Tuesday, January 21, 2025 6:40 AM EST

UK wage growth is proving sticky, though falling vacancy rates – particularly in hospitality – and lower private-sector employment point to a gradual reduction in pay pressures in 2025.

The first jobs report of the year paints a familiar picture of the UK labour market. Wage growth remains hot, and indeed excluding bonuses, was a tad hotter than expected at 5.6% year-on-year. That said, if you to get really into the details, the month-on-month increase in private-sector pay – a metric the Bank of England occasionally looks at – appeared more muted in the latest period. But generally, these figures have been proving uncomfortably sticky for the Bank.

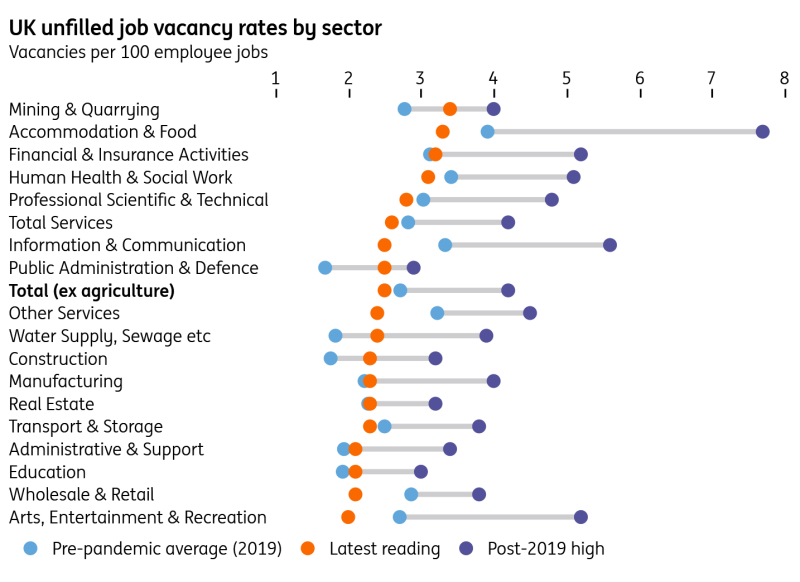

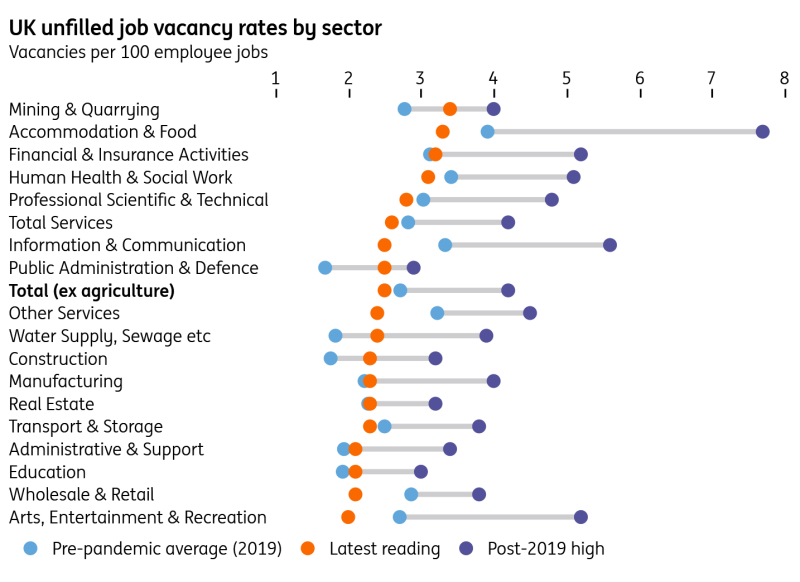

At the same time, plenty of evidence shows that the jobs market is continuing to cool down. Remember, don’t pay any attention to the unemployment rate, plagued by long-running and well-known quality issues. Instead, take a look at vacancies. These were down fractionally in the latest data, and more importantly, most sectors now have vacancy rates below pre-Covid levels – in some areas quite significantly so. Just look at hospitality or retail.

