Unlocking ASX Trading Success: Origin Energy Limited

ASX: ORIGIN ENERGY LIMITED – ORG Elliott Elliott Wave Technical Analysis TradingLounge

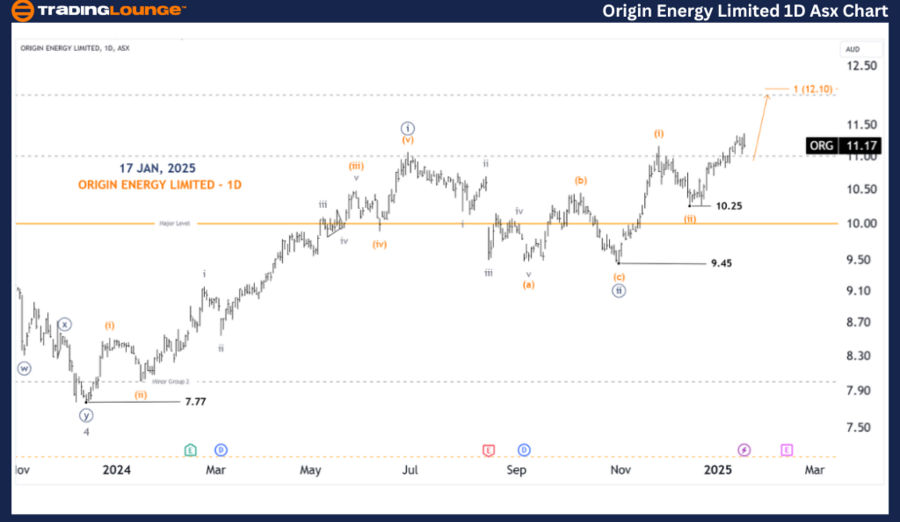

Greetings, Our Elliott Wave analysis today updates the Australian Stock Exchange (ASX) with ORIGIN ENERGY LIMITED – ORG. We see ASX:ORG moving much higher in wave (iii)-orange of wave ((iii))-navy. Today’s visual analysis will answer the question of whether to go long now or where the best point to go long is, along with visual key points to confirm potential future trends.

ASX: ORIGIN ENERGY LIMITED – ORG 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (iii)-orange of Wave ((iii))-navy

Details: Wave ((ii))-navy ended at 9.45 and wave ((iii))-navy is unfolding higher, which is itself an extended wave, so we continue to see wave (iii)-orange unfolding much higher. 4H chart analysis will give us some go long setups to look for.

Invalidation point: 10.25

ASX: ORIGIN ENERGY LIMITED – ORG 4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave i-grey of Wave (iii)-orange

Details: Wave iii-grey of wave (iii)-orange is unfolding and is moving higher. Perhaps wave i-grey will soon complete and we will see a three-wave decline with wave ii-grey, and then when price bounces back, turning 11.00 into tested support at that point, we can go long, and that is a very good and safe position.

Invalidation point: 10.25

Key point: Wave b of Wave ii-grey

Conclusion:

Our analysis, forecast of contextual trends, and short-term outlook for ASX: ORIGIN ENERGY LIMITED – ORG aim to provide readers with insights into the current market trends and how to capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing the confidence in our perspective. By combining these factors, we strive to offer readers the most objective and professional perspective on market trends.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source : Tradinglounge.com get trial here!

#ORG #TradingLounge #ASXStocks #Stocks #ElliottWave

More By This Author:

Unlocking ASX Trading Success - Coles Group Limited

Elliott Wave Technical Analysis: Advanced Micro Devices Inc. (AMD)

Elliott Wave Technical Analysis - U.S. Dollar/Japanese Yen

Analyst Peter Mathers TradingLounge™ Australian Financial Services Licence - AFSL 317817

.thumb.png.d1f33631f4f7cff23b22d85c021a9198.png)