar with the matter.

In his Fox interview, Lt Gen Kellogg explicitly referenced Mr Graham’s bill as the source of the “very serious” sanctions pointing at Moscow.

It also sounds like at least in the plan that was prepared, they are going to put some of the countries who have been active in their de-dollarization efforts to a choice between the West and the East.

And without going through the dynamics around the US Treasury market, or how the supply chain disruptions might be affecting the economy at the same time this is happening, that sure seems a bit risky to be cutting off additional creditors right now.

Emmanuel Macron, Sir Keir Starmer and other members of the “coalition of the willing” will no doubt do their best to convince Mr Trump.

Tymofiy Myolvanov, president of the KSE, said on Wednesday the “rumour” going around was that the president would back Mr Graham’s bill. One senior European diplomat told The Telegraph not to discount Mr Trump’s appetite for tougher measures, should he be persuaded of the idea.

Not good to hear them talking about ‘nuclear options.’ Especially since we’ve already heard them talk about physical nuclear options.

As I plan to dig into on Friday, and as you're probably already familiar, there do seem to be a lot of political figures who are really pushing for war. Especially on the European front.

Does that seem like that type of scenario would be a net positive for the gold price? I would think so. Although it’s certainly one of those conflicting situations, where I don't think that's something that even gold and silver investors would want to see occur.

Hopefully it won't. Although it's a new outcome that has some probability of occurring, that is worthy of being priced in.

Additionally, while there has not been as much talk about this lately, we still do see those stories from time to time suggesting that the US and/or Europe will confiscate the $300 billion of frozen Russian assets. Which would also inflame an already tragic scenario.

But we will hope for better news tomorrow, and perhaps this can serve as another good reminder to just be grateful for each day we are able to be happy and healthy with our families and loved ones.

More By This Author:

China Is Setting The Gold & Silver Prices NowECB Warns Of ‘Risk Of Squeeze’ In Gold Market

Chinese 'Hunt Brother' Who Took On JPMorgan Is Back