Unlocking ASX Trading Success: ASX:URW

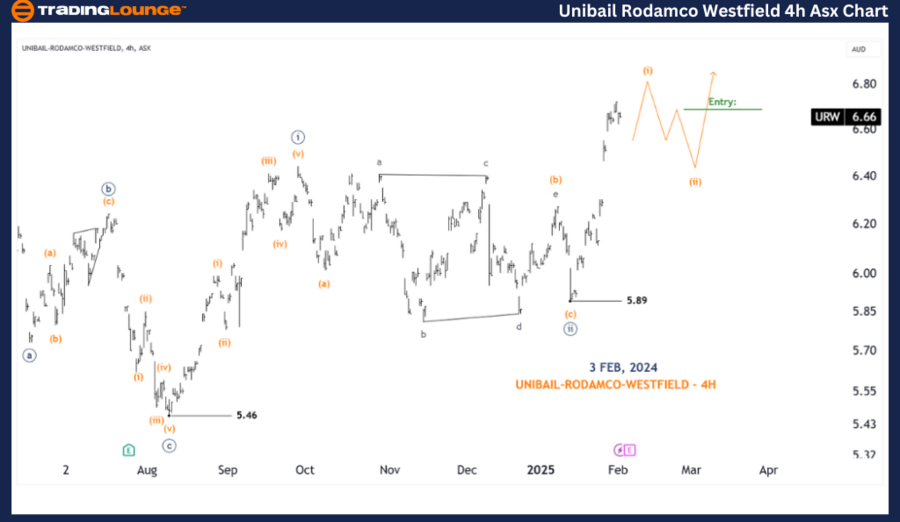

Today's Elliott Wave analysis presents an updated outlook on the Australian Stock Exchange (ASX) for Unibail-Rodamco-Westfield (URW).

We anticipate upside potential for ASX: URW in the near term. The short-term outlook focuses on awaiting a pullback with the second wave, which will provide an opportunity to identify high-quality long trade setups. This analysis outlines when to stay on the sidelines and when to enter positions in a structured and intuitive manner.

ASX:URW Elliott Wave Technical Analysis – 1D Chart (Semilog Scale)

Analysis

- Function: Major trend (Minor degree, grey)

- Mode: Motive

- Structure: Impulse

- Position: Wave ((iii)) - navy of Wave 3 - grey

- Details:

- Wave ((iii)) - navy is trending higher. A pullback around 6.50 with a corrective wave may create a potential long trade setup.

- On a smaller scale, wave (i) - orange is nearing completion. The expected decline in wave (ii) - orange will present a good buying opportunity for long trade setups.

- Invalidation Point: 5.89

ASX:URW 4-Hour Chart Analysis

- Function: Major trend (Minute degree, navy)

- Mode: Motive

- Structure: Impulse

- Position: Wave (i) - orange of Wave ((iii)) - navy

- Details:

- A closer look at the 4H chart suggests that wave (i) - orange is nearing completion.

- Since this wave has already extended significantly, a stop-loss level around 5.89 is required for long trades, but it may not be optimal.

- Instead, waiting for a pullback to enter a long position will allow for a tighter and more efficient stop level.

- Invalidation Point: 5.89

- Key Point: Wave b of Wave (ii) - orange

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation)

More By This Author:

Elliott Wave Trading Strategies: Top Market Analysis For SP500, Nasdaq & Tech Stocks

Unlocking ASX Trading Success: James Hardie Industries Plc

Elliott Wave Technical Analysis: McDonald’s Corp. - Friday, Jan. 31

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more

.thumb.png.1b4ba45ad56a21e4a880d08d924aed96.png)