US Dollar Benefits As BoJ Capitulates To Tighter Policy, Sinking Risk Assets

The US Dollar has been caught up the in the maelstrom ricocheting through markets in the aftermath of the Bank of Japan’s monetary policy tilt today.

The bank left its policy balance rate at -0.10%, but it adjusted its yield curve control (YCC) by targeting a band of +/- 0.50% around zero for Japanese Government Bonds (JGBs) out to 10 years.

The YCC target was previously +/- 0.25% around zero. The BoJ now holds more than 50% of all outstanding JGBs. USD/JPY collapsed from 137.50 to below 134.00 in seconds. More can be read here.

Government bond yields in developed markets vaulted higher with the hawkish turn. The benchmark 10-year Treasury note leapt from below 3.60% to trade above 3.70% today.

The funding of many investments might now be re-assessed and it could have unexpected outcomes for many asset classes.

The BoJ was one of the last central banks globally to not be tightening rates in the face of accelerating price pressure. Japan get CPI data this Thursday.

The tightening of policy undermined equity markets with a sea of red across the APAC region. Japan’s Nikkei 225 was down over 3% at one stage before making a slight recovery.

Futures markets are indicating a tough day ahead for stocks across Europe and North America when their cash markets open.

In currency land, growth-linked currencies such as AUD, CAD, NOK and NZD have taken a beating. AUD/JPY made a high above 92.00 earlier in the day before the news and has since collapsed toward 88.00.

Crude oil has been less impacted with the WTI futures contract near US$ 75.50 bbl while the Brent contract is a touch below US$ 80 bbl. Gold is steady near US$ 1,785 at the time of writing.

Elsewhere, China left two of their monetary policy levers unchanged today with the 1- and 5-year loan prime rate (LPR) unchanged at 3.65% and 4.30% respectively.

The consequences of the BoJ’s actions appear likely to play out for some time.

The US will see some housing data, while Canada will get retail sales figures.

The full economic calendar can be viewed here.

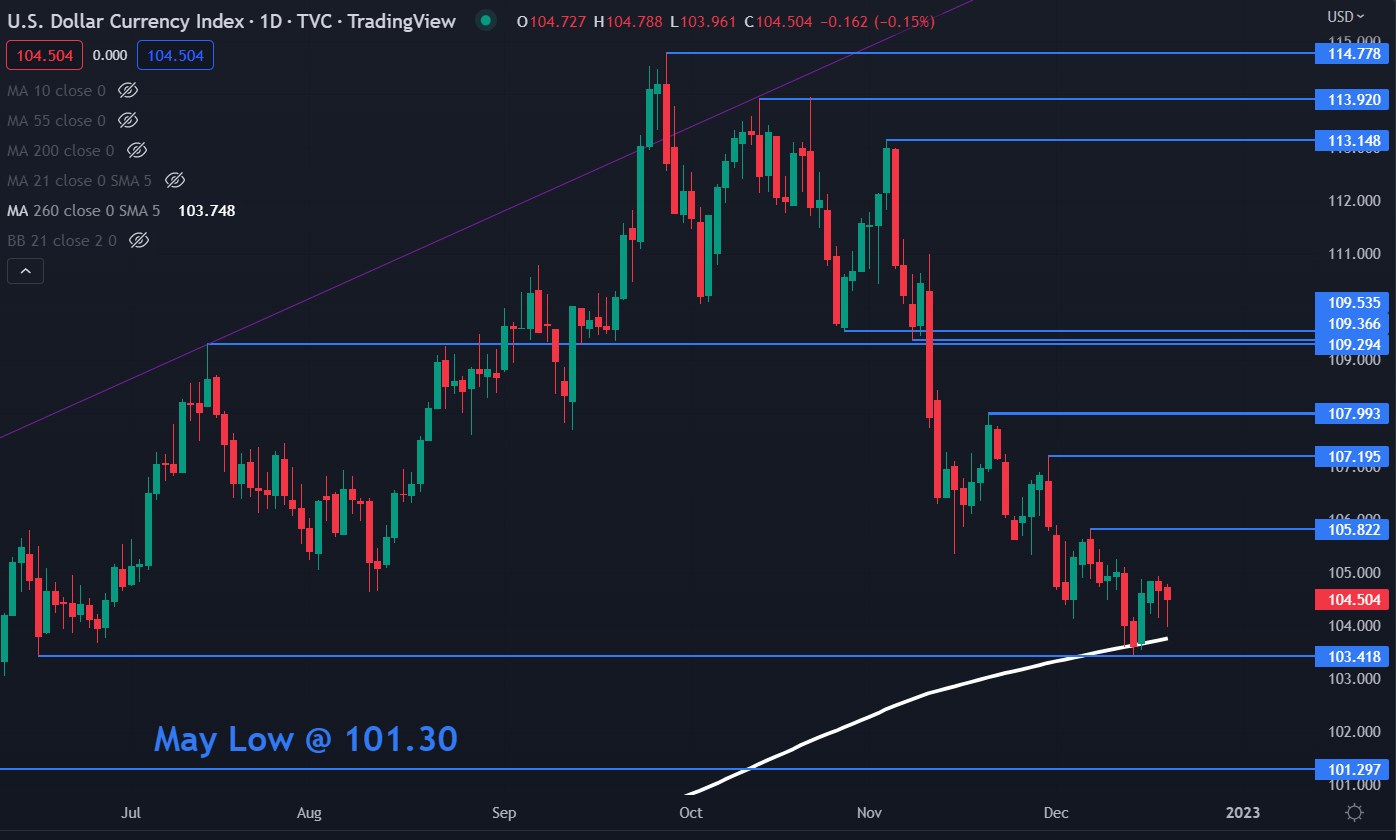

DXY (USD) Index Technical Analysis

The DXY index is a US Dollar index that is weighted against EUR (57.6%), JPY (13.6%), GBP (11.9%), CAD (9.1%), SEK (4.2%) and CHF (3.6%).

The DXY index is slightly lower today due to a huge rally in the Japanese Yen. The US Dollar is higher against all other currencies in the index.

The June low at 103.42 held on a test last week and might provide support if tested again. The 260-day simple moving average (SMA) is slightly above there and may provide support, currently at 103.42.

Further down, support may lie at the May low of 101.30.

On the topside, resistance could be offered at the previous peaks of 105.82, 107.20 and 107.99.

More By This Author:

S&P 500, Dow Jones, Nasdaq 100 Sink As Treasury Yields Climb, APAC Stocks At RiskUSDJPY, AUDJPY And CADJPY: Can The BOJ Trigger Loaded Technical Patterns?

GBP/USD Looking To Snap Two-Day Losing Streak

Disclosure: See the full disclosure for DailyFX here.