Vacancy rates below pre-Covid levels in most sectors

(Click on image to enlarge)

Source: Macrobond, ING calculations

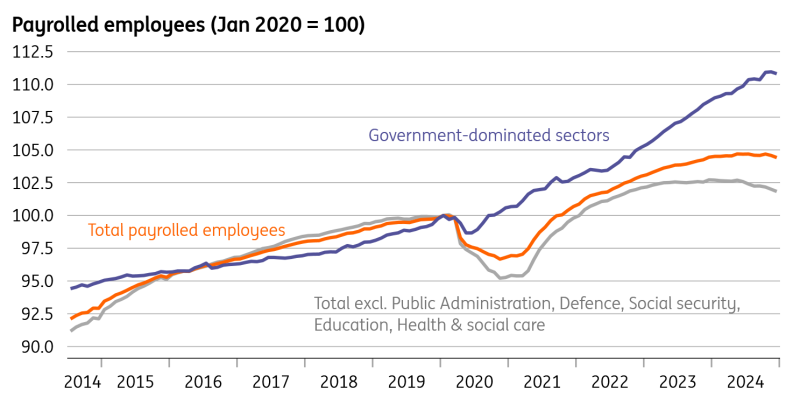

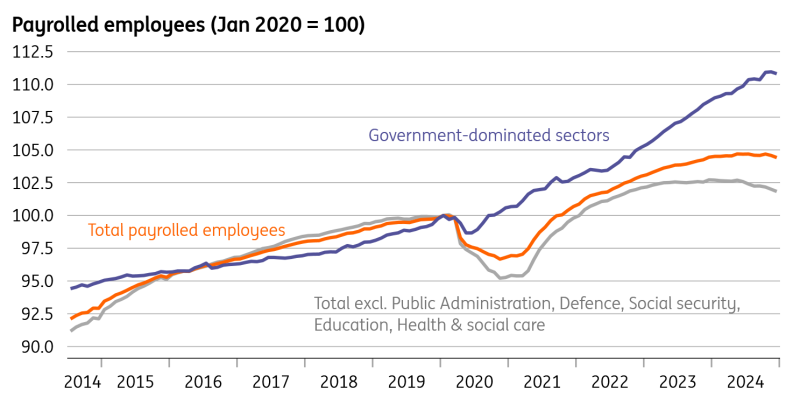

Then there’s payrolled employment, which is perhaps the most reliable jobs indicator we have right now. If we strip out government-dominated sectors like health and education, the number of payrolled employees fell by 0.9% across 2024. That’s not a huge number, but this all points to a backdrop where wage growth can come lower across 2025. Indeed if we look at the latest couple of readings from the Bank of England’s own Decision Maker Panel (a survey of CFOs), it shows that expected wage growth has finally slipped below 4% as of the past couple of readings.

Payrolled employment fell in 2024 outside of government-heavy sectors

(Click on image to enlarge)

Source: Macrobond, ING calculations

Nothing here is likely to change the Bank of England story dramatically, and it looks like policymakers are on course to continue gradually taking rates lower and probably more rapidly than markets now expect. Investors are largely pricing a February rate cut, but only 60 basis points of total easing this year.

More By This Author:

FX Daily: Day One Volatility Rates Spark: Trump’s Government Is Now A Fact Temporary Relief On U.S. Trade Triggers A Dollar Correction

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. ING forms part of ING Group (being for this purpose ING Group NV and its subsidiary and affiliated companies). The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam). In the United Kingdom this information is approved and/or communicated by ING Bank N.V., London Branch. ING Bank N.V., London Branch is deemed authorised by the Prudential Regulation Authority and is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. The nature and extent of consumer protections may differ from those for firms based in the UK. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority’s website.. ING Bank N.V., London branch is registered in England (Registration number BR000341) at 8-10 Moorgate, London EC2 6DA. For US Investors: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements.

less

How did you like this article? Let us know so we can better customize your reading experience.