Unlocking ASX Trading Success: Northern Star Resources

ASX: NORTHERN STAR RESOURCES LTD – NST

Elliott Wave Technical Analysis – TradingLounge,

Today’s Elliott Wave update for the Australian Stock Exchange (ASX) focuses on NORTHERN STAR RESOURCES LTD – NST.

According to our analysis, ASX:NST appears to be entering a short-term bearish trend, potentially dropping to the 16.86 level. There are currently no signs of a bullish market based on this forecast.

ASX: NORTHERN STAR RESOURCES LTD – NST

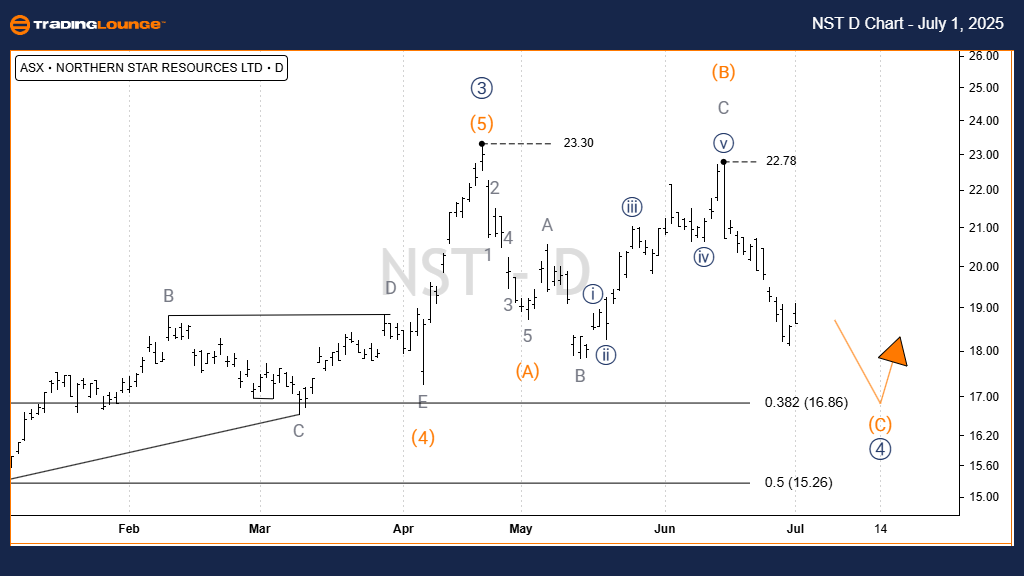

Elliott Wave Technical Analysis – 1D Chart (Semilog Scale)

- Function: Major trend (Minor degree, grey)

- Mode: Motive

- Structure: Impulse

- Position: Wave C) - orange of Wave 4)) - navy

Details:

Wave 4)) - navy continues to decline, likely developing as an ABC-orange zigzag pattern. Wave A)B) - orange has completed, and since peaking at 22.78, Wave C) - orange is targeting 16.86. There is no bullish evidence currently.

- Invalidation Point: 23.78

ASX:

NORTHERN STAR RESOURCES LTD – NST

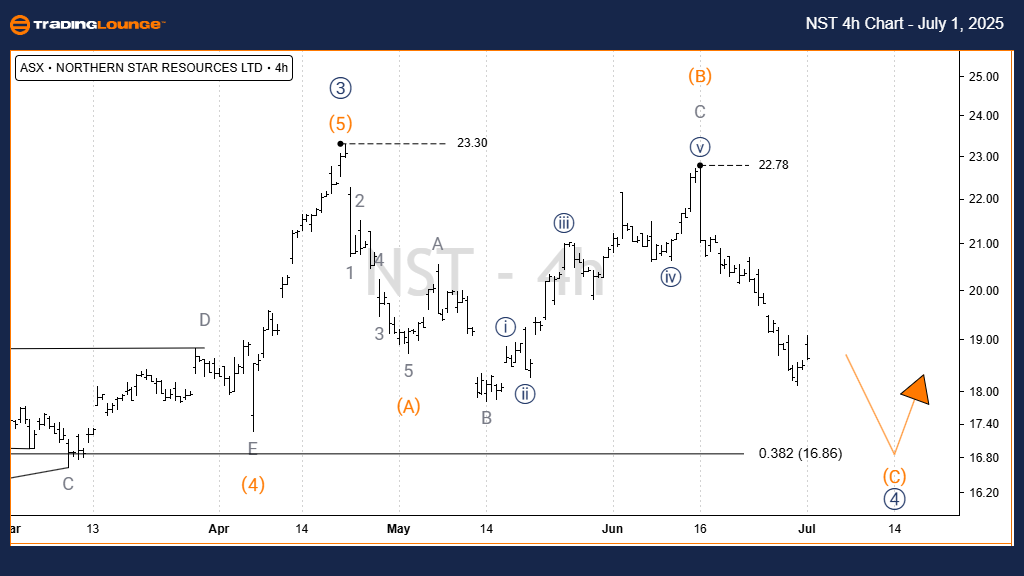

4-Hour Chart Analysis

- Function: Major trend (Minor degree, grey)

- Mode: Motive

- Structure: Impulse

- Position: Wave C) - orange of Wave 4)) - navy

Details:

No new data beyond the 1D chart. Since the 22.78 peak, Wave C) - orange is continuing lower, eyeing 16.86 as a target.

- Invalidation Point: 22.78

Conclusion:

Our forecast and technical evaluation for ASX:NST offer insights into the market’s current momentum. We outline precise price markers for validation and invalidation to strengthen the reliability of our Elliott Wave count. With a structured methodology, we aim to present the most objective and professional trading outlook.

Technical Analyst: Hua (Shane) Cuong, Certified Elliott Wave Analyst – Master Level (CEWA-M)

More By This Author:

Elliott Wave Technical Analysis: BHP Group Limited

Elliott Wave Analysis Dow Jones Index

Elliott Wave Technical Analysis: British Pound/Japanese Yen - Monday, June 30

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more